Putting the market in perspective

There’s only one certainty when investing for the long haul.

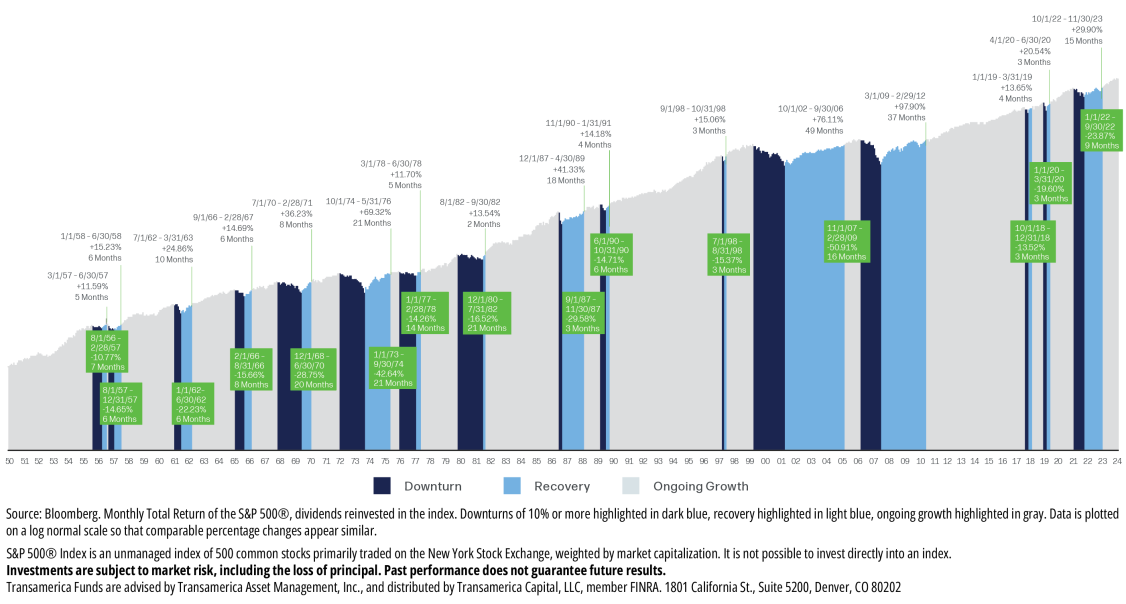

Markets are sure to fluctuate. While volatility can be unnerving, the U.S. stock market has been resilient, with historical data showing it has generally trended upward over time.

Time in the market, not timing the market.

While it’s impossible to predict when a market recovery will begin, it’s possible to miss one by waiting on the sidelines. Take emotion out of investing and stay the course with a well-conceived plan.

You can’t rebound if you’re not in the game

Attempting to time the market rather than staying invested during down periods can cause you to lock in losses – and miss out on potential market rebounds.

Market rebounds outlast declines

Timing the market is difficult because you never know what lies around the corner. History shows us whenever the market declines, a growth period follows that does more than merely recover the losses. Over the past 60 years, those periods of market growth have lasted much longer than the periods of decline. In fact, the market spends an average of 48 months longer in growth periods.

Markets tumble on tariff announcement: What investors need to know

Read the commentary from Tom Wald, CFA®, Chief Investment Officer, Transamerica Asset Management, Inc.