Learn more about Transamerica Portfolio Solutions today

A disciplined process for building better investment outcomes

Transamerica Portfolio Solutions model portfolios are designed to accommodate varying investment objectives and risk tolerances with the benefit of a diversified model portfolio and actively managed Transamerica Mutual Funds.

Planning for the long term

Transamerica Portfolio Solutions model portfolios provide your clients with the benefit of diversification and actively managed Transamerica Mutual Funds. This combination approach aims to help you keep your client invested at the target risk level that you determine is appropriate for his or her unique financial goals.

Risk-Based Series

The Transamerica Portfolio Solutions illustrated here are hypothetical and do not reflect the composition or performance of any Transamerica portfolio or product currently available to invest in or purchase. They are allocation strategies that you can use to build a portfolio for your client.

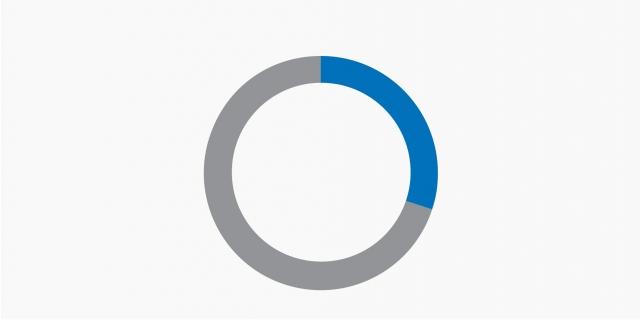

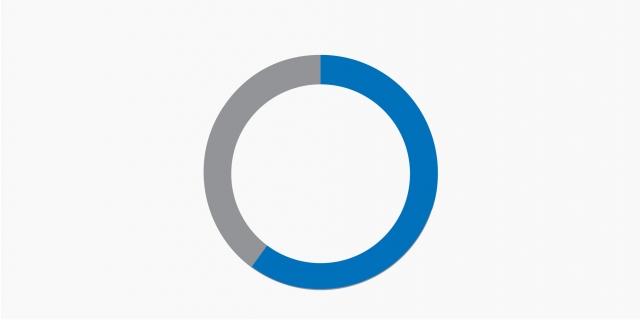

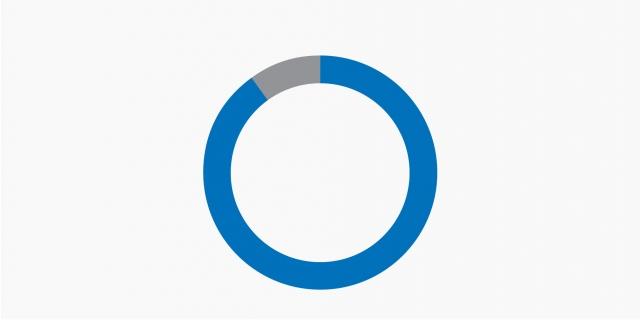

The Conservative portfolio seeks current income and preservation of capital. The Moderate portfolio seeks capital appreciation and current income. The Capital Appreciation portfolio seeks to provide long-term returns from growth of capital and growth of income. The Conservative, Moderate, and Capital Appreciation descriptions reflect the risks and benefits of each model portfolio in relation to the other and should not be compared to any other Transamerica product.

Transamerica Portfolio Solutions benefits

- Risk-Based Series: Conservative, Moderate, and Capital Appreciation model portfolios to suit different risk tolerances and investor goals

- Diversification and asset allocation (investing in multiple asset classes)

- Actively managed Transamerica Mutual Funds

- Access to professional money managers vetted through Transamerica Asset Management’s Investor First℠ process

- An easy-to-implement investment strategy

The Investor First℠ Process is our ongoing commitment to making sure you have access to the investments you deserve from some of the best asset managers in the industry. This process only applies to funds advised by Transamerica Asset Management, Inc. (TAM) and not to non-proprietary funds.

IMPORTANT INFORMATION

Transamerica Portfolio Solutions are created by Transamerica Asset Management, Inc. (“TAM”). These model portfolios are strategic in nature, utilize Transamerica Funds exclusively, and will typically be rebalanced on a quarterly basis. The model portfolios are actively monitored by TAM. Underlying allocations and funds may change at any time. This content should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice. The launch date for Transamerica Portfolio Solutions is 4/30/2021.

Portfolios may be offered in a different share class and/or placed on trading platforms that require changes such as an allocation to cash and a pro rata allocation of the remainder according to the Model Portfolio(s). These modifications will change investor outcomes.

Allocations may not achieve investment objectives. The model portfolio’s risks are directly related to the risks of the underlying funds, as described below. There are expenses associated with the underlying funds in addition to any fees charged by the intermediary. Additionally, the intermediary may include cash or other allocations which are not reflected here.

The preceding information should not be considered to be, and does not constitute, personalized investment advice, nor is it an offer or solicitation for the purchase of any financial product. It is designed to be informational and act as a discussion point between you and your client.

Mutual funds are subject to market risk, including loss of principal. Past performance is not indicative of future results.

Mutual Funds are sold by prospectus. Before investing, consider the funds’ investment objectives, risks, charges, and expenses. This and other important information is contained in the prospectus. Please go to transamerica.com or contact your financial professional to obtain a prospectus or, if available, a summary prospectus containing this information. Please read it carefully before investing.

Asset allocation and diversification do not assure or guarantee better performance, cannot eliminate the risk of investment losses, and do not protect against an overall declining market. Fixed-income securities are subject to risks including credit risk, interest rate risk, counter party risk, prepayment risk, extension risk, valuation risk, and liquidity risk. Credit risk is the risk that the issuer of a bond won’t meet their payments. Interest rate risk is the risk that fluctuations in interest rates will affect the price of a bond. Investments in small- and medium-sized companies present additional risks such as increased volatility because their earnings are less predictable, their share price more volatile, and their securities less liquid than larger or more established companies. Investing internationally, globally, or in emerging markets exposes investors to additional risks and expenses such as changes in currency rates, foreign taxation, differences in auditing, and other financial standards not associated with investing domestically.

About Transamerica Asset Management, Inc.

Transamerica Asset Management, Inc. (TAM) is an SEC registered investment adviser that provides asset management, fund administration, and shareholder services for institutional and retail clients. The funds advised and sponsored by TAM include Transamerica Funds and Transamerica Series Trust. Transamerica Funds and Transamerica Series Trust are distributed by Transamerica Capital, Inc. (TCI), member FINRA. TAM is an indirect wholly owned subsidiary of Aegon Ltd., an international life insurance, pension, and asset management company.

Transamerica Funds are advised by Transamerica Asset Management, Inc. (TAM) and distributed by Transamerica Capital, Inc. (TCI) member of FINRA.

1801 California St. Suite 5200, Denver, CO 80202