What is ESG? It Could Help Clients Invest for Good

Why It Matters:

- Younger investors are keen on investing based on environmental, social, and governance (ESG) factors.

- Investing for a better world doesn’t necessarily mean clients are settling for lower returns.

- Not all companies report on ESG metrics in the same way, so clients might ask financial professionals for help finding sustainable investments.

Investing isn’t just about money anymore, and we have younger generations to thank.

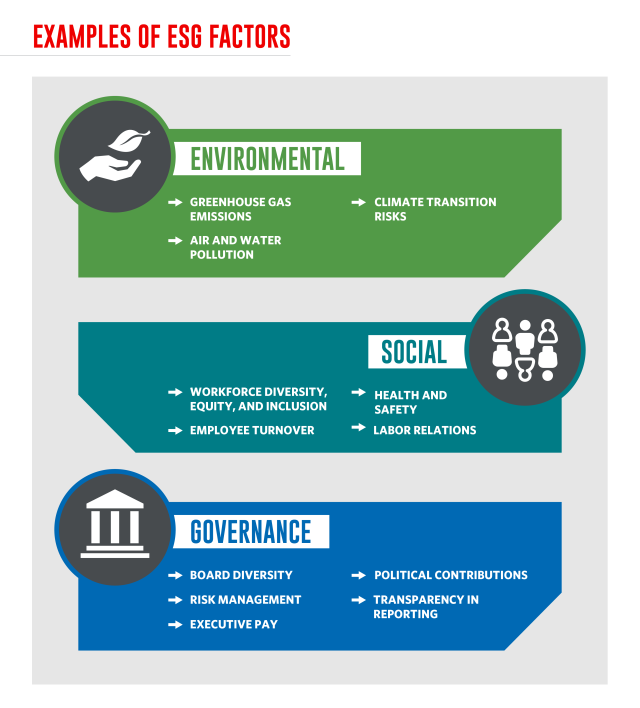

Interest is exploding in socially responsible investing based on environmental, social, and governance (ESG) factors, such as whether a company is working to reduce greenhouse gas emissions, increase diversity among leadership, and manage risk.

ESG-focused funds saw inflows of $649 billion in 2021 through November 30, up from $542 billion for all of 2020 and $285 billion in 2019, according to Refinitiv Lipper data.1 In fact, ESG investments could become a $1 trillion category by 2030, BlackRock’s head of iShares Americas, Armando Senra, has said.2

While 61% of investors in a recent survey3 said they wanted to know whether a company lives up to their social and moral beliefs before investing, that percentage rose to 72% for those ages 18 to 34.

ESG-minded investors are not focused on financial returns alone. However, companies that align with the United Nations’ Sustainable Development Goals (SDGs) to end poverty, ensure gender equality, and much more are working toward long-term economic growth, which is good for both investors and society at large.

Investing based on morals and values doesn’t necessarily mean settling for lower financial returns. S&P Global Ratings analyzed 2,000-plus studies on the impact of ESG factors and said more than 90% found that considering ESG factors led to average or above-average returns.4

What is ESG investing?

Investing based on ESG factors is not just about generating returns but directing money toward more sustainable businesses and ultimately, a better world.

Fund and portfolio managers have taken different approaches to ESG investing. They may choose to invest solely in bonds or companies that are solving environmental or social problems, such as bonds for eco-friendly, affordable housing projects. They might exclude investments they view as contributing to those problems, such as debt instruments that fund construction resulting in an outsized amount of carbon emissions.

Reading ESG reports and evaluating performance

If you think the definition of an ESG investment is a bit squishy, you’re not wrong. Without a standard definition of what a negative or positive ESG impact is, portfolio managers’ judgment of what qualifies will be subjective.

Furthermore, managers are forming their opinions based on ESG reporting that isn’t necessarily standardized. Europe is far ahead of the United States in regulating ESG disclosures to give investors better information to make more sustainable investments. The U.S. Securities and Exchange Commission (SEC) does require public companies to make some disclosures around risks they face related to climate change. SEC Chair Gary Gensler has said a new rule on climate disclosures is coming.

The newly formed International Sustainability Standards Board should bring more consistency to sustainability disclosures, supporters say.5 Until then, securities issuers that have led the way in ESG reporting are using a variety of frameworks to report on ESG metrics.

If clients read sustainability reports from some of the largest public companies in the world, they’ll see many have aligned with UN SDGs, the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB) reporting standards, and recommendations of the Task Force on Climate-related Financial Disclosures. These frameworks provide guidelines for companies to report progress on environmental, social, and governance goals but also for investors to judge ESG performance.

Companies can engage ratings providers to gain an ESG score or rating that provides investors with an indication of how well they’re doing on sustainability measures. Keep in mind, ratings agencies use different methodologies, so results may not be comparable across different rating providers.

An ESG focus is here to stay

Your clients may find that some securities issuers are not yet disclosing ESG performance. In many ways, it’s still early days for ESG disclosures in the United States — or even action. Let’s look at the “G” of ESG and consider board diversity. Only 30% of board directors for S&P 500 companies are women, 11% are Black, 5% are Hispanic, and 5% are Asian.6 Those percentages are below each group’s representation in the U.S.

Companies may not be perfect on ESG performance today. What will matter is measuring their progress over time — and staying invested for good.

Things to Consider:

- Momentum is building for international standards in ESG reporting, which could make it easier to compare ESG performance across investments in the future.

- Ratings agencies can provide an indication of an issuer’s ESG performance, but keep in mind that not all agencies use the same methodology to assign ratings.

- Sustainability-minded clients who don’t have time to evaluate every investment option for ESG performance can invest in an ESG fund or SDG-aligned instrument instead.

1 “Analysis: How 2021 Became the Year of ESG Investing,” Reuters, December 2021

2 “ESG Investing to Reach $1 Trillion by 2030, Says Head of iShares Americas as Carbon Transition Funds Launch,” CNBC, May 2021

3 “Workiva Fact Sheet: Individual Investors’ ESG Attitudes Data,” Workiva, May 2021

4 “Daily Update,” S&P Global, January 2022

5 “The ISSB: A Game-Changer for ESG Reporting,” Workiva, November 2021

6 “2021 S&P 500 Board Diversity Snapshot,” SpencerStuart, 2021

Transamerica Resources, Inc. is an Aegon company and is affiliated with various companies which include, but are not limited to, insurance companies and broker dealers. Transamerica Resources, Inc. does not offer insurance products or securities. The information provided is for educational purposes only and should not be construed as insurance, securities, ERISA, tax, investment, legal, medical or financial advice or guidance. Please consult your personal independent professionals for answers to your specific questions.