Why it matters

- Tax strategies can help make the most of your investments and lower your tax burden.

- This year, tax loss harvesting may be just what your taxes need — learn how to do it correctly.

- There’s still time for end-of-year tax moves — make yours before December 31st.

There's a good chance that right now, taxes are not top of mind for you. However, this is a great time to take steps that can help lower your tax bills and maybe even increase your tax refund at tax time.

Whether your financial portfolio is straightforward or complex, it can be helpful to understand how tax saving strategies can help with reducing taxes. Keep in mind that some tax reduction strategies are easy to execute. Other tax strategies, however, require the advice and guidance of a financial professional.

See which tax planning strategies may be right for your situation and the upcoming tax year.

1. Take advantage of tax-free or tax advantaged investments

If you have investments, it's crucial to understand how they impact your taxes. Two types of investments that can affect your taxes are tax-free or tax advantaged.

Tax-exempt investments

Tax-exempt investments like municipal bonds and tax-exempt funds are low risk and provide interest that is tax-advantaged right from the get-go. That means if your investment’s value increases, the interest is not subject to income tax. And it can be tax-exempt at multiple levels: state, local, federal, or all three, which is called a triple-tax-exempt investment.1

Tax-advantaged investments

Tax-advantaged investments include options such as retirement savings, annuities, and cash value life insurance. While most of us may have experience with retirement accounts, annuities and life insurance options may be less familiar. With this type of investment, taxes on gains are deferred until you’re in a lower income bracket, during retirement as an example. Here’s a more detailed look.

- Annuities are an insurance policy. As the policy holder, you pay regular payments or a lump sum to the annuity provider. In return, the annuity provider (insurance company) agrees to pay you a specific amount for a set period or more typically, until death. Not sure if including an annuity in your portfolio is right for you? Work with a financial professional to learn more and decide if an annuity is a good option for your goals.2

- Cash value life insurance policies offer a way for higher income earners to defer taxes. With these policies, money can grow tax-deferred and can be accessed without being taxed if the withdrawal amount is less than the total amount of premiums paid.3

2. Consider charitable donations and donor-advised funds

If charitable contributions are part of your household finances, you’ll want to understand how they can impact your taxes. For instance, for cash donations, you can deduct up to 60% of adjusted gross income and for appreciated securities’ donations, you can deduct up to 30% of adjusted gross income.3

If you do make charitable contributions, you may want to consider a donor-advised fund. This relatively new option offers significant tax advantages as well as streamlined giving.4 It’s worth noting that donor-advised funds are private funds managed by a third party on behalf of an individual, family, or organization and require the assistance of a financial professional. There are a few types of donor-advised funds to consider:

- Community foundations – ideal for donors interested in supporting local causes

- Public foundations – provide support for national and international charities

- National donor-alliance funds – these can be affiliated with financial institutions or national institutions such as the American Endowment Foundation4

3. Aim for long-term capital gains — time matters

Capital gains are relevant for anyone who owns a car, home, investment property, stocks, bonds, art, or collectibles. In other words — most of us should understand how to best manage capital gains.

One of the keys to understanding capital gains is timing. In most cases the goal is simple. For any asset that’s subject to capital gains tax, it’s important to hold on to the asset for at least one year. After one year, any gains are considered long-term gains and they’re taxed at 0%, 15%, or 20% depending on your income. On the other hand, gains on assets held for less than a year are considered short-term capital gains and they can be taxed up to 37% depending on your income.5

4. Max out your tax-advantaged accounts

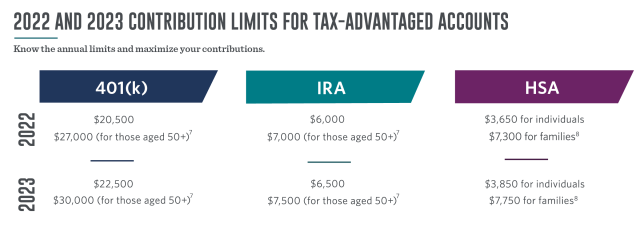

Are you among the millions of Americans with a retirement account? This may be a good time to make sure you’re maxing out your contributions. Accounts such as a 401(k), 403(b), traditional IRA, Roth IRA, or Health Savings Account (HSA) can benefit you now and later. Contributions made now can lower your current taxable income and defer taxation until after retirement when your income bracket and tax rates may be lower.6 Plus, if your employer offers matching contributions, you're essentially receiving free money which also isn’t taxed until retirement.

Understanding the contribution limits for tax-advantaged accounts is essential to maxing them out. The contribution limit for 401(k)s and 403(b)s in 2022 is $20,500, and $27,000 for those aged 50+ ($22,500 and $30,000 in 2023).7 The limit for IRAs is $6,000 and $7,000 for those 50+ (up to $6,500 and $7,500 in 2023).7 The limits for contributions to HSAs are $3,650 for individuals and $7,300 for families (up to $3,850 and $7,750 in 2023).8

5. Leverage asset location: where and how assets are held

For investors with equity and fixed-income investments, asset location methodology can be an important tax strategy. The idea is to reduce or defer tax liability by leveraging where assets are held. To do this, an investor spreads investments between taxable and tax-deferred accounts. Doing so allows investors to take advantage of how different investments are taxed and minimize taxes.

Here’s an example.

Let's say your portfolio includes a mix of 40% fixed-income investments and 60% equity (an example of asset allocation, which helps cushion market downturns by having holdings in different sectors).9 An investor who holds fixed-income investments in a tax-deferred account and equity investments in a taxable account will achieve the maximum benefit.9 The benefits of maximizing the location of your assets can be significant. Deciding how to position and hold assets can be complicated.

It's vital to understand your financial profile, prevailing tax laws, investment holding periods, and the tax and return characteristics of the underlying securities. Due to the complex nature of this strategy, it’s best to work with a financial professional.

6. Tax loss harvesting — when and how to do it

Tax loss harvesting is a little bit of a unicorn in the world of investments. An advanced tax reduction strategy, tax loss harvesting can be used to reduce taxable income when securities are sold at a loss, offsetting gains made from other investments.6 Once losses exceed gains, you can then decrease your federal tax liability by subtracting up to $3,000 from regular income annually (in addition to the benefit of any offset gains), with any additional losses carried into future years.10

Keep in mind, if you do engage in tax loss harvesting, it’s important to know how to do it correctly. You don’t want to unknowingly engage in what’s called a “wash sale.” A wash sale is when an investor sells a security and then buys an essentially identical security within 30 days of the original sale. The difference between the initial sale and the more recent purchase is considered a wash. If an investor does engage in a wash sale, they will not be eligible for the benefits of tax loss harvesting on their taxes.6

Given the complexities of tax loss harvesting, it is recommended to work with a financial professional to ensure it’s done correctly.

7. Understand which tax credits apply to you

When it comes to taxes, not many of us are interested in paying more than necessary. That’s where tax credits can come into play. Tax credits are important because they can help reduce the amount owed in tax liability on a dollar-for-dollar basis.11

Tax laws are ever-changing. As a result, it can be challenging to stay up to date on all the latest ways to reduce what you owe. For a complete list of all available credits, visit the IRS’s website. In general, there are three main types of credits: nonrefundable, refundable, and partially refundable. Here are a few of the more common tax credits associated with each type:11

As of the 2021 tax year, nonrefundable credit examples include:

- Adoption

- Education

- Child and Dependent Care

- Retirement Savings Contribution Credit

- Child Tax Credit

Refundable credits include:

- Earned Income Tax Credit

- Premium Tax Credit

Minimize taxes and maximize investments

While making the most of your investments may not always be in your control, how you optimize your tax strategies is. Whether you do it yourself or work with a financial professional, take the time to leverage these strategies — and others — to work toward financial freedom.

1 “How Can I Find Tax-Exempt Mutual Funds?” Investopedia, April 2021

2 “What Is An Annuity?” SmartAsset, March 2022

3 “Tax Saving Strategies for High-Income Earners,” SmartAsset, July 2022

4 “Donor-Advised Fund Definition,” Investopedia, August 2022

5 “Long-Term vs. Short-Term Capital Gains: What’s the Difference?” Investopedia, November 2022

6 “6 Tax-Efficient Investing Strategies For Tax-Aware Investors,” Merrilledge, September 2022

7 “401(k) limit increases to $22,500 for 2023, IRA limit rises to $6,500,” Internal Revenue Service, October 2022

8 “IRS Announces Spike in 2023 Limits for HSAs and High-Deductible Health Plans,” Society for Human Resource Management, April 2022

9 “Minimize Taxes with Asset Location,” Investopedia, May 2021

10 “Lower Your 2022 Tax Bill With The Best Year-End Tax Strategies,” CNBC, October 2022

11 “Tax Credit: What It Is, How It Works, What Qualifies, 3 Types,” Investopedia, January 2022

Transamerica Resources, Inc. is an Aegon company and is affiliated with various companies which include, but are not limited to, insurance companies and broker dealers. Transamerica Resources, Inc. does not offer insurance products or securities. The information provided is for educational purposes only and should not be construed as insurance, securities, ERISA, tax, investment, legal, medical or financial advice or guidance. Please consult your personal independent professionals for answers to your specific questions.