Upgrading Our Forecasts on the Economy and Stocks

In this article we review:

- We now believe the U.S. economy will achieve positive growth in the year ahead

- We are increasing our year-end price target on the S&P 500®

- We reiterate our year-end forecasts for both short- and longer-term interest rates

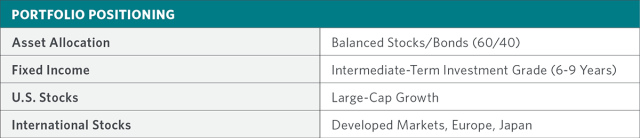

- We continue to favor balanced asset allocation strategies of growth stocks and intermediate-term, investment-grade bonds for the year ahead

Recent strength in the U.S. economy has resulted in an upgrade in our views for both gross domestic product (GDP) growth and equity return expectations for the year ahead. As such, we would like to highlight the following developments and revisions to our forecasts:

- Economy continues to exceed expectations. Economic strength has continued over the first two months of the year as seen in the advanced estimate of 4Q 2023 GDP annualized growth of 3.3% and current tracking estimates (Atlanta Fed GDP Now, Moody’s, and Nowcasting) on 1Q 2024 GDP growth now also exceeding 3%. From an employment standpoint, January’s impressive nonfarms payroll report of 353,000 jobs added to the economy has now pushed monthly averages of job gains up to approximately 290,000 during the past three months and 250,000 over the past six months. While we do expect this overall momentum to slow over the next few months, it now appears unlikely it will do so to the point of overall negative GDP growth, which makes the prospect of recession improbable.

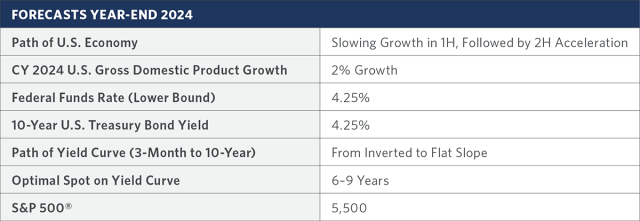

- We expect cumulative GDP growth to finish CY 2024 at approximately 2%. Following some slowing of GDP growth from its current 1H pace, we believe an acceleration is likely in 2H and will continue forward into CY 2025 based largely on lower rates of core inflation and upcoming Federal Reserve rate cuts. In our view, this should lead to positive overall economic growth in 2024 with upward momentum into 2025.

- Upgrading our year-end price target on the S&P 500 to 5,500. This increase is based mostly on rising earnings growth in the double-digit range for both CY 2024 and CY 2025. With a better economic environment, we are now more optimistic about S&P 500 net operating income estimates potentially rising to approximately $250 in CY 2024 and further increasing to about $290 in CY 2025, particularly given 12 full months of lower inflation and interest rates in the latter year. With a forward multiple of just over 19x, this would reflect a year-end 2024 price target about 10% higher than current levels.

- Maintaining our forecasts on short- and long-term interest rates. We continue to believe the Fed is most likely to reduce rates at a pace of four quarter-point rate cuts between June and December, concluding the year at a federal funds rate target range of 4.25–4.50%. This policy action would be based on continued progress on core inflation rates mitigating toward or below 3% and some slowing in the rate of economic growth. We continue to expect the yield curve to dis-invert over the year ahead, ending 2024 with a flat slope and therefore a 10-year Treasury yield also of about 4.25%.

In summary, we believe the year ahead should be a strong one for equities and fixed income, with current conditions setting up well for large-cap growth stocks and investment-grade bonds in the maturity range of six to nine years. From an asset allocation standpoint, we believe balanced strategies (60% stock/40% bond) should also be well positioned to deliver capital appreciation and income in better combination than has been the case in more than a decade.

The above strategy overview is intended to illustrate major themes for the identified period. No representation is being made that any particular account, product, or strategy will engage in any or all of the themes.

Investments are subject to market risk, including the loss of principal. Asset classes or investment strategies described may not be suitable for all investors.

Past performance does not guarantee future results. Indexes are unmanaged and an investor cannot invest directly in an index.

Equities are subject to market risk meaning that stock prices in general may decline over short or extended periods of time.

Fixed income investing is subject to credit rate risk, interest rate risk, and inflation risk. Credit risk is the risk that the issuer of a bond won’t meet their payments. Inflation risk is the risk that inflation could outpace a bond’s interest income. Interest rate risk is the risk that fluctuations in interest rates will affect the price of a bond. Investing in floating rate loans may be subject to greater volatility and increased risks.

Growth stocks typically are particularly sensitive to market movements and may involve larger price swings because their market prices tend to reflect future expectations. Growth stocks as a group may be out of favor and underperform the overall equity market for a long period of time, for example, while the market favors “value” stocks. Value investing carries the risk that the market will not recognize a security’s intrinsic value for a long time or that an undervalued stock is actually appropriately priced.

Investments in global/international markets involve risks not associated with U.S. markets, such as currency fluctuations, adverse social and political developments, and the relatively small size and lesser liquidity of some markets. These risks may be greater in emerging markets.

The information included in this document should not be construed as investment advice or a recommendation for the purchase or sale of any security. This material contains general information only on investment matters; it should not be considered as a comprehensive statement on any matter and should not be relied upon as such. The information does not take into account any investor’s investment objectives, particular needs, or financial situation. The value of any investment may fluctuate. This information has been developed by Transamerica Asset Management, Inc. and may incorporate third-party data, text, images, and other content to be deemed reliable.

Comments and general market-related projections are based on information available at the time of writing and believed to be accurate; are for informational purposes only, are not intended as individual or specific advice, may not represent the opinions of the entire firm, and may not be relied upon for future investing. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decisions.

The 10-Year U.S. Treasury bond is a U.S. Treasury debt obligation that has a maturity of 10 years.

S&P 500® Index: An unmanaged index of 500 common stocks primarily traded on the New York Stock Exchange, weighted by market capitalization.

Transamerica Asset Management, Inc., (TAM) is an SEC-registered investment adviser that provides asset management, fund administration, and shareholder services for institutional and retail clients. The funds advised and sponsored by TAM include Transamerica Funds and Transamerica Series Trust. Transamerica Funds and Transamerica Series Trust are distributed by Transamerica Capital, Inc., (TCI), member FINRA. TAM is an indirect wholly owned subsidiary of Aegon Ltd., an international life insurance, pension, and asset management company.