The Ongoing Appeal of the 60/40 Portfolio

In this article we review:

- A 60% stock/40% bond asset allocation remains one of the most effective means by which investors can seek both capital appreciation and income with a diversified asset allocation mix capable of potentially achieving attractive risk-adjusted returns.

- For investors seeking to redeploy cash, the 60/40 portfolio may help to provide capital appreciation through the compounding of recently elevated bond yields and rising stock prices.

- Many investment professionals are confident that the 60/40 portfolio will continue its historical performance, making it a relevant strategy for investors seeking a balanced approach to long-term wealth accumulation.

“This is one of the best environments in recent memory for 60/40 strategies. Given current conditions, this strategy appears exceptionally well positioned to deliver both capital appreciation and income.”

— Tom Wald, CFA®, Chief Investment Officer, Transamerica Asset Management, Inc.

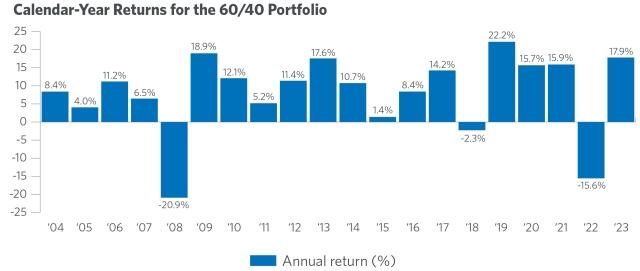

The current and future relevance of a strategic blend of about 60% equities and 40% fixed income securities (60/40 portfolio) has been widely discussed in the financial press for several years, with some critics often predicting the end of the strategy. The current bout of criticism has been fueled by less than stellar performance in 2022, when the strategy fell about 16% amid increasing inflation and interest rates. The double-digit loss was a relatively rare event for the strategy. In fact, the strategy has produced positive returns in 17 of the past 20 calendar years, and the longer-term track record exhibits reliable risk-adjusted returns that the portfolio was originally designed to produce.1

The 60/40 Portfolio is comprised of 60% S&P 500 Index, 40% Bloomberg US Aggregate Bond Index. Past performance does not guarantee future performance. It is not possible to directly invest in an index.

Source: Morningstar, Transamerica Asset Management as of 12/31/2023

Potential landing spot for cash on the sidelines

On the heels of the recent inflation surge, investors are currently holding an excess of cash, benefitting from higher yields on risk-free assets.2 With interest rates potentially decreasing later this year, investors may need to redeploy that cash into better risk-adjusted opportunities. When it comes to finding a reliable vehicle for generating risk-adjusted returns, the 60/40 portfolio may be worth another look.

The origin of the 60/40 portfolio

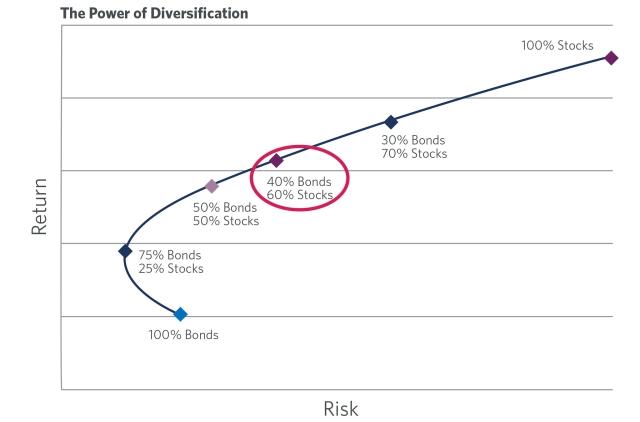

The 60/40 strategy’s roots can be traced back to the pioneering work of Nobel laureate Harry Markowitz in the 1950s. Markowitz's groundbreaking research led to modern portfolio theory (MPT), which emphasizes the importance of diversification and risk management in achieving optimal investment outcomes.

Note: Sample only. Not meant to represent any investment or specific portfolio.

Central to MPT is the concept of the efficient frontier, a graphical representation of the set of portfolios that offer the highest expected return for a given level of risk, or conversely, the lowest risk for a given level of return. Markowitz’s research demonstrated that by combining assets with different risk and return characteristics, such as stocks and bonds, investors could construct portfolios that offered superior risk-adjusted returns compared to portfolios constructed from an individual asset class.

The 60/40 portfolio emerged as a practical application of these principles. Some funds that incorporate this allocation method, usually in the "balanced funds" category, offer investors a simple but powerful approach to capital appreciation and risk mitigation. By allocating most assets to equities, which historically have provided higher returns over the long term (but with greater volatility) and complementing them with fixed income securities, which offer stability and income, investors could experience a smoother path through market swings while still capturing the upside potential of stocks.

Stocks and bonds have more recently shown higher correlation, notably in 2022, but the performance of these asset classes tends to decouple when investors need diversification the most — during market events that cause unexpected equity market drawdowns. As a recent example, during the first quarter of 2020 — the start of the COVID-19 pandemic — U.S. stocks declined by over 20%, but investment-grade bonds rose by about 3%.3

Historically, the 60/40 portfolio has effectively generated wealth while helping to mitigate portfolio risk.

The 60/40 Portfolio is comprised of 60% S&P 500 Index, 40% Bloomberg US Aggregate Bond Index. Past performance does not guarantee future performance. It is not possible to directly invest in an index.

Source: Morningstar, Transamerica Asset Management as of 12/31/2023

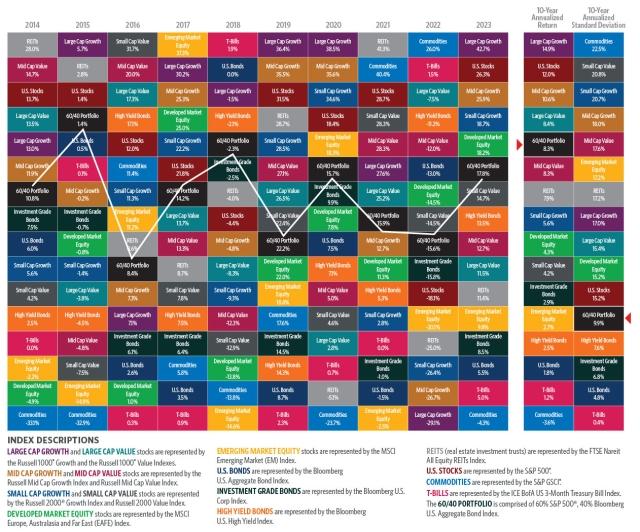

A lesson from history: Asset class performance remains unpredictable

As indicated by the year-in, year-out variability in asset class returns shown below, history continues to demonstrate the difficulty in predicting market leadership from year to year.

Past performance does not guarantee future performance and diversification does not guarantee a profit or protect against a loss in a declining market.

Source: Morningstar, Transamerica Asset Management as of 12/31/2023. Indexes are unmanaged and do not represent the performance of any Transamerica fund. You cannot directly invest in an index.

These fluctuations underscore the wisdom of a diversified portfolio exposed to multiple asset classes across various market cycles. Spreading risk across a spectrum of asset types mitigates the impact of market fluctuations and helps capitalize on opportunities that may arise in different economic environments.

The relevance of the 60/40 portfolio today

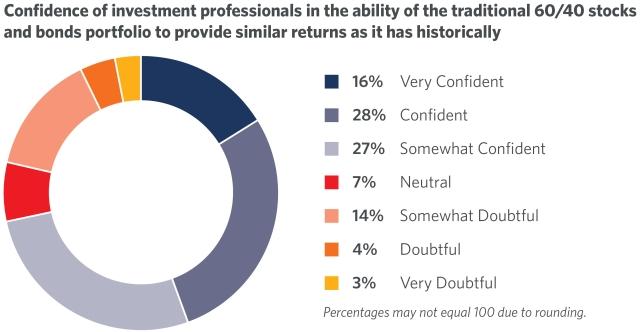

While some investment professionals are speculating that the 60/40 portfolio is on the way out, the overall confidence that financial professionals have in the 60/40 portfolio has increased in recent years. According to the 2023 Trends in Investing Survey conducted by the Journal of Financial Planning and the Financial Planning Association, over 71% of respondents in 2023 expressed some level of confidence that the 60/40 portfolio would continue to provide similar returns as it has historically. This level of confidence is up from 51% in 2018.4

Source: Journal of Financial Planning/FPA 2023 Trends in Investing Survey

The 60/40 portfolio does not promise gains in every market cycle, but its simple, enduring principles of asset class diversification and risk management suggest that it remains a relevant and robust strategy for investors seeking a balanced approach to long-term wealth accumulation.

Related Funds

Transamerica Multi-Managed Balanced

1 "Naysayers Were Wrong About the 60/40 Portfolio. Here's Why." Morningstar. Jan. 9, 2024

2 "Investors Are Holding More Money in Cash Than Ever Before: Is This a Smart Move?" Yahoo Finance. Jan. 25, 2024

3 “Experts: The 60/40 Portfolio is Dead,” Rochester Business Journal, Dec. 14, 2021

4 Is a 60/40 Portfolio Still Viable? Journal of Financial Planning, 2018

Investments are subject to market risk, including the loss of principal. Asset classes or investment strategies described may not be appropriate for all investors.

Past performance does not guarantee future results.

Mutual funds are sold by prospectus. Before investing, consider the funds' investment objectives, risks, charges, and expenses. This and other important information is contained in the prospectus. Please visit transamerica.com or contact your financial professional to obtain a prospectus or, if available, a summary prospectus containing this information. Please read it carefully before investing.

The price of equity securities fluctuates based on changes in a company’s financial condition and overall market and economic conditions. If the market prices of the equity securities owned by the fund fall, the value of the fund will decline. Fixed-income securities are subject to risks including credit risk, interest rate risk, counterparty risk, prepayment risk, extension risk, valuation risk, and liquidity risk. The value of fixed income securities generally goes down when interest rates rise.

During periods of market disruption (e.g., COVID-19), which may trigger trading halts, the fund's exposure to the risks described in the prospectus will likely increase. As a result, the value and liquidity of the fund's investments may be negatively affected.

Transamerica Funds are advised by Transamerica Asset Management, Inc. (TAM) and distributed by Transamerica Capital, Inc. (TCI), member of FINRA.

1801 California St., Suite 5200, Denver, CO 80202

© 2024 Transamerica Corporation. All Rights Reserved.