Why it matters

- Creating a legally binding will isn’t as hard as you may think.

- A will offers loved ones protection and support.

- Most Americans need a will but don’t have one.

Chances are, creating a will isn’t at the top of your to-do list — and you’re not alone. In a study by Caring.com, 67% of surveyed Americans reported they don't have a will, living will, or other end-of-life documents prepared.1 While you may have been one of those who put it off, making a will is the only way to legally determine how dependents are cared for and assets are distributed after your passing. A will allows you to plan events such as funerals, memorials, and burials, so loved ones can honor your wishes. On the other hand, not creating a will, which is called dying intestate, allows the courts in your state to determine how assets are distributed and who gains custody of dependents.2

Let’s look at how to get started, which estate planning documents to gather, how to make a will legal, and how to keep it safe.

Who needs a will?

To start, do you have dependents, own property, have bank accounts, investments, or retirement savings? If you’re over 18 and answered yes to any part of that question, you need a will.

Wills are part of estate plans. You don’t need to consult a lawyer to create one, however it is encouraged. You can write a will on your own or by using an online tool, service, or software. While most wills today are printed documents, handwritten wills are still accepted in some states if they adhere to state-specific requirements.3

To create a will, you’ll need to:

- Decide how you’ll do it — using a lawyer, an online tool, or on your own.

- Make decisions about assets, dependents, and final wishes.

- Talk to your family about your plans.

- Put it all in writing.

- Make it legal and keep it safe.

Keep in mind that talking about end-of-life planning with family can be challenging. It’s important to have everyone in the family involved in these important decisions.

Now that we're clear on who needs a will, let's look at how to begin creating one.

1. Compile a list of your assets

Begin by looking at your assets. This allows you to take stock of what can be used to pay for expenses or debts and what to leave to loved ones.

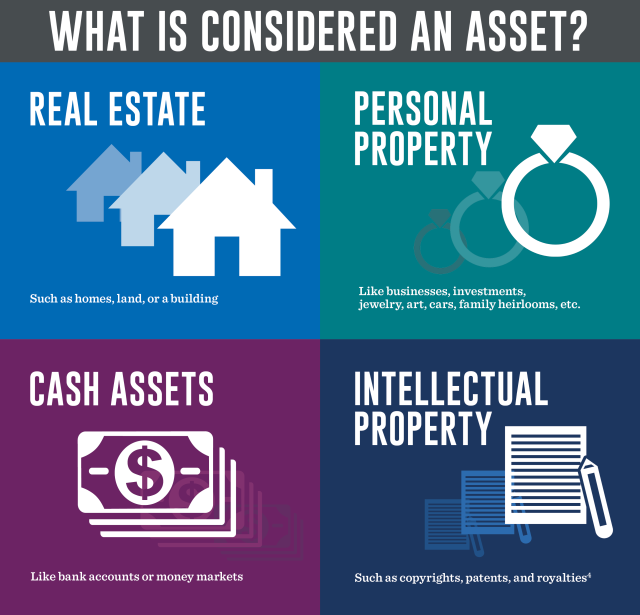

What’s considered an asset? Assets are anything you own at the time of your death that has a value — whether it’s a lot or a little. Items that have a beneficiary already designated, such as a life insurance policy, do not need to be listed as assets. These are non-probate assets and would not be left up to the state in the absence of a will.4 On the other hand, assets such as real estate, business ownership, jewelry, heirlooms, etc. that don’t have a beneficiary assigned do need to be included in a will.

When thinking about an asset, consider:

- Who will receive the asset?

- Do you want assets sold to pay for debts or funeral expenses?

- Would you like assets distributed evenly or unevenly between beneficiaries?

Make a list of who is to receive each asset and how much they should receive. Remember to include information on how to access assets such as account numbers, deeds, and titles so your executor can easily help the beneficiary claim the asset.

2. Gather important documents

Once you’ve compiled a list of assets, it’s time to gather the appropriate documents. Gathering this information and keeping it with your will makes it easier for your family and executor to follow your wishes. This way they don’t have to search for necessary documents, account numbers, or contacts to execute the will in a timely manner.

Important documents can include:

- Original birth certificates

- Marriage licenses and divorce decrees

- Deeds

- Car titles

Also, your will should include a list of relevant account numbers and contact information for your lawyer, CPA, and financial advisor.5

3. Choose beneficiaries

For many, beneficiaries are the main reason to create a will. Beneficiaries can be family members, friends, or organizations. Depending on the complexity of your estate, you may have one beneficiary, or you may have several. If you have a large estate, you may have many assets that you wish to divide between multiple people. In this case, working with an attorney may be helpful.

Whether your estate is straightforward or complex, it’s important to think through who you want to receive your assets and in what amount. Keep in mind that some beneficiary designations, like those in a life insurance policy, will trump anything stated in your will. For that reason, it can be helpful to revisit designations yearly to ensure accuracy.

When selecting beneficiaries, consider these options:

- Primary – The first individual(s) named to receive the death benefit of a specific asset.

- Contingent or Alternate – The person who receives a benefit if the primary beneficiary is deceased. Naming an alternate beneficiary is important if your primary beneficiary passes before you or with you.

- Minor – Beneficiary under 18. In this case, you will also want to identify a trusted adult to oversee the asset(s) until the minor turns 18.6

4. Nominate guardians for dependents

Identifying a guardian is one of the most critical decisions made when putting together your will. Without it, the future care of any minor children can be left to the state to decide.7

Before selecting guardians for any minor, ask yourself a few key questions:

- Who do you trust most to perform this task?

- Is the guardian up to the task physically, mentally, and financially?

- Are their values and beliefs in line with yours?

- Will children need to move or change schools?

- Should you consider identifying a co-guardian?

Once you’ve identified a guardian for each of your children, have a conversation with them to ensure they feel comfortable with your selection. For many, family members are the go-to guardian for children. However, as loved ones age, their ability to effectively care for children may change. Consider identifying a backup guardian.

Also, don’t forget about your fur baby. Even though many of us see our pets as family, the law sees pets as personal property. You can use your will to select a guardian for your pets rather than leave the selection up to the courts or friends and family.

5. Selecting an executor

By this point, your final wishes are starting to take shape. The next question is: who do you trust to make this all happen? It’s time to choose an executor.

The executor needs to be someone who:

- You trust to represent you and carry out your wishes

- Is responsible and can manage the required paperwork

- Will file your will with the courts

- Oversees using your assets to pay off debts

- Closes accounts and transfers the funds appropriately2

Serving as an executor is a big responsibility. It’s essential to speak with the person you select so you can make sure they’re up for the job. If they agree to accept the role, make sure they know where you keep your will and the necessary documents and information they’ll need to execute it correctly.

This may also be a good time to think about powers of attorney. Power of attorney allows an individual to manage healthcare decisions if you’re unable.2 It’s a good idea to speak to this person prior to making your selection official.

6. Make your will official

Whether you create your will with an attorney or on your own, it’s important to make sure it’s legal. Once your document is complete, there are general and state-specific requirements to keep in mind, including:

- In the U.S. you need to be of sound mind — conscious and aware of what you’re doing.

- You need witnesses — most states require two witness signatures.

- Some states require a will to be notarized, which can be helpful with probate.8

- If you move to a new state, check the requirements to be sure your will is still valid.

Store and update your will as needed

Once your will is complete, it’s crucial to keep it in a safe place. A few options include:

- A safety deposit box in your home or at a bank

- A fireproof safe or legacy drawer

- Your county clerks may offer storage of wills

- Your attorney may store your will and documents

After you’ve created your first will, you may not want to think about making changes to it. Life circumstances do change, however, and when they do your will may need to be updated.

You may need to update your will after:

- The birth of a child or grandchild

- A marriage or divorce

- The death of a beneficiary, executor, or guardian

- A large purchase or sale, such as a property or business

- Changes in inheritance, a patent, etc.

If you do need to update your will, one way to do it is with a codicil or an addendum. A codicil can add, change, or subtract from the original will. Codicils must be created by the individual who made the original will and typically must be signed by the original testator and two witnesses.9 In some cases, it can be best to create a new will. When this is the case, you must revoke the last will in writing in the new one. It’s also wise to destroy all copies of the previous will and codicils to avoid confusion.10

During an already difficult time, putting your final wishes into writing can help alleviate hard choices and disagreements for family and loved ones. Remember, your will is a living document. Creating a will isn’t likely to be anyone’s favorite activity, but it is an important one for you and those you care for and about.

Things to consider

- Make your will a priority.

- Follow these steps to get your estate in order.

- Revisit an existing will to make sure it’s still accurate.

1 “67% of Americans Have No Estate Plan, Survey Finds. Here’s How to Get Started on One,” CNBC, April 2022

2 “Here’s How to Decide Who's a Good Fit for Executor of Your Will,” CNBC, June 2021

3 “Holographic Will: Is a Handwritten Will Valid?” LegalZoom, May 2022

4 “What Types of Assets Should be Included in a Will?” Matus Law Group, August 2022

5 “8 Documents That Are Essential to Planning Your Estate,” MoneyTalksNews, March 2022

6 “What is a Beneficiary — A Complete Guide,” Trust & Will, accessed October 2022

7 “Top 10 Considerations When Naming a Guardian in Your Will”, LegalZoom, August 2022

8 “What Makes a Will Legal?” LegalZoom, May 2022

9 “Codicil,” Investopedia, October 2020

10 “How to Change a Will,” LegalZoom, September 2022

Transamerica Resources, Inc. is an Aegon company and is affiliated with various companies which include, but are not limited to, insurance companies and broker dealers. Transamerica Resources, Inc. does not offer insurance products or securities. The information provided is for educational purposes only and should not be construed as insurance, securities, ERISA, tax, investment, legal, medical or financial advice or guidance. Please consult your personal independent professionals for answers to your specific questions.