Too hot? Too cold? Or maybe just right

In this article we review:

- Short-duration corporate and government bonds have historically performed well when the Federal Reserve pivots its rate-hiking cycle from restrictive to being more accommodative

- Currently, breakeven yields are very healthy for short-duration bonds

- Inflation and labor market dynamics will likely be the key factors that dictate the Fed’s path forward

With inflation continuing to show signs of weakness and economic growth expected to slow and possibly dip into a recession, the Fed has indicated it expects to begin to cut its target federal funds rate multiple times in 2024. As of this writing, Aegon Asset Management’s forecast is for 100 basis points of cuts beginning in mid-summer, with the remaining Fed rate cuts occurring during the second half of 2024.

Short-duration bonds have historically performed well at this point in the cycle.

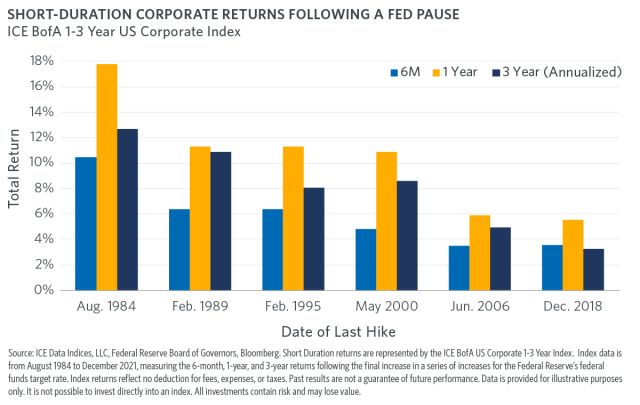

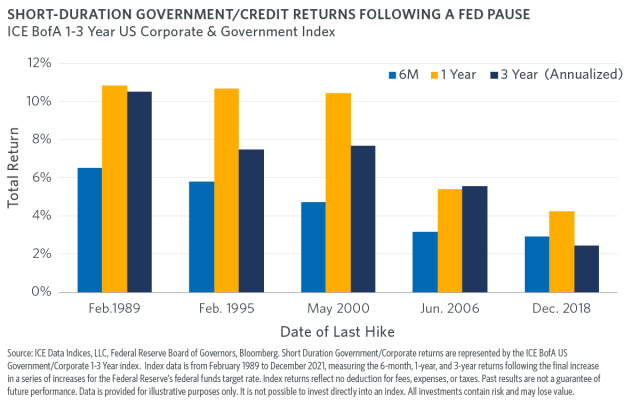

As shown below, during past rate cycles, when the Fed has paused its rate hikes, historical returns over six-month, 1-year, and 3-year (annualized) time frames have been positive for short-duration bonds.

What if the Fed keep rates at their current level, or it isn’t done raising rates?

Looking ahead, inflation and labor market dynamics will likely be the key data points driving the Fed’s policy decisions. As of this writing, the market has priced in several rate cuts. But what if the market is wrong? If inflation or the labor market continue to show no signs of weakness, the Fed may not cut rates as many times as expected.

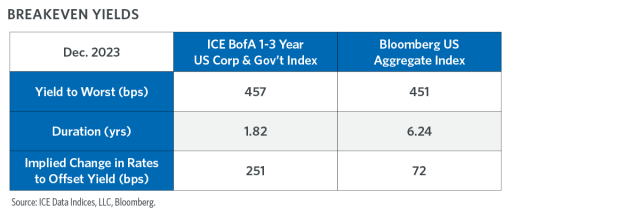

If that is the case, we could see bouts of interest-rate volatility persist. As shown below, short-duration bonds (as measured by the ICE BofA 1-3 year Corp/Gov index) should act as a cushion relative to intermediate-term bonds (as measured by the Bloomberg US Aggregate Index), which may help to dampen volatility against any unexpected re-pricing by the market.

Short-duration bonds appear well positioned.

Regardless of whether the Fed begins to cut rates, remains on-hold, or (in an unlikely scenario) has to raise rates a bit further, short-duration bonds seem well positioned to handle their next move. Historically, they have provided solid returns as the Fed cuts interest rates and are positioned to offer a cushion of over 250 basis points in breakeven yield as of December 31, 2023, to weather unexpected upward interest-rate pressure. Similar to Goldilocks’ quest to navigate her porridge choices in the tale of the “Three Bears,” short-duration bonds could be just right for investors as we get further into 2024.

About the Author

Norbert King is a senior portfolio manager responsible for the portfolio management of investment-grade credit strategies, long credit strategy, intermediate credit strategy, and multi-sector portfolios. Prior to his current role, Norbert was an investment-grade credit trader responsible for trading across all investment-grade credit and multi-sector mandates. He has been in the industry since and started with the firm and its affiliates in 2011. Norbert received his B.A. in accounting from the University of Lynchburg and an MBA with a concentration in finance from Villanova University.

Related Funds

All opinions, estimates, projections, and security selections contained herein are those of the sub-adviser. It does not constitute investment advice and should not be used as a basis for any investment decision.

Mutual funds are subject to market risk, including loss of principal. Past performance is not indicative of future results.

Mutual funds are sold by prospectus. Before investing, consider the funds' investment objectives, risks, charges, and expenses. This and other important information is contained in the prospectus. Please visit transamerica.com or contact your financial professional to obtain a prospectus or, if available, a summary prospectus containing this information. Please read it carefully before investing.

Fixed income securities are subject to risks, including credit risk, interest rate risk, counterparty risk, prepayment risk, extension risk, valuation risk, and liquidity risk. Interest rates may go up, causing the value of the fund's investments to decline. Changes in interest rates, the market's perception of the issuers and the creditworthiness of the issuers may significantly affect the value of a bond. These risks are described in more detail in the prospectus.

During periods of market disruption (e.g., COVID 19), which may trigger trading halts, the fund's exposure to the risks described in the prospectus will likely increase. As a result, the value and liquidity of the fund's investments may be negatively affected.

*Aegon Asset Management US (Aegon AM US) is the marketing name of the sub-adviser. The legal entity name of the sub-adviser is Aegon USA Investment Management, LLC.

Aegon USA Investment Management, LLC is an affiliate of Aegon companies. Transamerica companies are part of the Aegon group.

Transamerica Funds are advised by Transamerica Asset Management, Inc. (TAM) and distributed by Transamerica Capital, Inc. (TCI), member of FINRA.

1801 California St., Suite 5200, Denver, CO 80202

© 2024 Transamerica Corporation. All Rights Reserved.