Retirement Plan Trends in the Healthcare Industry

Why It Matters

- The landscape for retirement plans in the healthcare industry is continuously evolving.

- Motivating employees to save and to stay financially well is a daunting challenge.

- There are more ways than ever to help increase plan participation.

Retirement plan sponsors are facing an increasing number, and more unique, challenges than ever before when it comes to engaging participants. From finding ways to motivate employees to save for retirement to struggling with regulatory changes, the list of key difficulties plan sponsors face continues to grow. A recent study on Retirement Plan Trends in Today’s Healthcare Market – 2021, provides additional insights about these trends and offers some suggestions for what plan sponsors and their advisors can do to overcome some of their biggest hurdles as they benchmark plan design and plan management and seek ways to improve their retirement plans.

While this article will highlight many of the study’s key points, we encourage you to read the full study on your own here. You can also view a quick summary video about the survey here.

Indicators of retirement plan success

Once considered the gold standard of retirement plan success, plan participation is becoming less of an issue as more organizations implement automatic enrollment — and the numbers bear this out. In the 2021 survey, only 14% cited plan participation as a metric for success, down from 33% in 2019. Today, more healthcare organizations are citing measures such as retirement readiness (up 14% from 2019), income replacement ratio (up 12% from 2019), and the amount saved per employee (up 8% from 2019) as their preferred indicators of plan success.

Greatest challenges

With the design, planning, implementation, and maintenance of any retirement plan come inherent challenges. The survey uncovered some specific challenges for retirement plan administrators and to participant retirement savings.

Challenges for retirement plan administrators

The study revealed plan sponsors faced a slew of challenges in 2021, with motivating employees to save enough for retirement (50%) and keeping up with regulatory changes (46%) being at the top of the list. The next most cited challenges were helping employees invest wisely (43%) and managing the workload of HR staff (40%). The net effect of the focus on income goals stressed HR staff to increase retirement savings rates. Notably, mergers and acquisitions used to appear among the top concerns, but in this survey was cited by only 11%. It’s one more indication of the dynamic landscape retirement plan administrators face.

Challenges to participant retirement savings

The study points out that half of healthcare organizations recognize some common stumbling blocks participants have to saving money: high expenses and debt. Additionally, they also cite a lack of financial literacy, including failure to understand how much money they need to save for retirement, and a preference to spend rather than save. If one of the core goals is to increase retirement savings rates, these numbers show just how high the mountain retirement plan administrators have to climb is.

Overcoming these retirement plan challenges

Thankfully, there are resources in place to help address and overcome the challenges listed above. As the numbers show, most healthcare organizations looking to help participants retire find available assistance more than adequate to meet their needs.

Retirement plan service providers are here to help

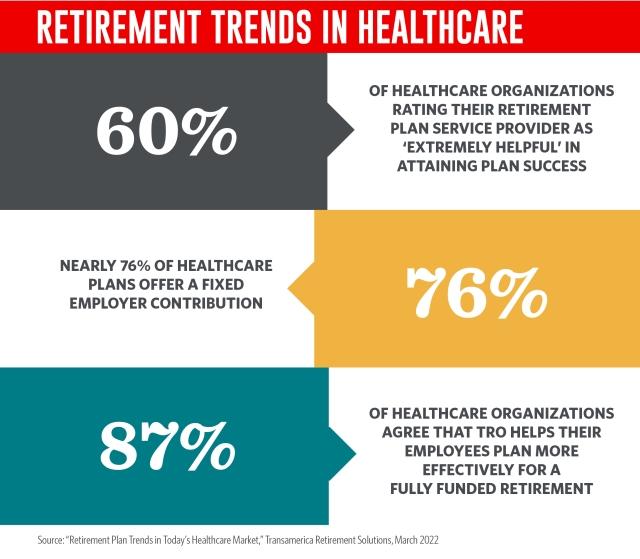

In order to achieve plan goals and plan administration, healthcare organizations are relying more and more on their retirement plan service providers. To that end, most plan sponsors are satisfied with the assistance they receive, with roughly 60% of healthcare organizations rating their retirement plan service provider as ‘extremely helpful’ in attaining plan success.

Financial wellness programs

As inflation continues to rise, it puts increasing stress on every dollar employees make. That’s why wellness programs now focus on everything from emergency savings and credit card debt management to budgeting, student debt, and home financing. They even address bigger life events like wills, taxes, and divorce.

Retirement plan design and offerings in the healthcare industry

To foster higher participation rates and bolster plan success, healthcare organizations have included these key components into their retirement plan designs.

Auto features

Healthcare organizations have tabbed automatic plan features as the de facto way to boost retirement readiness among their employees. The numbers bear this out. Since 2019, the number of healthcare organizations enrolling participants automatically grew by more than 41%. Now, the total number of healthcare organizations using automatic enrollment is 79%. But they don’t want to stop there. In addition to their increased use of automatic enrollment, healthcare organizations have also implemented automatic deferral escalation. The hope is to increase employee savings levels above and beyond the default 5% contribution rates. The popularity of the idea is spreading, as the survey revealed that 64% of healthcare organizations have now instituted automatic deferral increases.

Default investment elections

Compared to 2019, plan participants at surveyed healthcare organizations have remained fairly consistent with their default investment options. Stable value remained static at 15% while the surveys revealed a 3% increase in usage of balanced/asset allocation funds as the default option. Still the top choice among those surveyed, the biggest jump came from healthcare organizations citing target dates series as their default investment option, increasing 20% from 2019 to a total of 47% in 2021.

Participation rates

The surveys found that one of the most important steps in guiding plan participants to retirement readiness and driving participation rates was introducing automatic enrollment. The numbers show the biggest effect on non-highly compensated employees (NHCE), where healthcare organizations without automatic enrollment report NHCE participation at 30% versus 68% with auto-enrollment. This leap is consistent with the auto features findings above.

Employer contributions

Nearly 76% of healthcare plans offer a fixed employer contribution which represents a 17% increase since 2019. About 20% of healthcare organizations offer a discretionary contribution while 80% feature a percentage match to the employee contribution. Up noticeably in the last two years, around 68% now offer a contribution that is a stated percentage of the employee’s salary.

Defined benefit plans

Although their popularity is declining, 74% of surveyed healthcare organizations still maintain traditional defined benefit (DB) pension plans. Since 2019, more DB plans are funded above 80%, with a majority of healthcare organizations’ DB plans funded between 80% and 90%. Seventy percent of healthcare organizations with a DB plan maintain the salary history of employees covered by the plan in a single database and 65% of those organizations rely on HR or payroll to maintain that database.

Popular plan features

The survey shows healthcare organizations are doing an amazing job of giving employees a wide range of plan features they want. This is most evident when looking at types of employee contributions plans accept — 98% of 403(b) plans and 95% of 401(k) plans accept both tax-deferred and Roth contribution types. And the list of offered benefits continues to grow. More than 50% of healthcare organizations surveyed now offer access to health savings accounts, financial wellness programs, financial planning advice, group and one-on-one meetings, and educational materials and videos.

Advisor or consultant services

As healthcare organizations look for ways to optimize their plan design and offerings, their reliance on plan advisors and consultants continues to grow. In fact, the number of plans without an advisor who are planning to hire one in the next 12 months is up to 20% from 9% in 2019. It makes sense. Seen as playing an integral role in carrying out fiduciary responsibilities, healthcare sector-savvy plan advisors are trusted to help with fee analysis and with plan design assistance.

Total retirement outsourcing

Total Retirement Outsourcing (TRO) bundles all or most of the services required for defined contribution (DC), DB, and non-qualified deferred compensation (NQDC) retirement plan management with a single provider. Giving employees an integrated “one-stop-shop” to manage all their plans can not only provide a 360-degree view of their retirement forecast but can also deliver potential cost savings and reduce workloads for plan sponsors. The popularity of TRO plans is growing, with 43% of healthcare organizations currently implementing a TRO arrangement.

About 87% of healthcare organizations agree that TRO helps their employees plan more effectively for a fully funded retirement by helping them save and invest more appropriately than they would on their own. TRO also helps healthcare plan sponsors better assess how their DB and DC plans are performing in meeting retirement program goals.

As the popularity of TRO increases, there will be an increase in the likelihood that DB plan sponsors will reexamine their approach. The survey shows that 43% of healthcare organizations plan to hire a consultant to reassess their DB plans’ strategy while only 26% aren’t planning to make changes to their current DB plan.

As you review these retirement plan trends, it’s clear that the landscape continues to evolve. Leaning into the assistance offered by retirement plan service providers is one of the best ways healthcare organizations can maximize plan participation and optimize results.

Things to Consider

- Helping participants accumulate the funds needed to reach their retirement income goals remains the primary goal for plan sponsors.

- Plan sponsors are discovering more viable options and resources, including Total Retirement Outsourcing.

- Plan advisors are playing more important roles than ever before, so it’s important to offer the full scope of services to your healthcare industry clients.

Transamerica Resources, Inc. is an Aegon company and is affiliated with various companies which include, but are not limited to, insurance companies and broker dealers. Transamerica Resources, Inc. does not offer insurance products or securities. The information provided is for educational purposes only and should not be construed as insurance, securities, ERISA, tax, investment, legal, medical or financial advice or guidance. Please consult your personal independent professionals for answers to your specific questions.