Transamerica Reduces Fees on Floating Rate Fund

Transamerica Reduces Fees on Floating Rate Fund

Expense reductions part of ongoing commitment to maximize value for investors

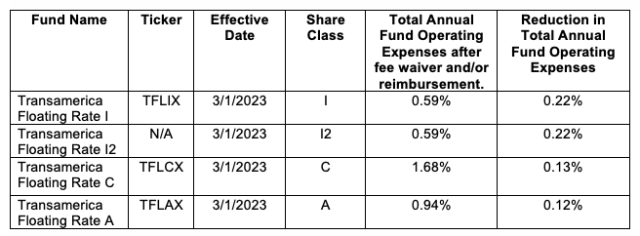

Transamerica is pleased to announce fee reductions on the four share classes of the Transamerica Floating Rate mutual fund. Contingent upon share class, these reductions range from 0.12% to 0.22% annually. These expense reductions will become effective on or about March 1, 2023. A chart listing the reductions by share class and date is shown below.

These expense reductions are part of Transamerica’s ongoing commitment to best serve mutual fund investors. Transamerica routinely reviews fund fees charged and is consistently looking for ways to maximize value.

Transamerica Asset Management, Inc. selects and monitors the sub-advisers managing Transamerica’s mutual funds. The Transamerica Floating Rate fund is sub-advised by Aegon USA Investment Management, LLC, an affiliate of Transamerica Asset Management. As of December 31, 2022, Transamerica Asset Management, Inc. maintained $62.86 billion in net assets under management.

Expense reductions for the Floating Rate fund by share class are as follows:

About Transamerica

With a history that dates back more than 100 years, Transamerica is a leading provider of life insurance, retirement, and investment solutions, serving millions of customers throughout the United States. Transamerica’s dedicated professionals focus on helping people live well today and empowering them to create a better tomorrow through saving, investing, and protecting their loved ones. Transamerica serves nearly every customer segment, providing a broad range of quality individual life insurance policies, workplace supplemental insurance benefits, workplace retirement plans, individual retirement accounts and investment products including mutual funds, annuities, stable value solutions, as well as asset management services.

In 2021, Transamerica fulfilled its promises to customers, paying more than $52 billion in insurance, retirement, and annuity claims and benefits, including return of annuity premiums paid by the customer. Transamerica’s head office is in Baltimore, Maryland, with other major operations in Cedar Rapids, Iowa, and Denver, Colorado. Transamerica is part of the Aegon group of companies. Each company of the Aegon group of companies is solely responsible for its own financial conditions and contractual obligations. Based in the Netherlands, Aegon is a diversified, international financial services group offering investment, protection, and retirement solutions. For the full year of 2021, Aegon managed over $1.1 trillion in revenue generating investments. For more information, visit www.transamerica.com.

About Transamerica Asset Management, Inc.

Transamerica Asset Management, Inc. is an SEC-registered investment adviser that provides asset management, fund administration and shareholder services for institutional and retail clients. The funds advised and sponsored by Transamerica Asset Management, Inc. include Transamerica Funds, and Transamerica Series Trust. Transamerica Funds and Transamerica Series Trust are distributed by Transamerica Capital, Inc. (TCI), member FINRA. Transamerica Asset Management, Inc. has total assets under management of more than $62.86 billion as of December 31, 2022, and is an indirect wholly owned subsidiary of Aegon N.V., an international life insurance, pension, and asset management company. Aegon USA Investment Management, LLC is an affiliate of Transamerica Asset Management, Inc.

Mutual Funds are subject to market risk, including loss of principal. Past performance is not indicative of future results.

Mutual Funds are sold by prospectus. Before investing, consider the funds’ investment objectives, risks, charges, and expenses. This and other important information is contained in the prospectus. Please visit www.transamerica.com or contact your financial professional to obtain a prospectus or, if available, a summary prospectus containing this information. Please read it carefully before investing.

Floating rate loans are often made to borrowers whose financial condition is troubled or highly leveraged. These loans frequently are rated below investment grade and are therefore subject to risks associated with high yield bonds. High yield bonds tend to be volatile and more susceptible to adverse events, credit downgrades and negative sentiments.

During periods of market disruption (e.g. COVID 19), which may trigger trading halts, the fund's exposure to the risks described in the prospectus will likely increase. As a result, the value and liquidity of the fund's investments may be negatively affected.

Transamerica Funds are advised by Transamerica Asset Management, Inc. (TAM) and distributed by Transamerica Capital, Inc. (TCI), member of FINRA.1801 California Street, Suite 5200, Denver, Colorado 80202.

Media inquiries:

Media.Relations@transamerica.com

Erin Yang

(303) 383-5295

Julie Quinlan

(303) 383-5923