Why It Matters:

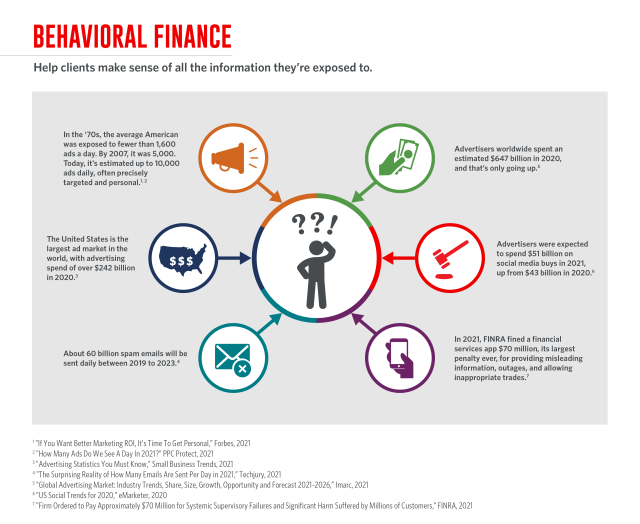

- Marketing is stacked against investors. Behavioral finance techniques may allow financial professionals to overcome client biases and media influence.

- Know the daily temptations your clients face and help them fight back.

- Irrational, impulsive, emotional decisions can torpedo even the best of plans. Behavioral finance aims to combat those forces.

In today’s rich media environment, clients may find themselves caught up in the excitement of a social movement or experience a fear of missing out when it seems everyone’s making fantastic gains, whether that’s Beanie Babies, cryptocurrencies, or so-called meme stocks (which long-running online site Investopedia refers to as “cult-like”).1,2,3

Marketing is all around us, every day, whether it’s convincing us a spouse will let us buy matching, costly SUVs as a holiday surprise or programs and articles posing as news and influencing us intellectually or emotionally.4

Maybe you missed the Society for Consumer Psychology’s latest conference, but scientists really do study consumer behavior. How about that session “When My Perceptions of Others’ Motives Become My Own: Social Contagion of Experiential Consumption Motives through Social Media.” Psychology informs marketing, and marketing targets consumers.5,6,7

Then there are the news headlines your clients see — “Dogecoin Jumps After Elon Musk Says He’ll Accept It for Some Merchandise,” “Why Bitcoin Could Smash Through $50,000 Before the End of the Year,” “GameStop Unseats Tesla as the Most Searched-for Stock of the Year.”8,9,10

To help clients understand how they can be misled by this battery of sensory input, financial professionals can learn, and incorporate, behavioral finance and the science of investor and financial market behaviors. There are plenty of resources available, including classes and certifications, for those interested in learning the value of understanding — and influencing — client behavior.11,12,13,14

Understanding behavioral finance and how it affects clients

The global customer experience analytics platform Clootrack breaks down psychological factors competing for consumer/investor attention into five areas. It’s not the deepest dive into consumer psychology, but it’s a start.15

- Psychological – Those competing for attention or seeking to spur action may attempt to unlock a target consumer’s motivation, existing perceptions, and existing attitudes and beliefs.

- Social – It’s natural to want to be accepted by our social groups. In the past, that may have been limited to family, friends, or business relationships. But now? It’s hard to escape the quicksand of social media platforms we carry around on our phones and have access to anywhere.

- Cultural – These are the bedrock beliefs we grow up on, learned and ingrained from family and social class interactions.

- Personal – Anything from age, to occupation, to income, to lifestyle could be a launchpad for an influencer to unlock a client’s thinking.

- Economic – As clients’ economic standing increases (and that may be every financial professional’s goal), it’s natural that they may feel more comfortable spending. And that economic standing may come with easier access to credit. Maybe time for a refresher on “wants” vs. “needs”? What’s the real goal — a secure retirement later, or a shiny new boat now?

While armies of global sales professionals understand these key factors, clients may unknowingly be dealing with their own behavioral habits and traps. Researchers point to preservation bias, cognitive, emotional, and belief preservation “errors,” hardwiring that can cause us to process what we see in front of us through a skewed prism or allow a client to understand legitimate information differently depending on how it’s presented or “framed.”15

Clients get it from all angles, whether marketers are trying to create a “pack mentality” (think meme stocks) or a purported voice of authority on “news” sites (have clients mentioned Jim Cramer, Suze Orman, or Mr. Money Mustache?).16

Barbarians at the gates, financial professionals at the ramparts

None of this means financial professionals need to become therapists. But there’s a growing push to blend an understanding of psychology into financial conversations and client relationships. Understanding how a client feels — or may react — if the markets experience volatility could help balance any rash decisions.17

Decades ago, maybe this wasn’t important. Even a fraught client had a limited ability to react quickly. Daily news didn’t lead to leaping online and making a series of trades. Things took time. Professionals were the gatekeepers, and trades were expensive and time consuming. A rash decision was still pretty hard to act on in a rash manner.18

Today, clients can watch entire channels dedicated to financial news and analysis. CNBC’s Jim Cramer hosts a “Lightning Round” and shows with provocative names such as “Squawk on the Street” and “Mad Money.” Phone apps allow investors to make trades almost instantly from anywhere, often at no charge. Online sites such as The Penny Hoarder and MarketWatch provide consumer-level info and advice. Clients are bombarded by information, and there are those who understand how to use this ocean of information to drive them to action.19,20,21,22

A professional versed in behavioral finance can help develop rational concepts of future outcomes and address feelings of impulsiveness and materialism.23

Financial professionals report seeing the value of understanding how behavioral finance works. A recent survey by Statista found advisors believe it helped them keep clients invested (and curbed emotional decisions) during periods of volatility; better manage client expectations (aren’t we all getting rich by investing in a game store?); and build stronger client relationships.24

What next? Getting started

A Transamerica study concludes behavioral finance is not another buzzword. It’s real. A client’s relationship with money may have formed at an early age. That can make addressing those assumptions and habits difficult. And we’ve seen how others latch onto those biases and may exploit weaknesses. A trained financial professional can incorporate an understanding of behavioral finance as they steer clients to the financial goals they desire and avoid the emotional distractions along the way.23

Certifications, classes, books, and blogs are all available to help financial professionals gain a deeper understanding of behavioral finance and differentiate themselves while “coaching” clients through a rational, consistent plan.25

Download Transamerica’s white paper, “The Impact Of Behavioral Finance On The Psychology Of Investing,” free, by clicking here.

Things to Consider:

- The science of behavioral finance appears to be here to stay. An overload of outside influences has changed the game.

- There are numerous behavioral finance books, classes, and certifications on behavioral finance available.

Behavioral science may help you understand the marketing forces stacked against investors, and how to take action.

-

“The Rise and Fall of Beanie Babies, Which Made Ty Warner A Billionaire But Now Are Nearly Worthless,” Business Insider, 2021

-

“Thinking of Buying Bitcoin? What Experts Say About Big Crypto Concerns: ‘You Have to Be Mentally Prepared,” CNBC, 2021

-

“What Is a Meme Stock,” Investopedia, 2021

-

“How Does Marketing Manipulate Us,” Marketing Manipulation Club, accessed 2021

-

“2022 SCP Boutique Conference,” Society for Consumer Psychology, 2021

-

“What is Consumer Psychology,” VeryWellMind.com, 2021

-

“The Science of Persuasion: How to Influence Consumer Choice,” Business News Daily, 2021

-

“Dogecoin Jumps After Elon Musk Says He’ll Accept It For Some Merchandise,” CNBC, 2021

-

“Why Bitcoin Could Smash Through $50,000 Before the End of the Year,” Nasdaq, 2021

-

“Gamestop Unseats Tesla As The Most Searched-For Stock Of The Year,” Fortune, 2021

-

“Why Financial Professionals Should Learn Behavioral Finance,” Kaplan Financial Education, 2021

-

“Best Behavioral Finance Books,” OptionsTradingIQ, 2021

-

“Applied Behavioral Finance,” Investments & Wealth Institute, accessed 2021

-

“Professional Designations,” Finra, 2021

-

“Major Factors Influencing Consumer Behavior,” Clootrack, accessed 2021

-

“The Science of Persuasion: How to Influence Consumer Choice,” Business News Daily, 2021

-

“There’s A Growing Demand For Psychology In Financial Planning. How Top Firms Use It In Their Practices,” CNBC, 2021

-

“Stocks Then And Now: The 1950s And 1970s,” Investopedia, 2021

-

“Jim Cramer. Mad Money. Investing Club,” CNBC, accessed 2021

-

“Best Stock Trading Apps of 2022,” Business Insider, 2021

-

“The Penny Hoarder,” thePennyhoarder.com, accessed 2021

-

“MarketWatch,” Marketwatch.com, accessed 2021

-

“The Impact Of Behavioral Finance On The Psychology Of Investing,” Transamerica, accessed 2021

-

“Main Benefits Of Incorporating Behavioral Finance Into Financial Advisors' Practice Worldwide 2019 And 2020,” Statista (paywall), 2021

-

“Using Behavioral Finance Principles To Behaviorally Coach Clients To Make Better Decisions,” Michael Kitces, Kitces.com, 2020

Transamerica Resources, Inc. is an Aegon company and is affiliated with various companies which include, but are not limited to, insurance companies and broker dealers. Transamerica Resources, Inc. does not offer insurance products or securities. The information provided is for educational purposes only and should not be construed as insurance, securities, ERISA, tax, investment, legal, medical or financial advice or guidance. Please consult your personal independent professionals for answers to your specific questions.