Transamerica Asset Management, Inc. 2025 Market Outlook

Transamerica Asset Management, Inc.

Tom Wald, CFA®

Chief Investment Officer

Transamerica Asset Management, Inc.

2025 year-end forecasts

| Forecasts | Year-End 2025 |

|---|---|

| CY U.S. GDP Growth | 2.50% |

| Core CPI Inflation | 2.60% |

| Core PCE Inflation | 2.20% |

| Slope of Yield Curve (3 Month–10 Year) | Upward |

| Federal Funds Rate (Lower Bound) | 3.50% |

| 10-Year U.S. Treasury Bond Yield | 4.40% |

| S&P 500® | 6,500 |

| Portfolio Positioning | |

|---|---|

| Asset Allocation | Balanced Stocks/Bonds (60/40) |

| Optimal Spots on Yield Curve | 6–9 Years |

| Fixed Income | Intermediate Term, Investment Grade (6–9 Years) |

| U.S. Stocks | Large-Cap Value |

| International Stocks | Developed Markets, Europe, Japan |

Click the (i) below to read a text description of this chart or download a PDF

For year-end 2025, Transamerica forecasts U.S. GDP growth of 2.5%, CPI core inflation of 2.6%, PCE core inflation of 2.2%, a lower bound federal funds rate of 3.50%, 10-year U.S. Treasury bond yield of 4.40%, and an S&P 500 price target of 6,500. Regarding portfolio positioning, Transamerica favors balanced 60/40 stock/bond portfolios, intermediate-term, investment-grade corporate bonds with maturity ranges 6–9 years, large-cap value stocks, and international developed stocks in the regions of the eurozone and Japan.

All opinions, estimates, projections, and security selections contained herein are those of Transamerica Asset Management, Inc. It does not constitute investment advice and should not be used as a basis for any investment decision. Please reference the glossary of terms and additional definitions at the bottom of this page.

U.S. economy

We believe the U.S. economy is capable of achieving approximately 2.5% cumulative gross domestic product (GDP) growth in 2025, which we view as continuing to be a favorable environment for stocks and bonds. Catalysts for the year ahead include Federal Reserve rate cuts, declining inflation, rising corporate earnings growth, and a more business-friendly environment within the federal government. We see core rates of inflation continuing to mitigate into the sub-2.5% range by year-end.

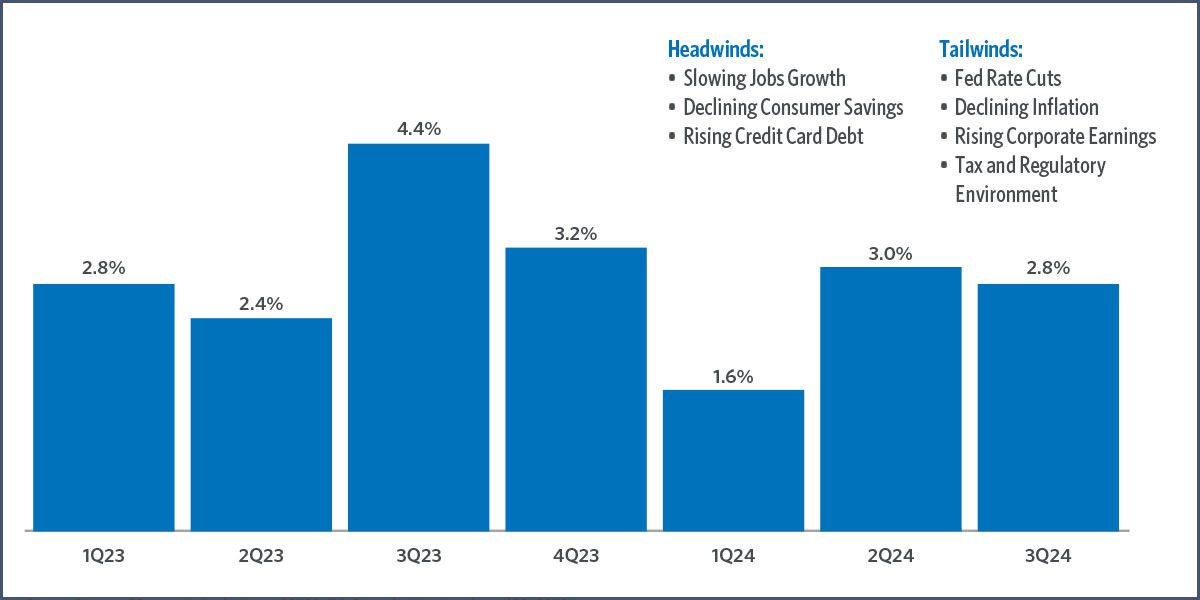

GDP growth trends

Annualized GDP growth, 1Q 2023–3Q 2024

Source: Bureau of Economic Analysis, as of 9/30/24. Second estimate released 10/30/24.

Click the (i) below to read the text description of this chart or download a PDF

GDP growth is tracking to conclude CY 2024 at about 2.5%, which is below the CY 2023 growth rate of better than 3%. At the current time, the economy is experiencing a combination of tailwinds and headwinds. Tailwinds include upcoming Federal Reserve rate cuts, declining inflation, and rising corporate earnings growth. In addition, we believe the prospects of a less onerous tax and regulatory environment following this past November’s election will also help to boost consumer confidence. Potential headwinds include rising credit card debt and uncertainty in the labor markets pertaining to the pace of future jobs growth. All considered, we believe the economy is capable of approximately 2.5% cumulative GDP growth, which we view as a favorable environment for both stocks and bonds.

Overall economic growth, as measured by GDP, is looking to conclude CY 2024 tracking at about 2.5%, a pace we see as likely to continue through 2025. At the current time, the economy is experiencing a combination of headwinds and tailwinds, though we see a net advantage to positive growth factors, such as upcoming federal reserve rate cuts, declining inflation, and rising corporate earnings growth. In addition, we believe the prospects of a less onerous tax and regulatory environment following November’s election will also help to boost consumer confidence. Potential headwinds include rising credit card debt and uncertainty in the labor markets pertaining to the pace of future jobs growth. All considered, we believe the economy is capable of approximately 2.5% cumulative GDP growth, which we view as a favorable environment for stocks and bonds.

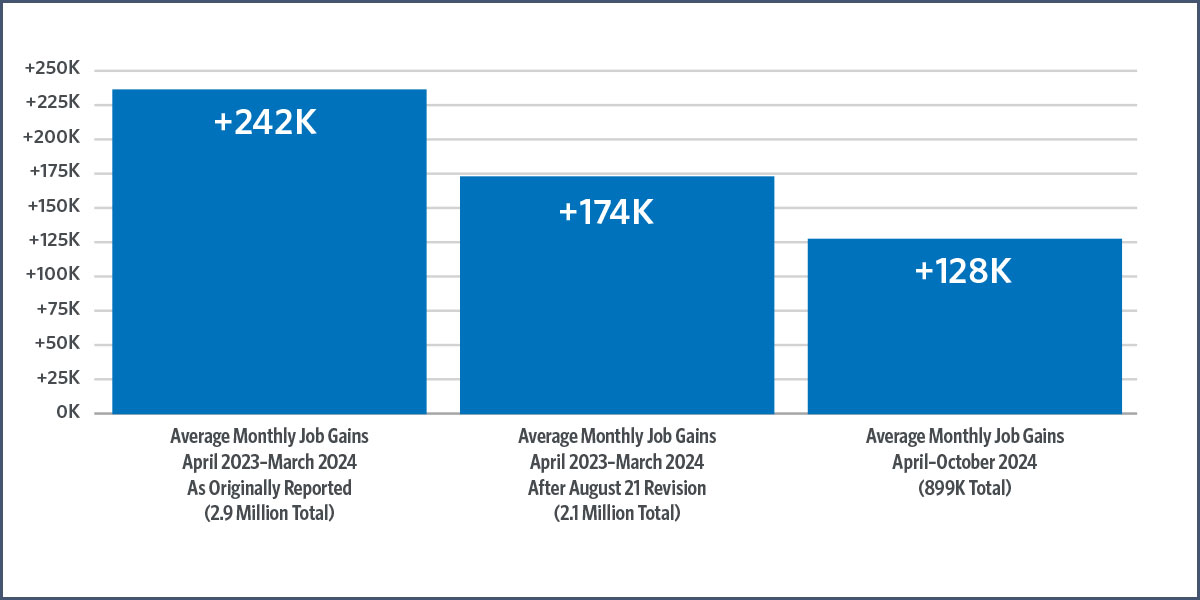

Job market trends

Monthly nonfarm payroll growth, April 2023–October 2024

Source: Bureau of Labor Statistics, as of 10/31/24

Click the (i) below to read a text description of this chart or download PDF

Originally, the U.S. Bureau of Labor Statistics (BLS) estimated that 2.9 million new jobs were added to the economy between April 2023-March 2024 for a 12-month average of 242K. In August, the BLS revised that estimate downward to 2.1 million and a monthly average of 174K. Between April 2024-November 2024, the BLS estimates 899K of new jobs have been added to the economy for a monthly average of 128K.

An area of uncertainty in the economy as we enter 2025 is the level of strength in the labor markets, as seen in the monthly U.S. Bureau of Labor Statistics (BLS) nonfarm payroll reports. Following a decline in the monthly pace of new jobs added to the economy beginning last spring, the BLS downwardly and meaningfully revised its estimates, resulting in a materially lower reported number of new jobs than originally believed. However, in our view, the monthly trends remain net favorable, and when they’re combined with recent and expected future Fed rate cuts and the prospects of ongoing lower corporate tax rates, we believe job growth and consumer spending should continue to be positive throughout the upcoming year.

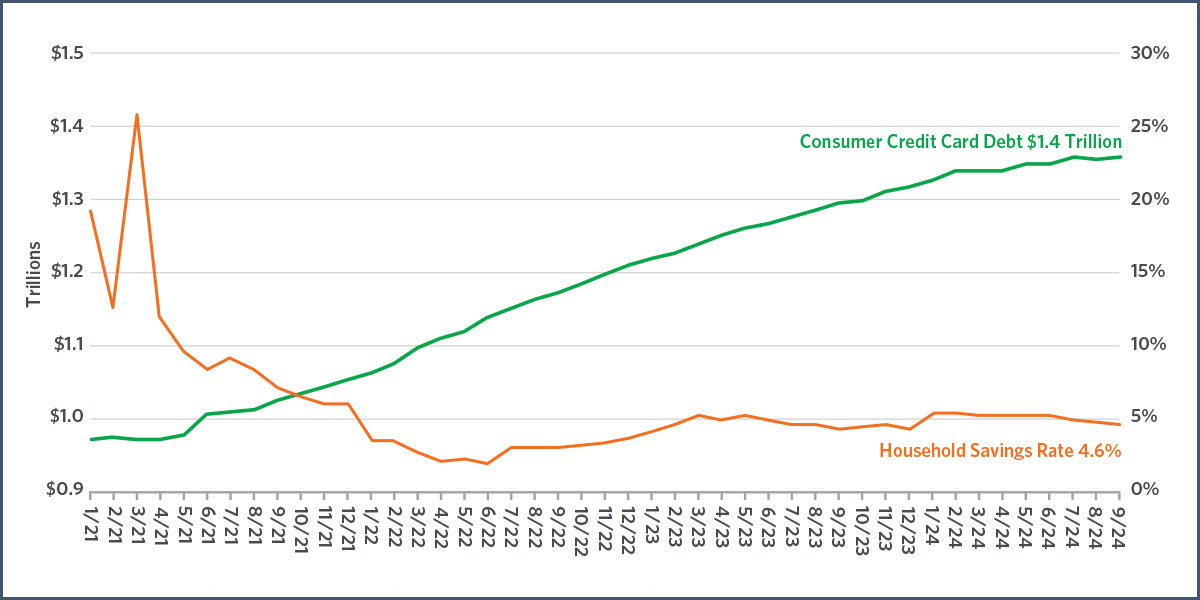

Consumer headwinds

Household savings and credit card debt

As of 9/30/24; Revolving Consumer Credit Outstanding; Source: Federal Reserve; Household Savings Rate; Source: Bureau of Economic Analysis

Click the (i) below to read a text description of this chart or download PDF

Since 2021, national aggregate credit card debt has risen more than 40% to $1.4 trillion and monthly household savings has declined from more than 10% to 4.6%.

Perhaps the largest headwind facing the U.S. economy continues to be the inverse cross correlation of rising aggregate credit card debt and declining household savings rates. This somewhat ominous combination of less money to spend and more bills to pay could wind up creating an incremental net drag on economic growth in the year ahead.

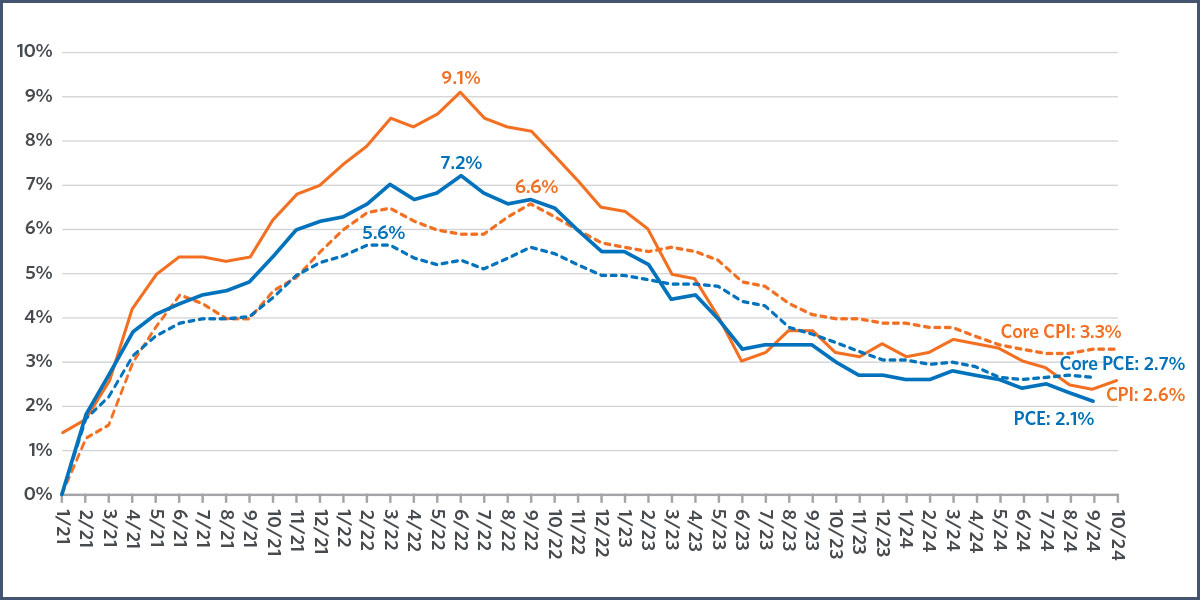

Inflation trends

Key inflation rates, January 2021–October 2024

CPI Source: Bureau of Labor Statistics, as of 9/30/24; PCE: Bureau of Economic Analysis, as of 10/31/24

Click the (i) below to read a text description of this chart or download PDF

Since various points in 2022, year-over-year CPI inflation has declined from 9.1% to 2.6%, CPI core inflation from 6.6% to 3.3%, PCE inflation from 7.1% to 2.1%, and PCE core inflation from 5.6% to 2.7%.

The four most closely watched inflation metrics — consumer price index (CPI), CPI core inflation (ex food and energy components), personal consumption expenditures (PCE) and PCE core inflation — have all shown precipitous declines since they reached cycle peaks more than two years ago. Looking forward, we believe these measures are likely to continue declining into 2025 and we expect core inflation to conclude the year at a lower pace of about 2.4% on a year-over-year basis, as defined by the average of CPI core and PCE core rates.

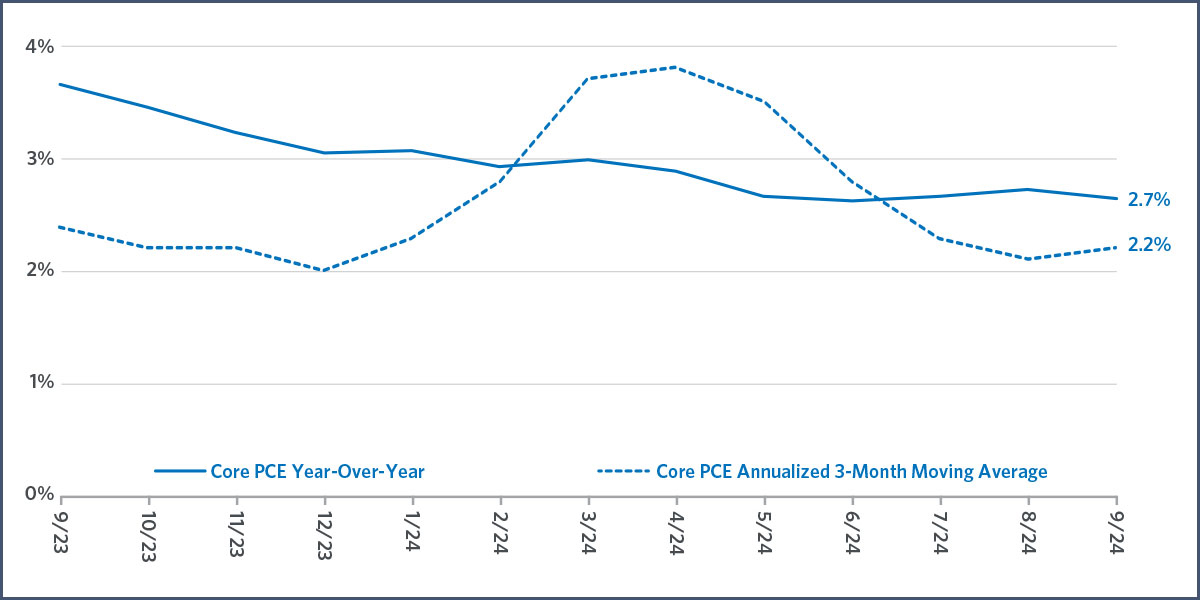

Inflation trends

PCE core inflation trending lower, September 2023–2024

As of 9/30/24; Source: Bureau of Economic Analysis

Click the (i) below to read a text description of this chart or download PDF

The year-over-year pace of PCE core inflation as of the end of September 2024 was 2.7%. However, the three-month moving average was lower at 2.2%.

One reason why we believe year-over-year rates of core inflation will continue declining into 2025 can be seen in the three-month pace of PCE core inflation (the Federal Reserve’s preferred metric), which is declining faster than the most recent year-over-year reading. Much of this can be attributed to the lagging impact of housing services (leases and rents), which includes contracts initiated in previous years when inflation was higher. More recent rental and leasing terms are yet to be fully incorporated into year-over-year reports, leading us to believe annualized core inflation rates are prone to decline in 2025.

Finally, the likelihood the Tax Cuts and Jobs Act of 2017 is extended to a permanent status for many provisions, including personal income and capital gains tax rates and potentially lower corporate tax rates, is, in our view, an important economic tailwind in terms of longer-term consumer confidence in the economy. This scenario is now a more distinct probability following the election of President Trump and Republican victories in the Senate and House of Representatives.

Potential tax changes in 2025

Personal, capital gains, and corporate tax rates

| Current Law | Potentially to be Proposed in 2025 | |

|---|---|---|

| Marginal Tax Rates | The top marginal tax rate of 37% for individuals and married individuals filing jointly These tax rates are expected to increase back to pre-2017 Tax Cuts and Jobs Act (TCJA) of 39.6% after 2025 | Make the lower TCJA top marginal rate permanent after 2025 |

| Capital Gains and Qualified Dividends Tax Rate | Top tax rate for capital gains and qualified dividends of 20% Subject to renegotiation after 2025 | Make the TCJA top capital gains and qualified dividends rate permanent after 2025 |

| Corporate Tax Rates | Corporate tax rate of 21% Subject to renegotiation after 2025 | Lower to between 15%– 20% |

Source: "President Trump's Tax Proposals at a Glance," Crowe.com, Nov. 7, 2024

Click the (i) below to read a text description of this chart or download a PDF

Following the U.S. elections in November 2024, there is a strong probability Congress extends the marginal individual tax rate of 37% and personal capital gains tax rate of 20% to a permanent status. In addition, there is also the probability that the marginal corporate tax rate is reduced from 21% to perhaps as low as 15%.

With a “lower for longer” tax rate environment, it is more probable, in our view, that consumer spending and corporate profitability post-2025 are likely to exceed previous expectations and their actual results over the past several years. Final reconciliation regarding an extension on personal and capital gains rates and a potentially lower corporate rate (perhaps from 21% to as low as 15%) is expected to be determined by Congress by the end of 2025.

Market Pulse summary: U.S. economy

We believe the U.S. economy is likely to achieve approximately 2.5% cumulative GDP growth in 2025. We see inflation, when averaging CPI and PCE core measures, continue to mitigate to the sub-2.5% range by year-end. All considered, we view this overall macroeconomic environment as favorable for stocks and bonds.

Fixed income

It is our assessment the Federal Reserve is likely to continue cutting rates and close out 2025 with a federal funds rate target range of 3.50–3.75%. This is based on continuing expectations of declining inflation and the Fed’s desire to normalize the real rate of interest closer to historical levels. We believe the 10-year Treasury bond yield will remain close to current levels, finishing the year at approximately 4.4%, thereby resulting in an upward sloping yield curve. In this environment, we view intermediate-term, investment-grade corporate bonds as providing a strong risk-return profile.

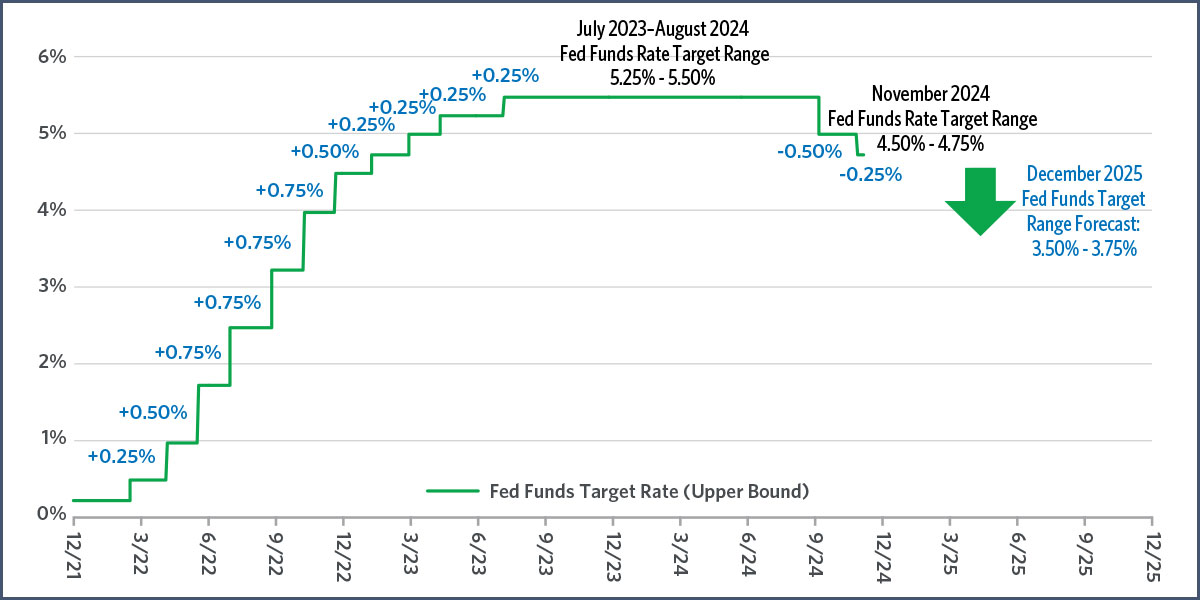

Forecasted path of federal funds rate

As of 11/7/24. Source: Fed Funds Target Rate: Federal Reserve Board of Governors. Forecast: Transamerica Asset Management, Inc.

Click the (i) below to read a text description of this chart or download PDF

In March 2022, the Federal Reserve began raising the federal funds rate to combat inflation, taking it from an upper bound of 0.25% to 5.5% by July 2023. The Fed kept it at that level until September 2024 when it lowered the federal funds rate to 5% and then in November to 4.75%. Looking forward, it is our best estimate that the Fed concludes 2025 with a federal funds rate target range of 3.50%–3.75%.

Following the Fed’s historic rate hike tightening cycle from March 2022–July 2023, we believe the Fed has established a new objective to calibrate the federal funds rate to a lower level more representative of current inflation rates and positive economic growth. Looking forward, we estimate the Fed will conclude 2025 with a fed funds target range of 3.50%–3.75%.

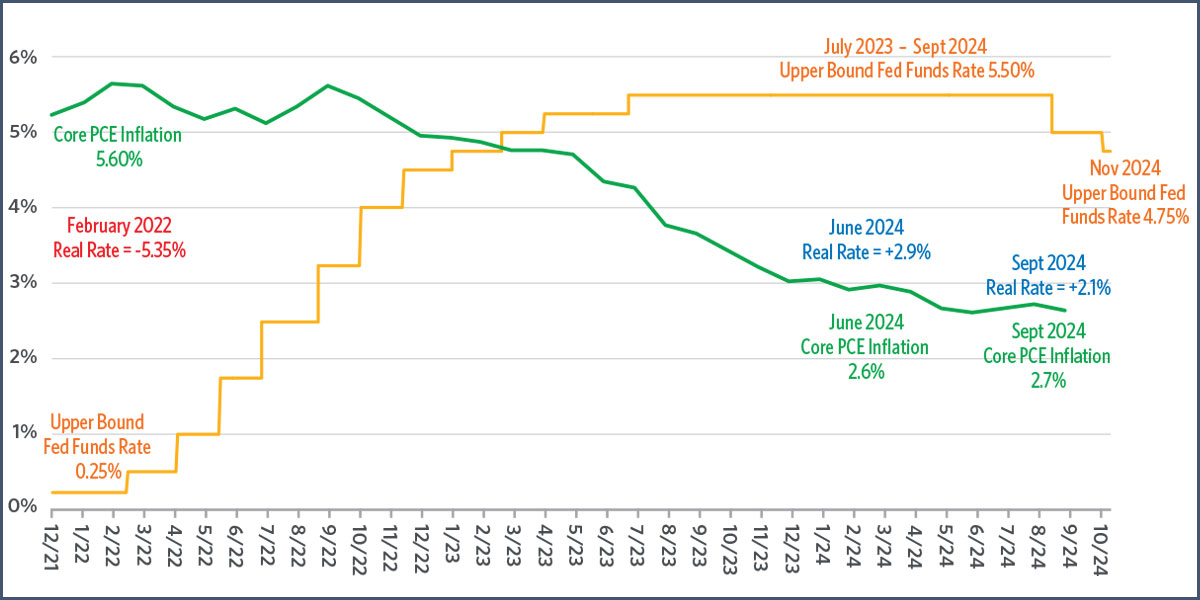

Real rate of interest

Federal funds rate minus core rate of inflation, December 2021–September 2024

Source: Federal Reserve Board of Governors; core PCE as of 9/30/24; fed funds rate as of 11/7/24

Click the (i) below to read a text description of this chart or download PDF

In February 2022, as inflation was heating up, the real rate of interest was negative at -5.35% (upper bound federal funds rate at 0.25% less PCE core inflation 5.6%). As the Fed raised rates and inflation declined, the real rate flipped positive in early 2023 before hitting 2.9% (upper bound federal funds rate 5.5%, PCE core inflation 2.6%) in August 2024. This was the highest the real rate had been since 2007. The real rate is now at about 2.0% (4.75% less 2.7%).

The key reason why we believe the Fed will continue reducing rates in 2025 is the inflation-adjusted real rate of interest, as calculated by the upper bound fed funds rate less PCE core inflation, currently at just above 2.0% (4.75% minus 2.7%). We believe the Fed views this current real rate as being overly restrictive in nature and will seek to bring it down to a level of approximately 1.25%. Therefore, should PCE core inflation fall further to the mid-2% range, as we believe is likely to be the case by year-end 2025, this would imply a federal funds target range of 3.50%–3.75%.

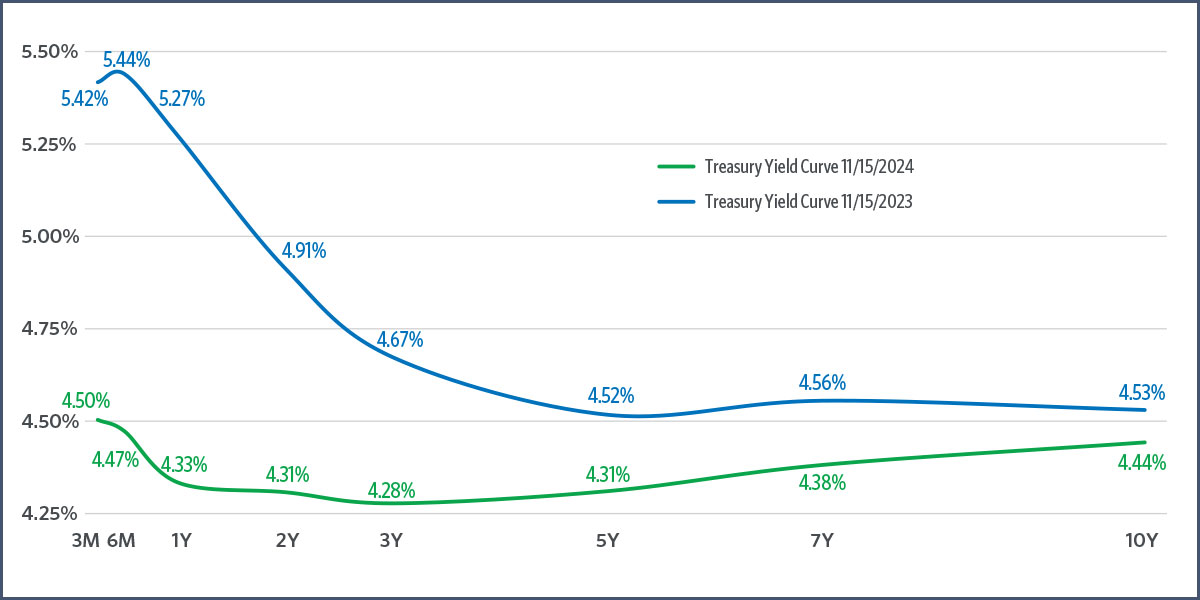

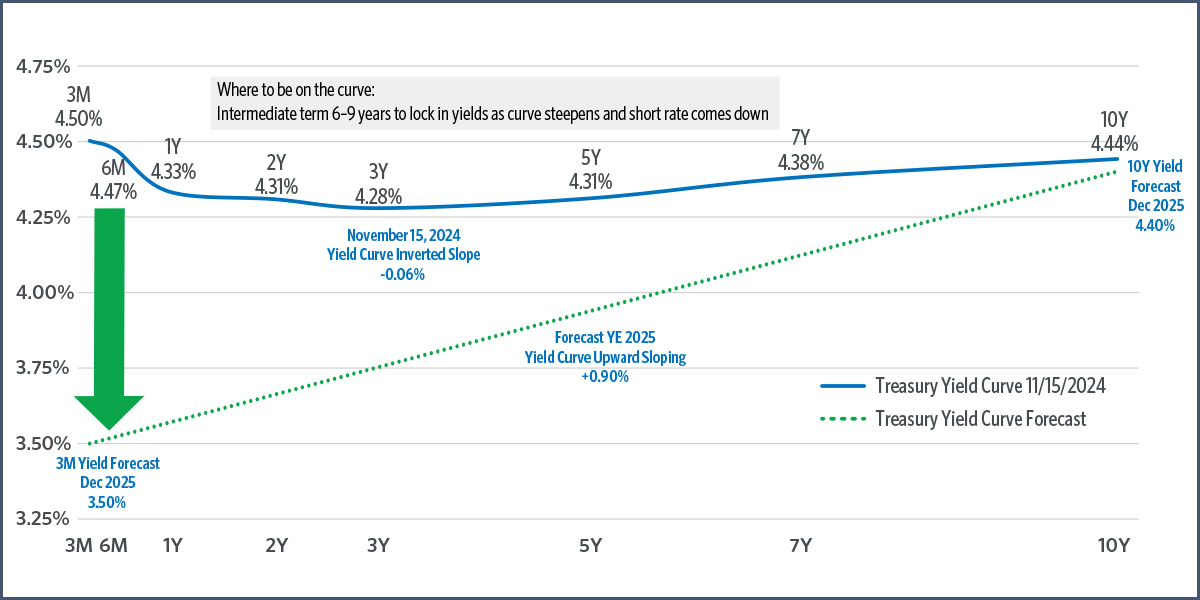

Adapting to a changing yield curve

3-month to 10-year Treasury bond yields, November 2024 vs. November 2023

As of 11/15/24; source: Bloomberg

Click the (i) below to read a text description of this chart or download PDF

The current 3-month to 10-year Treasury bond yield curve has shifted from a negative differential of -0.89% (4.53% minus 5.42%) in November 2023 to -0.06% (4.44% minus 4.50%) in November 2024.

Over the past year, the 3-month to 10-year Treasury bond yield curve has also normalized from a deeply inverted slope (short-term rates higher than longer-term rates) toward a more traditional upward slope. Given what we believe will be more rate cuts in 2025 pressuring the 3-month yield lower to approximately 3.5%, combined with the 10-year yield remaining close to its current level, we expect this curve to further steepen to an upward slope in the year ahead.

Adapting to a changing yield curve

Forecasted 3-month to 10-year Treasury bond yield curve — year-end 2025

As of 11/15/24; sources: Yield Curve — Bloomberg; Forecast — Transamerica Asset Management, Inc.

Click the (i) below to read a text description of this chart or download PDF

Transamerica forecasts the 3-month Treasury yield to be approximately 3.5% and the 10-year Treasury Yield to be about 4.4% by the end of 2025 for an upwardly sloping yield curve of just under 1%. In this changing environment, intermediate-term bonds in the 6–9 year maturity range appear well positioned to lock in current yields while mitigating against reinvestment risk at the short end of the curve and excessive duration-based price risk at the longer end.

Taking these forecasts into account, we see the 3-month to 10-year yield curve steepening to a slope of just below 1% by the end of 2025. Under such a scenario, we would see the most logical position on the curve to be in the 6–9 year maturity range to lock in current yields in a declining rate environment while mitigating reinvestment rollover risk at the short end of the curve as well as duration-based price risk at the longer end (10 years or greater).

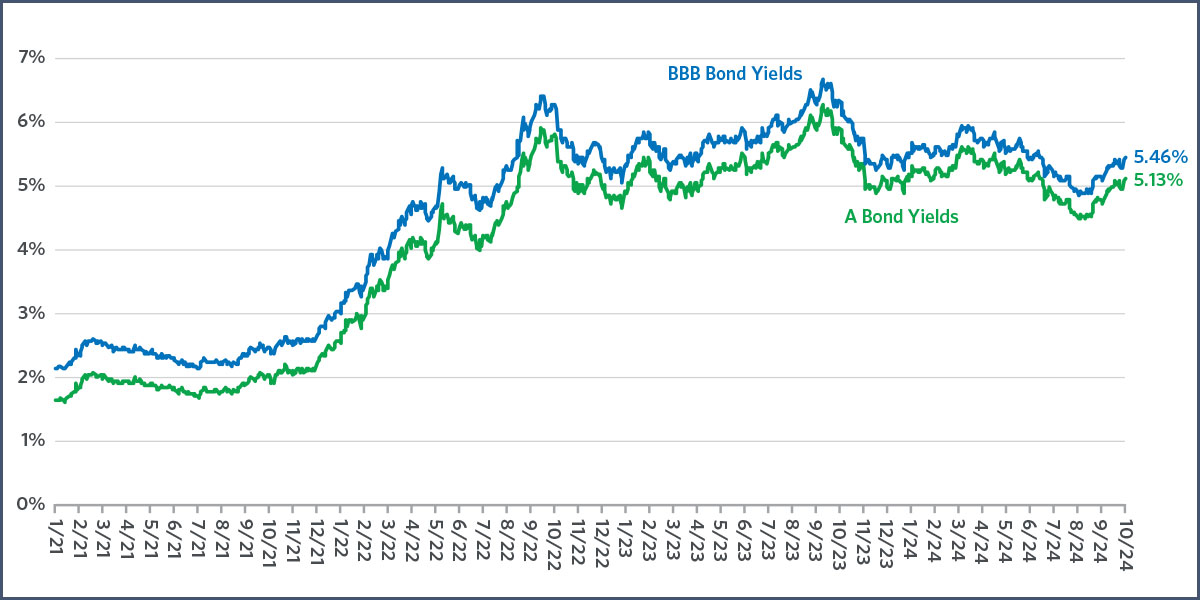

Investment-grade corporate bond yields

A-rated and BBB-rated corporate bond yields, January 2021–November 2024

Source: Bloomberg, as of 11/15/24. A-Rated Bond Yields represented by the Yield to Worst on the US Aggregate Bond: A Index; BBB-Rated Bond Yields represented by the Yield to Worst on the US Aggregate Bond: BBB Index

Click the (i) below to read a text description of this chart or download PDF

ICE B of A Indexes for A-rated and-BBB rated corporate bonds as of November 2024 offer yields well in excess of early 2021, before the higher inflation, rising interest rate market conditions took hold.

We believe corporate credit spreads will likely hold stable and strong risk-return opportunities remain for intermediate-term, investment-grade bonds in the 6–9 year maturity range. We see opportunities for A-rated and BBB-rated corporate bonds in the middle of the curve where investors can lock in recently elevated yields that could prove particularly attractive given the prospects of further Fed rate cuts and declining inflation.

Market Pulse summary: Fixed income

The year ahead appears to be one remaining favorable for intermediate-term, investment-grade bonds amid Federal Reserve rate cuts, an upward sloping yield curve, and a stable credit environment.

U.S. stocks

We see more upside in the equity markets, and our year-end 2025 price target on the S&P 500® is 6,500. Potential catalysts for stocks in the year ahead include accelerating economic growth, rising corporate earnings growth, Federal Reserve rate cuts, ongoing lower taxes, and a less onerous regulatory environment. As the year proceeds, based on some level of convergence in historically wide valuation differentials, we see a high probability of a shift in market leadership likely favoring value stocks versus growth.

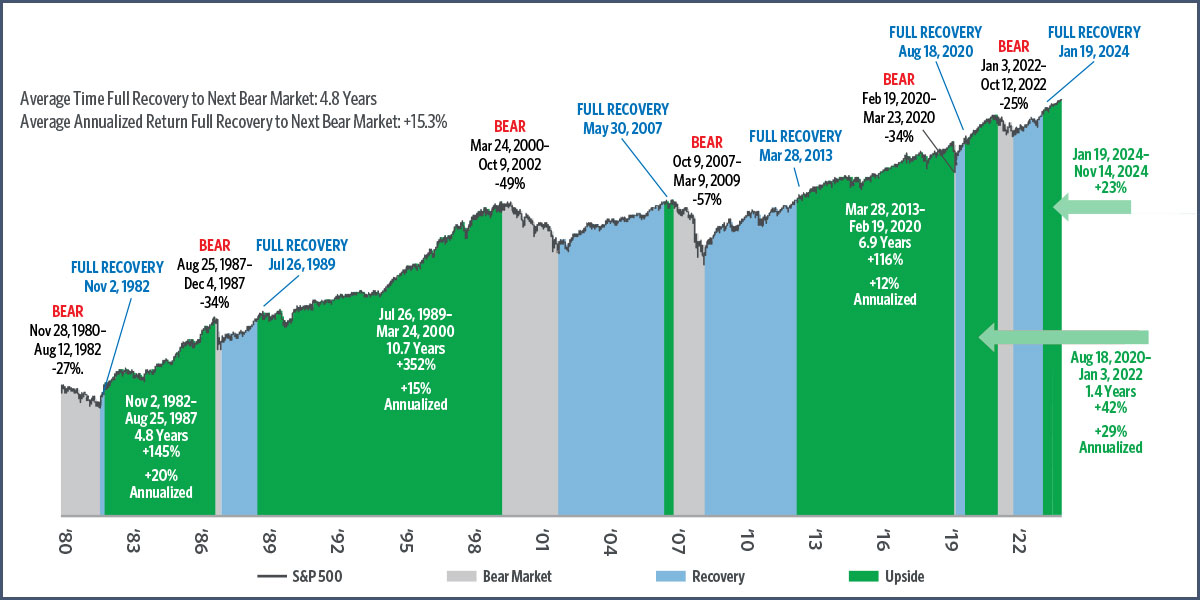

Historical returns following bear market recoveries, 1980–2024

S&P 500 Index price returns

Source: Bloomberg, as of 11/14/2024

Indexes are unmanaged and an investor cannot invest directly in an index. Past performance does not guarantee future results.

Click the (i) below to read a text description of this chart or download PDF

Since 1980, there have been six bear markets (defined as a 20% or worse decline in the S&P 500) averaging to approximately once every seven years. In four of the past five bear markets that occurred before the most recent one that began in 2022 and fully recovered in 2024, stock investors earned well above historical average price gains when buying or owning stocks after the S&P 500 fully recovered all of its bear market price losses. These cases occurred in November 1982, July 1989, March 2013, and August 2020. Since 1980, the average time frame between a full bear market price recovery and the beginning of the next bear market was 4.8% and the average annualized price return during those interim periods was 15.6%.

In looking at the past six bear markets (defined as a 20% or worse decline in the S&P 500), history suggests it has not only proven advantageous for investors to own stocks after they have bottomed and a new bull market has been initiated, but also after stocks have fully recovered their bear market price losses (as was the case in January 2024), which is a far more identifiable and actionable milestone.

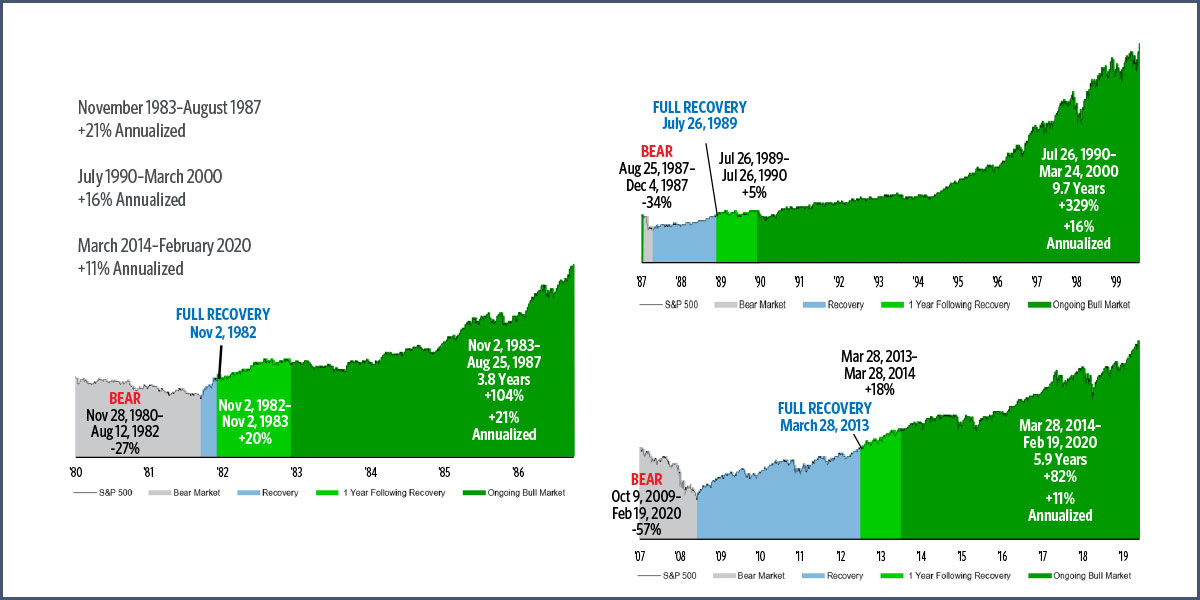

Historical returns following bear market recoveries

S&P 500 index price returns one year after full price recovery

Source: Bloomberg

Indexes are unmanaged and an investor cannot invest directly in an index. Past performance does not guarantee future results.

Click the (i) below to read a text description of this chart or download PDF

In comparing the current market environment, now one year out from full bear market loss price recovery, there are three historical examples of similar market cycles one year past complete bear market recoveries worth noting. These occurred in November 1983, July 1990, and March 2014. In these instances, the S&P 500 generated annualized price gains up to the beginning of the next bear market of 21%, 16%, and 11%, respectively.

We are currently about one year past the full recovery of the 2022 bear market, and we believe stocks remain in a longer-term bull market cycle that’s likely to continue through the upcoming year. The S&P 500 fully recovered its 2022 bear market price losses in January 2024, and though it has appreciated more than 25% since then, it’s still comparably positioned to previous post one-year bear market recoveries, such as in November 1983, July 1990, and March 2014. In those cases, the S&P 500 went on to post multi-year periods of well above historically average annualized price returns.

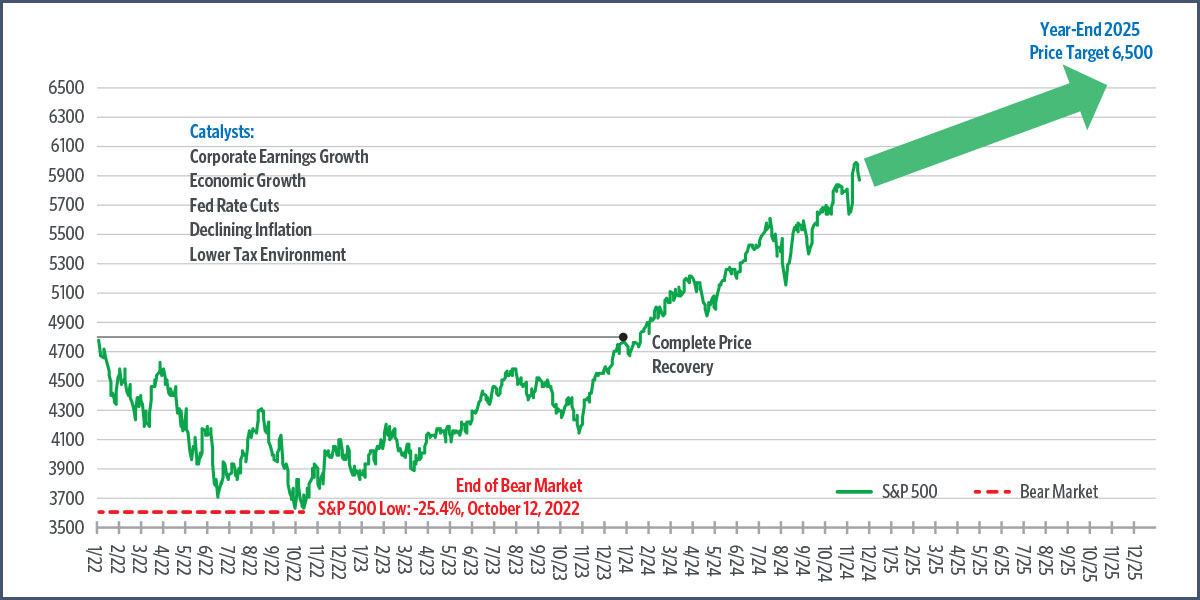

Bear market recovery

S&P 500 Index, January 2022–November 2024

As of 11/15/24. Source: Bloomberg; Forecast: Transamerica Asset Management

Indexes are unmanaged and an investor cannot invest directly in an index. Past performance does not guarantee future results.

Click the (i) below to read a text description of this chart or download PDF

The current trend of the S&P 500 appears comparable to previous post-bear market recoveries. In addition, current catalysts seem to be in place to drive stock prices higher in the year ahead. These include economic and corporate earnings growth, Fed rate cuts, declining inflation, and a more favorable tax and regulatory environment.

When looking at the recent path of the S&P 500 since its full recovery of bear market losses in January 2024, we view its technical profile as similar to the historical patterns of November 1983, July 1990, and March 2014. There also appears to be several identifiable catalysts capable of driving stocks higher in the year ahead. These include potentially accelerating economic growth, rising corporate earnings growth, Federal Reserve rate cuts, declining inflation, and a “lower for longer” federal tax environment. When taking this history and current catalysts into account, we view a fair year-end price target on the S&P 500 to be 6,500

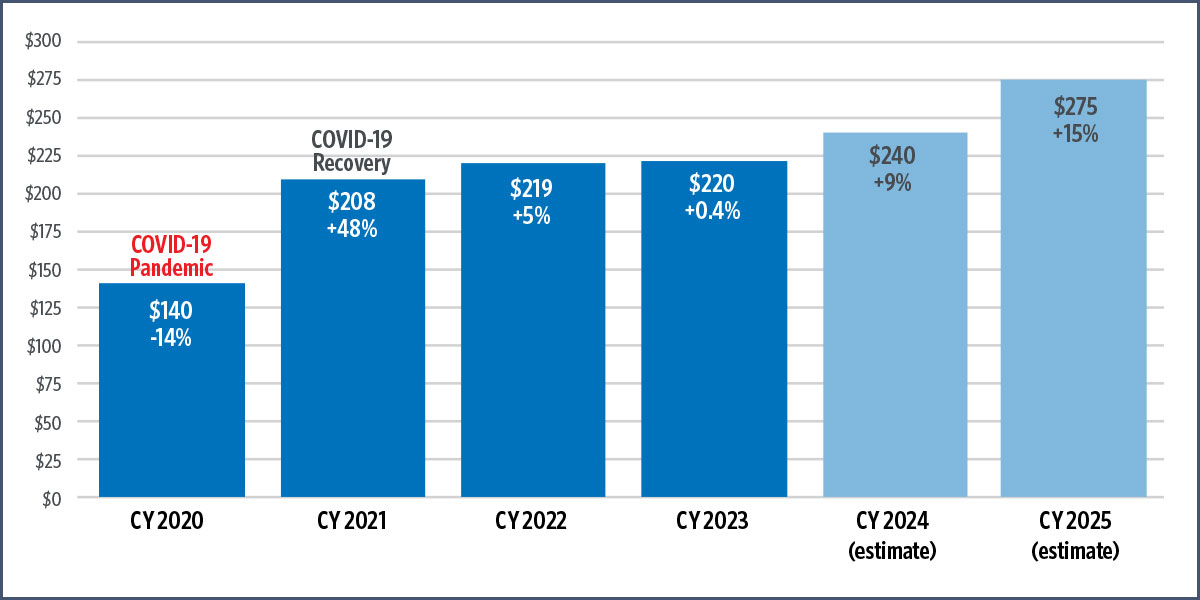

Corporate earnings growth

S&P 500 net operating income annualized and estimated growth, 2020–2025

Source: FactSet Earnings Insight; as of 11/15/24

Click the (i) below to read a text description of this chart or download PDF

When looking at past S&P 500 annual net operating earnings growth since 2020 on all underlying companies (as gathered, weighted, and calculated by FactSet Earnings Insight), a case can be made for a meaningful corporate profits breakout now being underway. Following three years of close to flat earnings growth between 2021–2023, aggregated analyst estimates are forecasting about 9% earnings growth for soon to be completed CY 2024 and about 15% earnings growth for CY 2025. Should these estimates come to fruition, we believe it is fair to expect total returns on stocks of similar magnitudes and consistent with our year-end 2025 price target on the S&P 500 of 6,500.

Of all the current catalysts for stocks, we view rising corporate earnings growth to be the most important. When looking at past S&P 500 annual net operating earnings growth since 2020 — on all underlying companies as gathered, weighted and calculated by FactSet Earnings Insight — a case can be made for a meaningful corporate profits breakout now being underway. Following three years of close to flat earnings growth between 2021–2023, aggregated analyst estimates are forecasting about 9% earnings growth for soon to be completed CY 2024 and about 15% earnings growth for CY 2025. Should these estimates come to fruition, we believe it is fair to expect total returns on stocks of similar magnitudes and consistent with our year-end 2025 price target on the S&P 500 of 6,500.

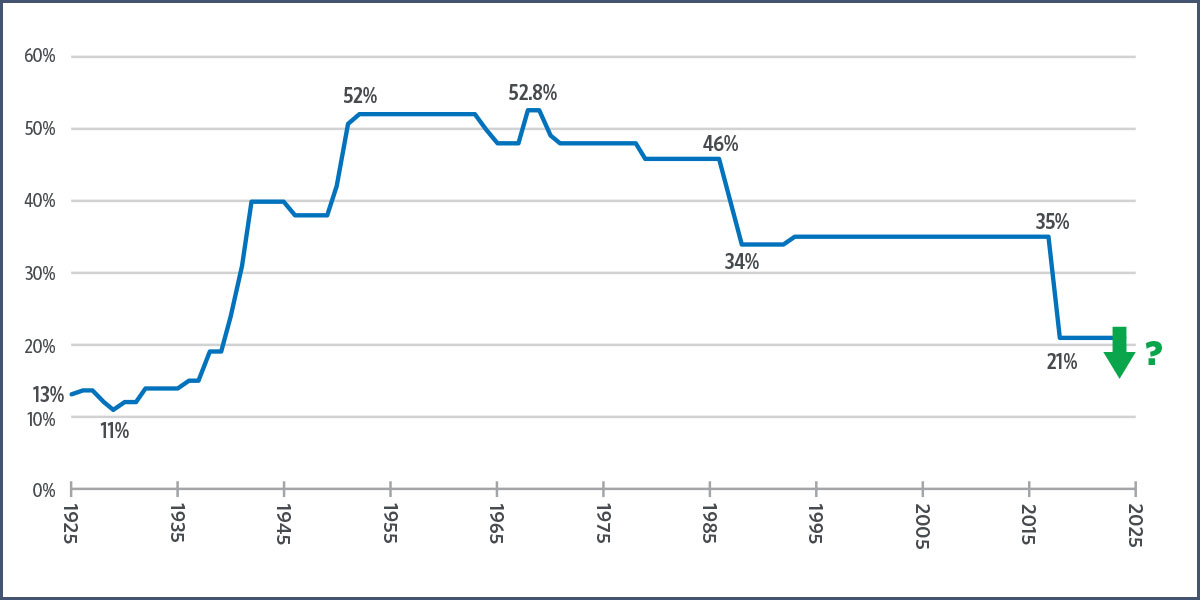

History of U.S. corporate tax rate

Markets potentially entering a 'lower for longer' tax environment

Source: Internal Revenue Service

Click the (i) below to read a text description of this chart or download PDF

Over the past century, the marginal corporate tax rate in the U.S. has ranged from a low of 11% in 1929 to 52% in the 1960s. The current rate since 2017 has been 21% and prior to the election, there was widespread concerns of an increase of this marginal corporate tax rate from 21% to 28%, which would have taken effect in 2026. However, given the somewhat unexpected election results of a Republican-controlled White House and that party’s majorities in Congress, a corporate tax increase now looks, for the most part, off the table and a potential corporate tax reduction perhaps to as low as 15% range could be back on.

Corporate earnings growth for 2025 and beyond could be further strengthened by the recent presidential and congressional elections, which will likely lead to a less burdensome regulatory environment and the extension of and/or revisions to the 2017 Tax Cuts and Jobs Act that is set to expire by the end of 2025. Prior to the election, there was widespread concerns of an increase to the marginal corporate tax rate from 21% to 28% which would have taken effect in 2026. However, given the somewhat unexpected election results of a Republican-controlled White House and that party’s majorities in Congress, a corporate tax increase now looks, for the most part, off the table and a potential corporate tax reduction perhaps to as low as 15% range could be back on.

All else being equal, this could create additional upside to CY 2026 corporate earnings estimates as they materialize over the upcoming year. In summary, the corporate tax environment looks as though it is now in a “lower for longer” profile and has therefore shifted from a headwind to a tailwind for stocks.

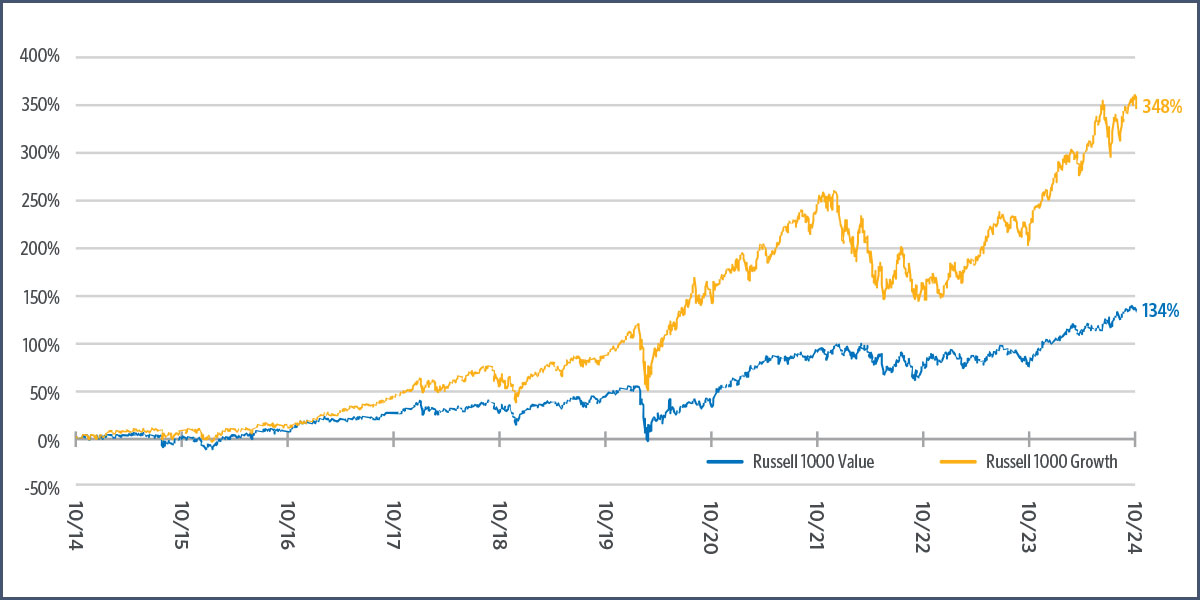

Growth vs. value — comparative returns

Russell 1000 Growth vs. Russell 1000 Value total return, October 2014–October 2024

Source: Bloomberg as of 10/31/24

Indexes are unmanaged and an investor cannot invest directly in an index. Past performance does not guarantee future results.

Click the (i) below to read a text description of this chart or download PDF

Over the past decade, the Russell 1000® Growth Index has posted a cumulative total return of 348% versus a 133% total return for the Russell 1000® Value Index.

Over the past decade, growth stocks have meaningfully outperformed value stocks, as can be seen in the comparative returns of the Russell 1000® Growth Index versus the Russell 1000® Value Index. During this time frame, Russell 1000 Growth has posted total returns more than double that of Russell 1000 Value.

We believe value and growth stocks can generate positive returns in the current market environment. However, as we enter 2025, we believe there is a strong probability of a shift in market leadership during the year ahead, providing for an upside regression to the mean and new cycle of relative outperformance for value stocks. As a result, we believe investors may want to consider shifting relatively higher equity allocations from growth to value as the year moves forward.

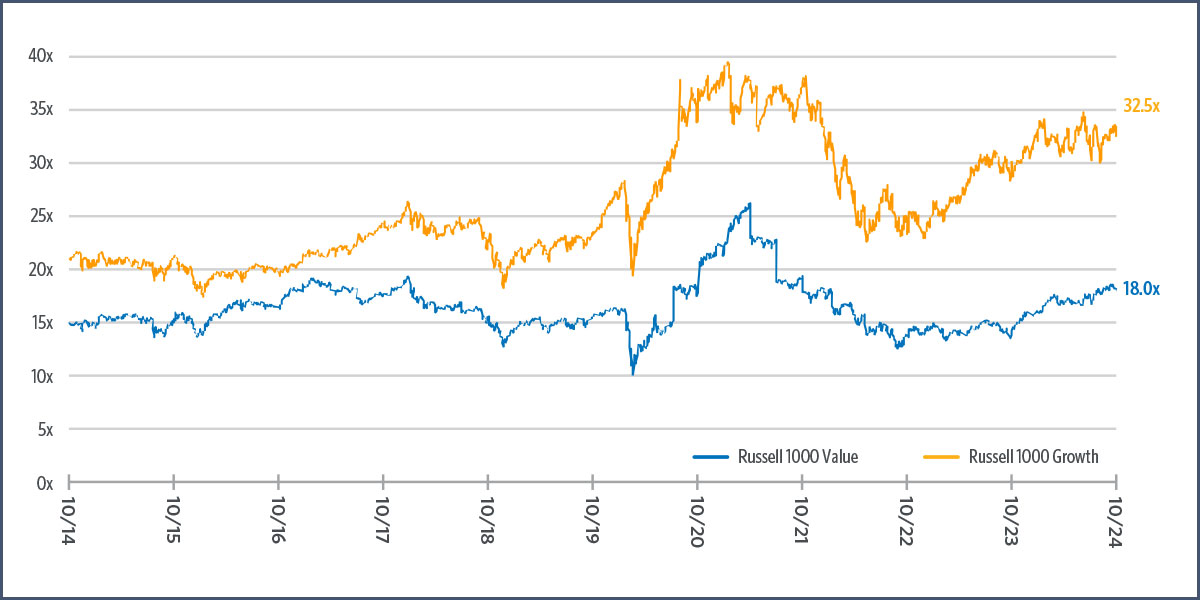

Growth vs. value — comparative valuations

Russell 1000 Growth vs. Russell 1000 Value price to trailing 12-month earnings multiple

October 2014–October 2024

Source: Bloomberg as of 10/31/24

Indexes are unmanaged and an investor cannot invest directly in an index. Past performance does not guarantee future results.

Click the (i) below to read a text description of this chart or download PDF

As of November 2024, the trailing 12-month price/earnings ratio on the Russell 1000® Value Index is 18x, versus more than 32x on the Russell 1000® Growth Index.

At the forefront of this case for value stocks is the widening valuation discounts they currently trade at versus their growth counterparts. At more than a 40% discount to growth stocks on trailing 12-month price/earnings multiples (Russell 1000 Growth versus Russell 1000 Value), this valuation gap is now close to historical levels. With the economy likely to accelerate in 2025 and Fed rate cuts potentially concluding in 2H 2025, we view such an environment as one setting up value stocks extremely well for strong absolute and relative performance, particularly in the second half of the year.

Market Pulse summary: U.S. stocks

We believe stocks will continue to see more upside in 2025 and our year-end price target on the S&P 500 is 6,500. Catalysts include accelerating economic growth, rising corporate earnings, Fed rate cuts, less onerous regulatory conditions, and a “lower for longer” corporate tax environment. We believe a shift in market leadership is likely to occur favoring value stocks versus growth.

International stocks

Despite more than a decade of lagging in comparative performance versus U.S. stocks, the environment could be turning constructively for international developed stocks. With highly attractive relative valuations and identifiable catalysts in Europe and Japan, we believe global investors could benefit from allocations to this space.

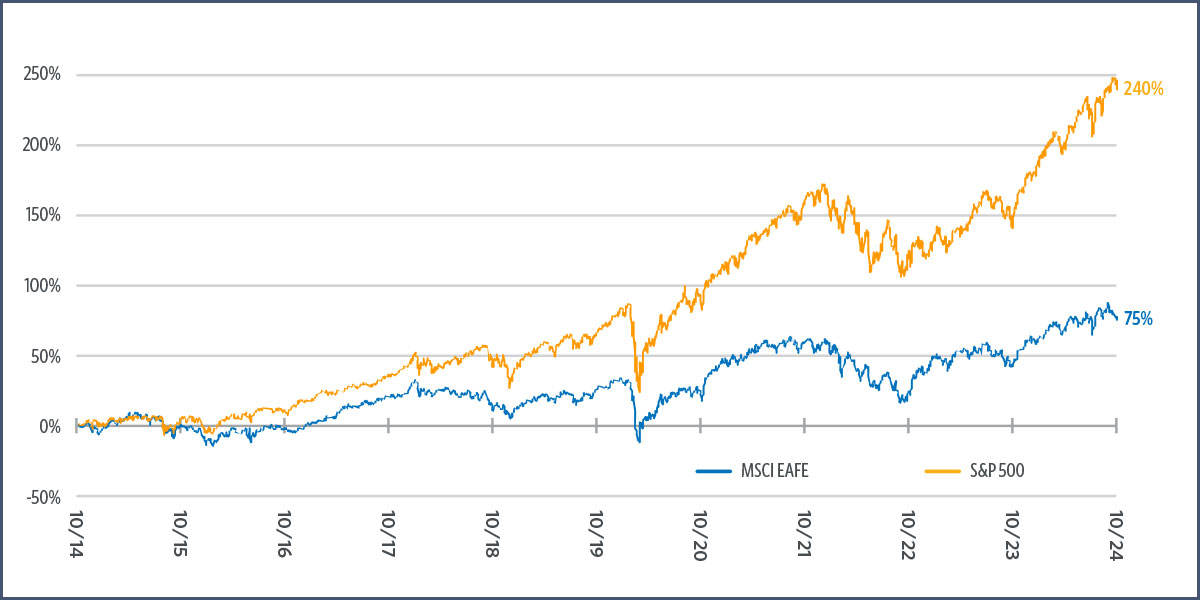

MSCI EAFE vs. S&P 500 — comparative returns

October 2014–October 2024

Indexes are unmanaged and an investor cannot invest directly in an index. Past performance does not guarantee future results.

Source: Bloomberg, as of 10/31/2024.

Click the (i) below to read a text description of this chart or download PDF

The MSCI EAFE Index has generated a cumulative total return between November 2014–November 2024 of 75%, versus 240% for the S&P 500.

Entering 2025, international developed stocks continue more than a decade of underperformance relative to their U.S. counterparts, as seen in the comparative returns of the MSCI EAFE versus the S&P 500.

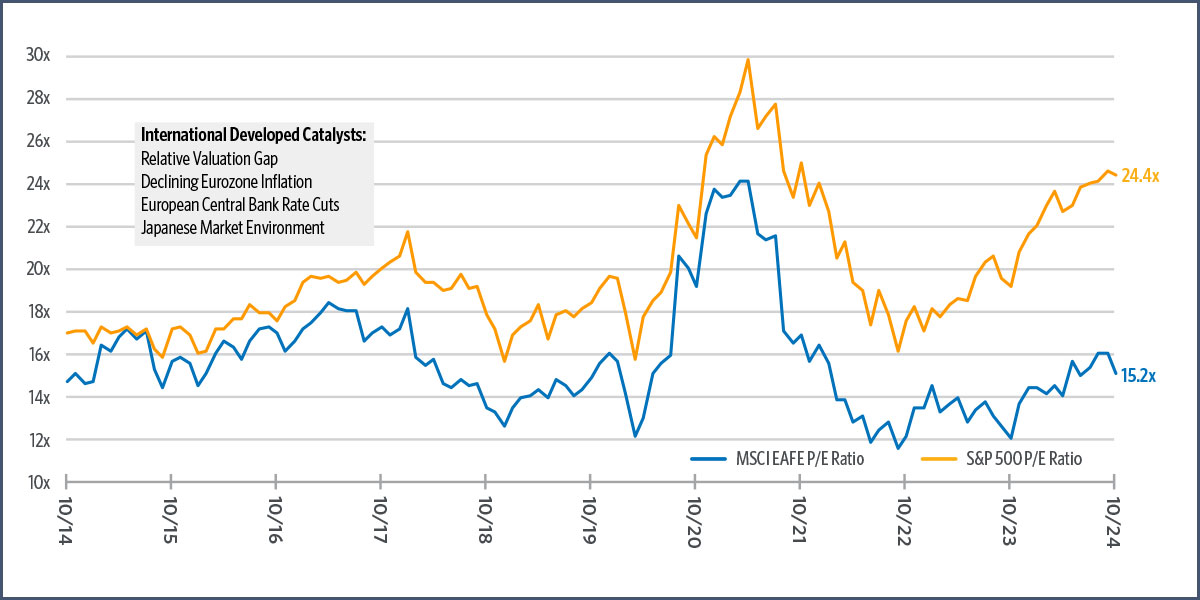

MSCI EAFE vs. S&P 500 — comparative valuations

Trailing 12-month P/E ratios, October 2014–October 2024

As of 10/31/2024. Source: Bloomberg

Indexes are unmanaged and an investor cannot invest directly in an index. Past performance does not guarantee future results.

Click the (i) below to read a text description of this chart or download PDF

As of November 2024, MSCI EAFE is trading at 14x trailing 12-month earnings as compared to 24x for the S&P 500. This could bring to the forefront catalysts for international developed stocks, which would include falling inflation and European Central Bank rate cuts in the eurozone, and an improving market environment in Japan.

However, this underperformance by international developed stocks has also resulted in a meaningful valuation differential versus U.S. equities approaching historic levels, as seen in widening trailing 12-month price/earnings ratios between MSCI EAFE and the S&P 500. We believe this could provide for an opportunistic profile for international developed stock portfolios and particularly those with a focus on the eurozone and Japan.

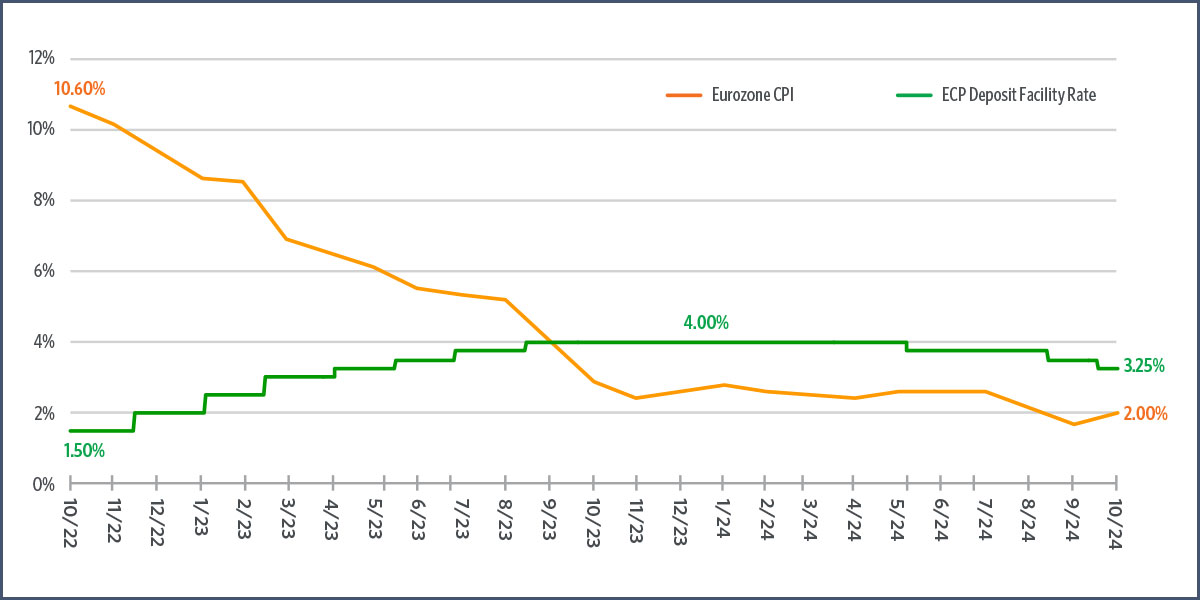

Eurozone inflation and ECB key interest rates

Eurozone CPI, October 2022–October 2024

As of 10/31/2024. Eurozone CPI Source: Eurostat; ECB Deposit Facility Rate, Source: European Central Bank

Click the (i) below to read a text description of this chart or download PDF

Since October 2022, eurozone consumer price index inflation has declined from 10.6% annually to 2% in October 2024, and the ECB has cut its deposit facility rate from 4.00% to 3.25% between June–November 2024.

Having seen inflation peak in October 2022 at higher than 10%, the eurozone has managed to reduce consumer prices at a faster pace than in the U.S., reaching an annualized rate below 2% in September 2024. As a result, the European Central Bank (ECB) has cut the deposit facility interest rate from 4% to 3.25% since June 2024. We believe more rate cuts from the ECB will be forthcoming in 2025, which, when combined with declining inflation, could provide a favorable environment for global investors.

Improving market environment in Japan

Nikkei 225 December 1989–November 2024

Source: Bloomberg, as of 11/15/2024

Indexes are unmanaged and an investor cannot invest directly in an index. Past performance does not guarantee future results.

Click the (i) below to read a text description of this chart or download PDF

The Nikkei℠ 225 Index has recently eclipsed its record high dating back to December 1989. Criteria of improving market conditions include a rebounding economy and corporate governance reforms encouraging corporations to more profitably manage their balance sheets and returns on capital.

Despite an intense sell-off this past August that was driven by a large short-term yen carry-trade unwind, we believe certain catalysts could be at work in the Japan market responsible for multi-decade highs recently established in the NikkeiSM 225. This includes a rebounding economy (actually welcoming of inflation following a lengthy period of deflation), as well as corporate governance reforms encouraging corporations to more profitably manage their balance sheets and returns on capital. We view these changes as potentially representing a longer-term shift in Japan’s overall market environment attracting a growing base of international investors.

Market Pulse summary: International stocks

International developed stocks could be positioned well for the year ahead based on historically favorable valuations and improving market environments in the eurozone and Japan.

Wild card

In the aftermath of the U.S. elections, we view the single biggest wild card to the markets as being the potential implementation of additional trade tariffs by the U.S. The degree to which the Trump administration imposes additional tariffs, be it on China or a wider set of nations, could have economic and market impacts during the year ahead.

A risk wild card could quickly emerge regarding the degree to which the Trump administration might impose additional tariffs on China and other nations. Key points of consideration on this uncertainty include:

- Escalating tariff-based trade policies could have inflationary impacts as well as affects on global trade.

- Depending on the number and specific terms of additional tariffs, markets could react negatively and in a similar fashion to when the first Trump administration announced tariffs on China in 2018.

- We view a key variable in this wild card as being whether President Trump’s administration uses the prospects of tariffs mostly for tactical trade negotiations on a case-by-case basis or as longer-term strategic policy.

- A potential silver lining could be a favorable market reaction if it becomes apparent that tariffs are applied to a lesser degree than most might currently anticipate.

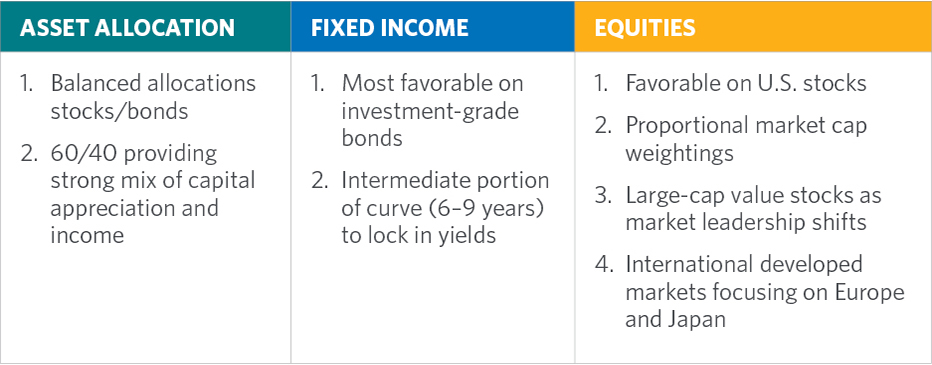

Portfolio positioning 2025

- From an asset allocation perspective, we feel investors can benefit from balanced 60/40 stock/bond portfolios capable of providing capital appreciation and income amid an economic environment we believe will be favorable for equities and fixed income.

- Within stocks, we favor large-cap over mid- and small-cap, utilizing proportional market cap weightings.

- While we view the current market environment as conducive for value and growth stocks, we believe the year ahead is likely to see a shift in market leadership favoring value stocks. Therefore, we believe investors should consider increasing allocations to value stocks throughout the year.

- Global investors may want to consider increasing allocations to international developed stocks, particularly in the eurozone and Japan, based on historically favorable valuations and improving market environments in these two regions.

- In fixed income, given expectations of more Federal Reserve rate cuts in 1H 2025 accompanied by a steepening yield curve and stable credit markets, we favor intermediate-term, investment-grade corporate bonds in the 6–9 year maturity range.

Click the (i) below to read a text description of this chart or download PDF

From an asset allocation perspective, we feel investors can benefit from balanced 60/40 stock bond portfolios capable of providing capital appreciation and income amid an economic environment we believe will be favorable for equities and fixed income. Within stocks, we favor large-cap over mid- and small-cap, utilizing proportional market cap weightings. While we view the current market environment as conducive for value and growth stocks, we believe the year ahead is likely to see a shift in market leadership favoring value stocks. Therefore, we believe investors should consider increasing allocations to value stocks throughout the year ahead. Global investors may want to consider increasing allocations to international developed stocks, particularly in the eurozone and Japan, based on historically favorable valuations and improving market environments in these two regions. In fixed income, given expectations of more Federal Reserve rate cuts in 1H 2025 accompanied by a steepening yield curve and stable credit markets, we favor intermediate-term, investment-grade corporate bonds in the 6–9 year maturity range.

The above strategy overview is intended to illustrate major themes for the identified period. No representation is being made that any particular account, product, or strategy will engage in any or all of these themes.

About the author

Tom is the Chief Investment Officer of Transamerica Asset Management, Inc., the mutual fund arm of Transamerica. Tom has more than 30 years of investment management experience and has managed large mutual fund portfolios and separate accounts.

As a member of the senior management team, Tom heads Transamerica Asset Management’s thought leadership efforts and provides perspectives to advisors, clients, the media, and general public. He writes and publishes Transamerica’s Market Outlook and other relevant commentary. He also heads Transamerica’s mutual fund sub-adviser selection and monitoring process, as well as product management. Tom holds a bachelor's degree in political science from Tulane University and an MBA in finance from the Wharton School at the University of Pennsylvania.

Learn more about our mutual funds and get the latest advisor resources.

Glossary & Index Definitions

CPI: Consumer price index

ECB: European Central Bank

EPS: Earnings per share

GDP: Gross domestic product

PCE: Personal consumption expenditures

The Bloomberg US Aggregate Bond Index measures investment grade, U.S. dollar-denominated, fixed-rate taxable bonds, including Treasurys, government related and corporate securities, as well as both mortgage- and asset-backed securities.

The Bloomberg US High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC-registered) of issuers in non-EMG countries are included.

The Bloomberg Municipal Index consists of a broad selection of investment-grade general obligation and revenue bonds of maturities ranging from one year to 30 years. It is an unmanaged index representative of the tax-exempt bond market.

The Bloomberg US Corporate Investment Grade Index is an unmanaged index consisting of publicly issued U.S. Corporate and specified foreign debentures and secured notes that are rated investment grade (Baa3/BBB or higher) by at least two ratings agencies, have at least one year to final maturity and have at least $250 million par amount outstanding. To qualify, bonds must be SEC-registered.

The 10-Year U.S. Treasury bond is a U.S. Treasury debt obligation that has a maturity of 10 years.

The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip U.S. stocks.

The federal funds rate refers to the target interest rate range at which commercial banks borrow and lend their excess reserves to each other overnight, which is set by the Federal Open Market Committee.

The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets.

The Russell 1000 Growth Index® measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values.

The Russell 1000 Value Index® measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

The Russell 2000 Index® measures the performance of the 2,000 smallest companies in the Russell 3000 Index.

The S&P 500 Index is widely regarded as the best single gauge of the U.S. equities market. The index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. The S&P 500 Index focuses on the large-cap segment of the market; however, since it includes a significant portion of the total value of the market, it also represents the market.

The Nikkei 225 stock index is a price-weighted index composed of Japan's top 225 blue-chip companies traded on the Tokyo Stock Exchange. The Nikkei is equivalent to the Dow Jones Industrial Average (DJIA) Index in the United States.

Indexes are unmanaged. The figures for the index reflect the reinvestment of all income or dividends, but do not reflect the deduction of any fees or expenses which would reduce returns. Investors cannot invest directly in indexes.

Important information

Investments are subject to market risk, including the loss of principal. Asset classes or investment strategies described may not be appropriate for all investors.

Past performance does not guarantee future results.

Fixed income investing is subject to credit rate risk, interest rate risk, and inflation risk. Credit risk is the risk that the issuer of a bond won’t meet their payments. Inflation risk is the risk that inflation could outpace a bond’s interest income. Interest rate risk is the risk that fluctuations in interest rates will affect the price of a bond. Investing in floating rate loans may be subject to greater volatility and increased risks.

Equities are subject to market risk meaning that stock prices in general may decline over short or extended periods of time.

Growth stocks typically are particularly sensitive to market movements and may involve larger price swings because their market prices tend to reflect future expectations. Growth stocks as a group may be out of favor and underperform the overall equity market for a long period of time, for example, while the market favors “value” stocks.

Value investing carries the risk that the market will not recognize a security’s intrinsic value for a long time or that an undervalued stock is actually appropriately priced.

Investments in global/international markets involve risks not associated with U.S. markets, such as currency fluctuations, adverse social and political developments, and the relatively small size and lesser liquidity of some markets. These risks may be greater in emerging markets.

The information included in this document should not be construed as investment advice or a recommendation for the purchase or sale of any security. This material contains general information only on investment matters; it should not be considered as a comprehensive statement on any matter and should not be relied upon as such. The information does not take into account any investor’s investment objectives, particular needs, or financial situation. The value of any investment may fluctuate. This information has been developed by Transamerica Asset Management, Inc., and may incorporate third-party data, text, images, and other content to be deemed reliable.

Comments and general market-related projections are based on information available at the time of writing and believed to be accurate; are for informational purposes only, are not intended as individual or specific advice, may not represent the opinions of the entire firm and may not be relied upon for future investing. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decisions.

Transamerica Asset Management, Inc. (TAM) is an SEC-registered investment adviser that provides asset management, fund administration and shareholder services for institutional and retail clients. The funds advised and sponsored by TAM include Transamerica Funds and Transamerica Series Trust. Transamerica Funds and Transamerica Series Trust are distributed by Transamerica Capital, LLC. member FINRA. TAM is an indirect wholly owned subsidiary of Aegon Ltd., an international life insurance, pension, and asset management company.

1801 California Street, Suite 5200, Denver, CO 80202, USA