The Beauty of the Side Hustle

Why It Matters

- Inflation reached 7 percent in December 2021, representing the biggest 12-month change in 40 years.1

- Pinching pennies might save a bit of money, but there are other ways to build savings without giving up the little pleasures in life.

- A side job or gig can help build wealth, not to mention provide an avenue for other passions or careers.

Grocery bills, restaurant checks, and the cost of a new couch or even a used vehicle have been heading up, up, up, leaving many of us watching our spending more this year. In fact, Inflation reached 7 percent in December 2021, representing the biggest 12-month change in 40 years, 1 as the Consumer Price Index rose for items including clothing and energy.

Cutting a venti latte purchase in the morning or borrowing books from the library instead of buying them might save a few bucks. But there are other ways to build savings without giving up the little pleasures in life. Enter the side job.

Who’s getting side jobs

A side hustle can take many forms, whether it’s renting out a spare room in your home, bartending, teaching a fitness class during your off hours, driving people around town, or otherwise freelancing.

Of course, not everyone who freelances is doing it as a side job. Still, it’s a popular way to earn money. One-third of the U.S. workforce — about 59 million Americans — performed freelance work in the past 12 months, according to a survey commissioned by the work and job platform Upwork from Aug. 27-Sept. 29, 2021. About half of freelancers provided skilled services such as computer programming, marketing, IT, and business consulting, the survey found.2

Others are taking on jobs in the gig economy, serving as shoppers for services like Instacart, driving for Uber or Lyft, or taking on one-off projects advertised on Fiverr or TaskRabbit.

What you can earn

Kingsley Thomas was working in IT when he started renting out his family’s property in Puerto Rico. His family started out using a property manager to rent out the place. Then he did some light renovations and hired a cleaning service on his own and found that after expenses, he was making as much as the property manager had, or about $15,000 a year.

In 2021, managing the property on his own, his family made about $50,000 from rentals. Thomas also has invested in bitcoin on the side. He and his wife have since branched out into buying a property in Appalachia to rent out to tourists. The mortgage, taxes, and interest are less than $900 a month, and for the 2021-2022 winter, they are averaging around $9,000 a month in rental income through Airbnb.

What was originally more of a side job and a hobby are now his main source of income. “There’s no point having a regular job if I can repeat this,” he said.

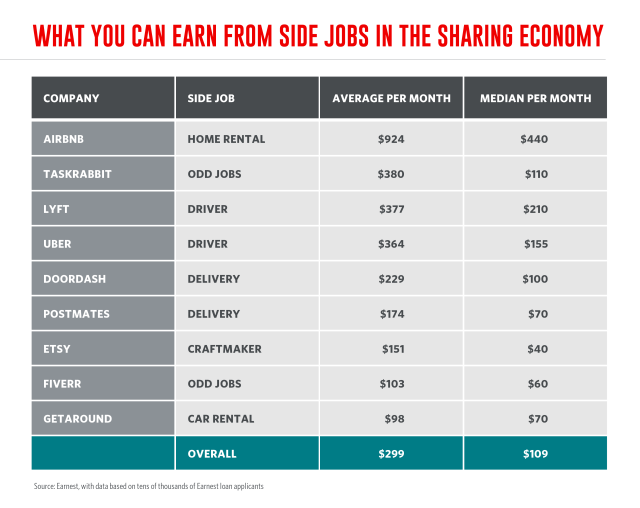

Even a smaller side job can help defray the costs of inflation or buying a coffee on the way to your day job. Lyft includes a calculator at lyft.com/drive-with-lyft where you can enter your city and see what other drivers are earning up to in your area. Based on 215 self-reported driver earnings to the job review site Glassdoor, the average earnings for a Lyft driver are nearly $35,000 per year.3 However, median earnings may be closer to $210 per month,4 based on an analysis of loan applicant information by the online lender Earnest. Nevertheless, it’s enough to pay for an expensive coffee once in a while, with enough left over to put into savings.

Here’s a look at what other side jobs can pay, according to the analysis by Earnest.

5 ideas for side hustle jobs

You can turn your existing skills, expertise, or assets into something that can earn you a little more cash. Here are just a few ideas:

1. Home or car rental

Platforms like Airbnb and VRBO can help you earn money by renting out spare rooms, while services like Turo help you list your vehicle for rent.

2. Consumer focus groups

Companies often conduct consumer research to find out what customers really want, and they’re willing to compensate you for your opinions. Some consumer research agencies are looking for consumers of specific types of products or from a mix of demographics. You could earn $5 or so to take a survey or up to a few hundred dollars an hour for in-depth focus group work.5

3. Driver

Lyft and Uber have both publicly discussed the demand for drivers to shuttle people around. That could make this a good time to test the waters if you haven’t driven for Lyft or Uber before. Vehicle requirements vary,6 but in general, both require you to drive a four-door vehicle.

4. Gym instructor

Ask your favorite yoga studio, cycle gym, dance studio, or barre studio if they need extra instructors and what the requirements are. You can earn extra money leading fitness sessions before or after your day job, and chances are, you may also receive free classes or entry to the gym.

5. Bartender

In this tight labor market, caterers, arenas, stadiums, and event organizers sometimes need a bartender to fill in on short notice. If you’ve tended bar before, you know it can be a lucrative source of tips in exchange for an evening spent on your feet.

When Shannyn Steele was a counselor for a Denver nonprofit organization, she would sometimes bartend, do inventory for retail stores, teach yoga, and house sit in her 20s and 30s to earn extra money for savings and fun things like travel or skiing.

“The cost of living in Denver was going up, but our pay wasn’t,” she said. “My paycheck covered rent and groceries, but if I wanted to travel, I needed a second job. I would put money into savings for unexpected emergencies and for travel.”

She later became a nurse and continued to house sit to supplement her income as a beginning nurse before she gained more experience and earned raises.

What to do with your extra money

Side jobs can provide a cushion of extra cash in case of emergencies, extra income to cover expenses, and extra savings for retirement.

Remember you’ll most likely owe taxes on your extra income. A financial professional or tax pro can help you not only make sure you’re calculating your taxes correctly but also evaluate options for what to do with your extra money.

Things to Consider:

- Talk to a financial professional for suggestions of how to use or invest your extra cash, as well as to make sure you’re calculating taxes on your extra income correctly.

- Side jobs can bring benefits beyond extra cash, like an opportunity to pursue a passion or hobby.

- In some cases, a side job could turn into a new career.

1 Bureau of Labor Statistics, January 2022

2 “Upwork Study Finds 59 Million Americans Freelancing Amid Turbulent Labor Market,” Upwork,

3 Glassdoor, January 2022

4 “How Much Are People Making From the Sharing Economy?” Earnest, November 2021

5 Google, January 2022

6 Lyft, accessed January 2022

Transamerica Resources, Inc. is an Aegon company and is affiliated with various companies which include, but are not limited to, insurance companies and broker dealers. Transamerica Resources, Inc. does not offer insurance products or securities. The information provided is for educational purposes only and should not be construed as insurance, securities, ERISA, tax, investment, legal, medical or financial advice or guidance. Please consult your personal independent professionals for answers to your specific questions.