Is A Housing Market Crash Looming?

Why it matters

- Owning a house has always been a central part of the American Dream.

- Rising home prices have made it more difficult than ever for potential homeowners to purchase a house.

- The housing market is starting to cool off, possibly showing signs of a recession.

For nearly 100 years, owning a home has been the centerpiece of the American Dream. In recent years, soaring home prices have made that dream harder and harder to achieve for more and more Americans. For homeowners, the continued rise in home prices marks a seller’s market. That means that for those looking to buy or rent homes, the lack of inventory, high prices, and rising interest rates can be difficult to swallow. This strong dichotomy has many potential homeowners asking if the housing bubble is poised to burst like it did in 2008. According to experts, there’s a lot of debate about what may happen next.

Home prices

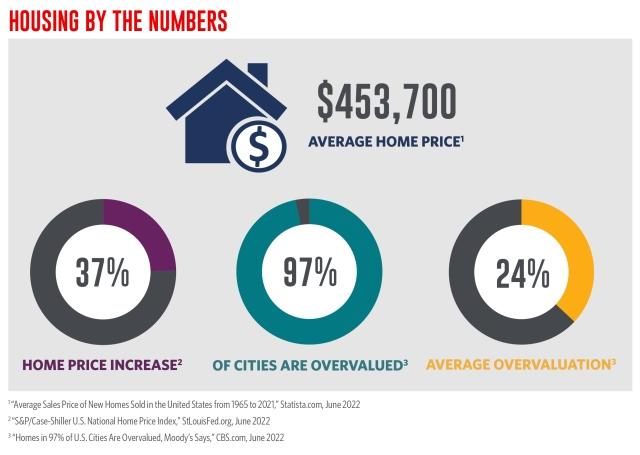

Whatever does happen, it’s safe to say that home prices will be at the center of the debate. Throughout the U.S., home prices have increased 37% from March 2020 till March 2022 according to the S&P CoreLogic Case-Shiller U.S. National Home Price Index.1 Translated into dollars and cents, the average home price in the U.S. in 2021 is $453,700, up from $391,900 in 2020.2 Moody’s Analytics notes that 97% of U.S. cities have overvalued home prices with an average overvaluation of 24%.3,4 This does not mean that home prices are expected to drop 24%, but that housing costs are eating more of a household’s income. Add ballooning inflation and rising mortgage interest rates to the equation and people are beginning to be priced out of the market, which then may create a decrease in demand.4 The operative word in each of these scenarios, of course, is “may.”

What can we expect from the housing market in 2022?

In short, no one knows for sure what’s going to happen. That’s why any prediction should be taken with a grain of salt. As the Fed increases interest rates to combat inflation, home buyer demand may decrease even more.5 Moody’s Analytics estimates a potential 5-10% home price decrease in the next 12 months.4 If a recession hits, significantly overvalued markets could expect up to a 20% reduction in home prices. This is far from the crash of 2008. There were many different factors at play then, including cheap debt, predatory mortgage lending, and complex financial engineering that led to a foreclosure crisis as well as a credit crisis among investors, that don’t appear to be relevant to the housing market situation now.6

Lending Tree economist, Jacob Channel, echoes that thought, saying there’s more evidence of a slowdown than an impending market crash. “I think there’s a big distinction between a cool off and a crash. The 2008 financial collapse is still really fresh in everyone’s minds and it’s really important to point out that distinction, because even if the market does cool and slow down a little bit, that doesn’t mean that we’re going to end up in the same situation that we were in 2008, when you had people defaulting on their loans left and right and the market was absolutely flooded with houses that were just dropping and dropping in value because nobody wanted to buy.”7

This perspective seems to be the prevailing opinion among market experts right now, which bodes well for the economy in both the near and long-term. With that assurance in hand, it should lead potential homeowners today to ask the next big question: rent or own?

Is it better to rent or own right now?

This has been an age-old debate. Traditionally, the thinking was renting made more sense in the shorter term while owning was seen as more of a long-term investment. And, for the most part, those maxims still hold true. However, with higher home prices proving prohibitive to potential buyers, renting has been the default option for many originally looking to make the jump from renting to owning. With uncertainty abounding in today’s housing market, the smartest play is to balance your own financial situation with your appetite for risk. Online tools like rent versus buy calculators give you the ability to input numerous data points as you determine what makes the most sense for you now.8

Home prices: time to sell or buy?

For existing homeowners, this may seem like the perfect time to sell. As we’ve pointed out, there’s tremendous overvaluing of homes in many markets, almost guaranteeing a seller would have a huge return on investment compared to their original purchase price. But it’s important to remember there are two sides to every coin. For example, if you sell now, where will you live? You’d inevitably have to decide to buy (or rent) someplace else, so the potential is there for all the profit you made on your sale to be eaten up by the higher prices you’ll pay in getting into a new place. And that’s just one consideration. Potential sellers also need to think about things like a shrinking pool of possible buyers, availability in their new location, and much more.

Conversely, buyers need to consider their ability to put together competitive offers, including paying over the asking price. (And, in some cases, well over the asking price.) Buyers should also think about other aspects when the market is in flux, including rising interest rates and their overall ability to provide consistent income to cover mortgage payments, HOA dues, home repairs and more.

The only thing certain with the housing market in 2022 is that there will be ongoing uncertainty. By keeping abreast of the latest trends, potential buyers and sellers can better position themselves to make the financial decisions that make the most sense for their short- and long-term goals.

Things to consider

- Take every prediction about the housing market with a grain of salt.

- Assess whether renting or owning is a better option for you by balancing your financial situation with your risk appetite.

- Watch trends in the housing market so you make the best-informed decisions you can.

1 “S&P/Case-Shiller U.S. National Home Price Index,” StLouisFed.org, June 2022

2 “Average Sales Price of New Homes Sold in The United States From 1965 To 2021,” Statista.com, February 2022

3 “Homes In 97% Of U.S. Cities Are Overvalued, Moody's Says,” CBS.com, June 2022

4 “40 Overvalued Housing Markets That Could See 15% To 20% Home Price Declines in A Recession,” Fortune.com, June 2022

5 “Housing Feels Stress of Rising Mortgage Rates as Inflation Weighs on Consumer Spending,” FannieMae.com, May 2022

6 “The Great Recession Misled Millennials: It Made Them Think High Home Prices Will Eventually Come Down,” BusinessInsider.com, June 2022

7 “US Housing Market Crash Coming?” MPAMag.com, June 2022

8 “Rent vs Buy – What’s Right for You?” Nerdwallet.com, accessed July 2022

Transamerica Resources, Inc. is an Aegon company and is affiliated with various companies which include, but are not limited to, insurance companies and broker dealers. Transamerica Resources, Inc. does not offer insurance products or securities. The information provided is for educational purposes only and should not be construed as insurance, securities, ERISA, tax, investment, legal, medical or financial advice or guidance. Please consult your personal independent professionals for answers to your specific questions.