Why it matters

- Approximately every seven seconds, a working age American suffers a disabling injury or illness that will last at least a month.1

- Medical bills contribute to 60% of bankruptcies and more than 50% of mortgage foreclosures.2

- Only 10% of disabilities are caused by accidents; 90% are caused by illnesses like cancer.3

Welcome to open enrollment season, the time of year when employees can opt-in to many different types of insurance offered through workplace benefits programs. Many workplaces offer health insurance, but now is also the time to consider options like life insurance, pet insurance, and disability insurance. It may be tempting to think, “I won’t need disability insurance.” But the statistics say otherwise: one in four of today’s 20-year-olds can expect to be unable to work for at least a year because of a disabling condition before reaching retirement.4 Also, 95% of disabling accidents and illnesses are not work-related.3

Did you know disability insurance is one of the most valuable benefits you can tap into during open enrollment season? The truth is, disability insurance covers a lot more medical conditions than you’d think. Disability insurance protects your income — covering essentials like rent, mortgage, tuition and more if you’re unable to work — and includes surprising coverage like maternity /pregnancy, depression, and anxiety.5 Best of all, disability insurance is less expensive when offered through your employer. Read on to learn more about this powerhouse benefit.

Short- vs. long-term disability insurance – what’s the difference?

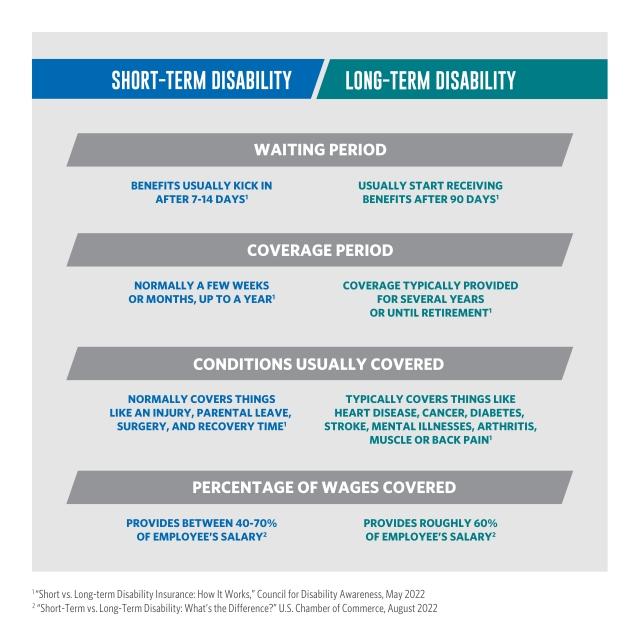

Disability insurance protects your ability to earn a paycheck if circumstances leave you with a serious illness or injury. This does not include minor illnesses like the flu, but it does cover situations like cancer, broken bones, back/muscle or joint pains, arthritis, diabetes, surgery recovery, and more.5 There are two types of disability insurance: short- and long-term. The main difference between the two is the amount of wait time until you receive benefits, and benefit period duration. Both plans provide you with disability income, which protects you until you can return to work. Some employers offer short-term or long-term, and can be employer-paid, employee-paid, or a mixture of both.

Why would I need short-term disability insurance?

Depending on your injury or illness, you may be eligible for short-term disability benefits. This type of insurance protects your paycheck for a shorter period of time — from up to a few weeks or a few months, but usually no longer than one year.5 In the event that Social Security benefits are approved, a short-term disability plan would pay disability income for the five-month waiting period between the onset of the disability and Social Security benefits.6

Why do I need long-term disability insurance?

As the name implies, long-term disability insurance protects your paycheck for a longer period of time. If you’re facing a long recovery or serious medical condition, long-term disability would likely prove helpful. Depending on the plan you select, you could receive disability income benefits for two to ten years, or even until you retire. The “waiting period” for long-term disability is longer, usually 90 days.5 About half of large and mid-sized employers offer long-term coverage, with benefits replacing about 60% of salary.7 Despite its low cost and availability, about 67% of American workers have no long-term disability insurance.8

Why is disability insurance so important?

Nearly 80% of all U.S. employers offer short-term and long-term disability benefits, but fewer than half of all workers take advantage of the benefit.3 Are you thinking of skipping your employer-offered disability benefit? Think twice before doing so. Many Americans are not prepared to handle an income-limiting event like a disability. In fact, 48% of U.S. adults say they can only cover three months of living expenses without income.8 Did you know that more than 50% of foreclosures on conventional mortgages are caused by a disability? It’s true.2

Think disabilities only occur with major car accidents? Think again: Only 10% of disabilities are caused by accidents; 90% are caused by illnesses including cancer, heart disease, and arthritis.3 Often your employer will offer to pay for basic disability insurance, giving you the option to purchase supplementary coverage for a fee. As you weigh whether or not to purchase this additional coverage, consider if you would be able to cover the rest of your salary if you were unable to work. (On average, a long-term disability policy will cover about 60% of your base salary.)7

Should I consider more disability coverage?

The short answer is, if you need your income to pay your monthly bills, yes you should. Even if you are a young person and think you don’t need disability insurance, you probably haven’t had many working years to build up a sizable emergency savings account. Just because you’re young doesn’t mean you’re immune from disabling illnesses. Did you know that Millennials and Gen X are overall in worse health than their parents and grandparents at the same age, setting them up for disabling illnesses?9

How much will it cost? Purchasing disability insurance through an employer often costs far less than buying on an individual basis. If your employer-provided disability isn’t enough, supplemental disability insurance helps to bridge the gap. Your employer doesn’t offer disability coverage? Don’t worry, you can still purchase individual disability. Not having any coverage at all is a huge risk.

A rule of thumb for cost of a long-term disability insurance policy is one to three percent of your income to protect salaries of $15,000 per year or more.10 The insurance company determines your premium rate by looking at factors including age, occupation, health, benefit period, and coverage amount.11 It’s important to note that your benefits may be seen as taxable income and should be reported to the IRS.12

What is Social Security Disability Insurance?

You may be thinking, “I don’t need disability insurance, the Social Security Administration will take care of me.” That’s not exactly true. There is such a thing as Social Security Disability Insurance (SSDI), but it has strict limits. This insurance is meant to protect people who can’t work because they have a medical condition that’s expected to last at least a year or result in death. So, for a shorter duration disability, you would be without coverage. In addition, there is a waiting period for people relying on SSDI, and short-term coverage would be needed to provide coverage during this gap. Also, the average SSDI benefit for a disabled worker as of July 2022 was $1,362 per month, or $16,344 annually.13 This amount is technically below the poverty guideline of $18,310 for a two-person household.14

So SSDI isn’t exactly a viable alternative to short- or long-term disability. Given the option to elect disability coverage, it would be wise to do so. Also, you have to work for a total of 10 years before becoming disabled in order to qualify for Social Security Disability Insurance.15

Give disability insurance another look during open enrollment

Is it time for open enrollment? Take a good look at your company’s offerings for short- and long-term disability coverage. If you already have employer-provided disability coverage, consider bumping up your coverage. That way, you’re covered if circumstances affect your ability to work. For a relatively low fee, you could buy yourself some peace of mind and disability income that will be there when you need it.

Things to consider

- Sixty four percent of workers rate their odds of disability at 2%, when in reality it’s 30%.2

- Social Security disability benefits may be hard to obtain — 70% of initial applicants are denied.16

- Disability insurance protects your ability to earn a paycheck.

1 “The Disability Disconnect,” Council for Disability Awareness, accessed October 2022

2 “The Role of Disability in Mortgage Foreclosure,” Life Insure, accessed October 2022

3 “Hey Gen X: Time to Protect Your Income,” Council for Disability Awareness, July 2022

4 “Disability Insurance is important No Matter Your Age – What to Consider,” Council for Disability Awareness, September 2022

5“Short vs. Long-term Disability Insurance: How It Works,” Council for Disability Awareness, May 2022

6 “How Short-Term Private Disability Insurance Affects Public Benefits,” National Bureau of Economic Research, July 2022

7“Will My Employer Provide Disability Coverage?” Insurance Information Institute, accessed October 2022

8“95+ Disability Insurance Stats & Disability Facts (2021),” Simplylnsurance.com, February 2022

9“Gen X, Millennials in Worse Health Than Prior Generations,” WebMD, March 2021

10“How Much Does Disability Insurance Cost?” PolicyGenius.com, March 2022

11“The Cost of Long Term Disability Insurance,” GuardianLife.com, accessed October 2022

12“Life Insurance and Disability Insurance Proceeds”, IRS.gov, September 2022

13“Monthly Statistical Snapshot,” SSA.gov, July 2022

14 “HHS Poverty Guidelines for 2022,” Office of the Assistant Secretary for Planning and Evaluation, ASPE.HHS.gov, January 2022

15“How Long Do I have to Work to Qualify for SSDI?” AARP.org, December 2021

16“Top 5 Signs You May be Denied Disability,” Disability Benefits Help, October 2022

Transamerica Resources, Inc. is an Aegon company and is affiliated with various companies which include, but are not limited to, insurance companies and broker dealers. Transamerica Resources, Inc. does not offer insurance products or securities. The information provided is for educational purposes only and should not be construed as insurance, securities, ERISA, tax, investment, legal, medical or financial advice or guidance. Please consult your personal independent professionals for answers to your specific questions.