In this article we review:

- How the fixed income market is much broader than many investors realize

- Why a flexible, unconstrained fixed income portfolio can help increase the possibility of favorable returns

- The nature of bond markets and how active managers can potentially exploit inefficiencies

Treasurys, other government securities, and corporate bonds tend to constitute the familiar fixed income landscape for many investors. But the fixed income world is much broader and more diverse than often perceived. A wide array of fixed income securities can be accessed by individual investors, offering a vast variety of maturities, issuer and risk profiles, liquidity and opportunities for income and capital appreciation. At a time when investors are focused on attractive income and total returns but are unsure about the direction of the economy and government policy, a “go-anywhere” approach to the fixed income market that attempts to anticipate and adapt to changing market conditions may be worthy of consideration.

The past few years have been a rocky time for bond investors, especially after the Federal Reserve began a series of interest rate increases in March 2022 to combat rising inflation. For bond investors, the move appeared to mark an end of a decades-long bull market in fixed income investments that saw investors benefitting from steadily rising bond prices. In the face of higher rates, those prices dropped sharply in 2022, rattling investors who saw the value of their holdings decline and causing turmoil in markets that extended into 2023.

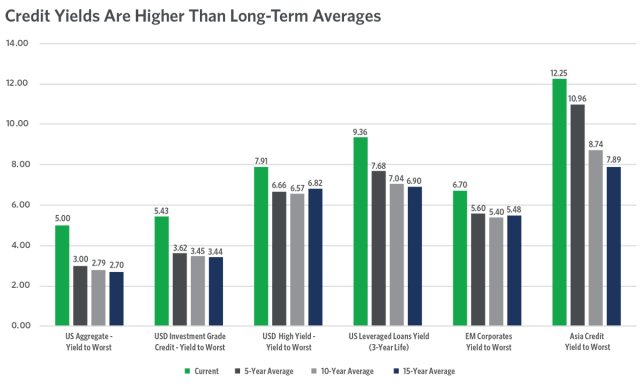

The corollary to lower bond prices, of course, is higher yields. Individual investors who felt they had no place to turn for steady, meaningful yields when interest rates hovered near zero now find that fixed income markets have a lot to offer in terms of income. Exhibit 1 highlights that yields for many fixed income assets classes have improved in today’s market environment and are now considerably higher than longer-term averages. But fixed income markets — which are three times as large as global equity markets1 — can be confusing for investors familiar with Treasurys, core bond funds, municipal bonds, and not much else.

Source: Bloomberg as of June 30, 2024. US Aggregate yield to worst represented by the Bloomberg US Aggregate Index, USD Investment Grade Credit yield to worst represented by the Bloomberg US Credit Index, USD High Yield yield to worst represented by the Bloomberg US Corporate High Yield Index, US Leveraged Loans 3-year life yield represented by the Credit Suisse Leveraged Loan Index, EM Corporates yield to worst represented by the JP Morgan Corporate Emerging Markets Bond Index, and Asia Credit yield to worst represented by the JP Morgan Asia Credit Index. For illustrative purposes only. Past performance is not indicative of future results. It is not possible to invest directly in an index, which also does not include the application of fees. Yield to worst is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting.

Fixed income markets include not only publicly traded securities, such as bonds, notes, and commercial paper, but also nonpublicly traded securities — all with a vast combination of maturities, ratings, and provisions that can affect performance.

Given the size of each fixed income issue and the needs of borrowers and lenders, the fixed income market traditionally has been dominated by institutional investors such as pension funds, banks, and insurance companies. More recently, asset management companies have come to play an important role in the market by packaging fixed income securities into structures, including actively managed mutual funds, index mutual funds, and exchange-traded funds. These funds enable individual investors to own fractional interests in securities they often were not able to access in the past.

Today, there are many bond funds specializing in various segments of the fixed income market, including investment-grade and high-yield corporate and municipal bonds, mortgage-backed and other asset-backed bonds and securities, bank loans, and foreign corporate and government bonds. Passively managed fixed income funds aim for returns that match the performance of a benchmark for a specific type of investment, such as an index for high-yield bonds. Actively managed funds try to outperform their benchmark. Some active bond funds forego a benchmark or a particular type of security in favor of a “go-anywhere” or unconstrained approach. This means that their managers are free to select from the wide universe of fixed income securities in trying to meet the fund’s stated investment objective, such as capital appreciation or income.

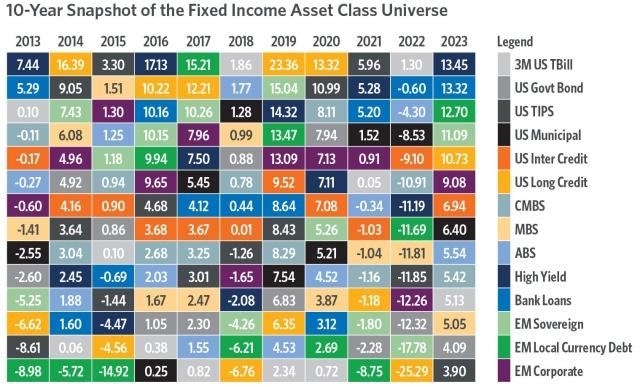

As of December 31, 2023. Returns derived from following: Three-month US T-Bill (Bloomberg Barclays US Treasury Bills TR USD); US Government Bond (Bloomberg Barclays US Government TR USD); US TIPS (Bloomberg Barclays US Treasury US TIPS TR USD); US Municipal (Bloomberg Barclays Municipal TR USD); US Inter Credit (Bloomberg Barclays US Intermediate Credit TR USD); US Long Credit (Bloomberg Barclays US Long Credit TR USD); CMBS (Bloomberg Barclays CMBS TR); MBS (Bloomberg Barclays US MBS TR USD); ABS (Bloomberg Barclays ABS TR USD); High Yield (Bloomberg Barclays US Corporate High Yield TR USD); Bank Loans (S&P/LSTA Leveraged Loan TR); EM Sovereign (JPM EMBI Global Diversified TR USD); EM Corporate (JPM CEMBI Broad Diversified TR USD); and EM Local Currency Debt (JPM GBI-EM Global Diversified TR USD). Past performance is not indicative of future results. It is not possible to invest directly in an index, which also does not include the application of fees.

Portfolios that are not constrained by asset-type may benefit investors, as the table above illustrates. The fixed income markets’ many asset classes produce a wide range of outcomes each year, with very little consistency in any one asset’s relative return performance. In 2018, for example, three-month T-bills were the top performer, returning a hardly stunning 1.86%; in 2019 they returned 2.34% but were at the bottom of the chart, switching places with 2018’s worst-performing class, U.S. long credit, which went from a return of -6.76% to a gain of 23.36%.

Managers of unconstrained funds, like all active managers, tend to have a deep understanding of market fundamentals — forces such as the direction of the economy and interest rates and the financial strength of a particular issuer. Active managers also develop a sense of the market’s technical forces, especially supply and demand, which often significantly affect a fixed income security’s price, and therefore its yield. In the fixed income market, where there is often very little trading outside of a small group of very liquid securities such as Treasury bonds, this means that small changes in economic outlook or the number of sellers at a particular moment may move a security’s price to a degree that represents a very attractive buying opportunity for active managers. As Morningstar Magazine recently noted, “the very nature of bond markets creates inefficiencies to exploit.”2

At a time of uncertainty about geopolitics and the direction of the economy and interest rates, fixed income investors seeking returns may be less interested in the specific sector from which those returns are derived and more interested in a portfolio that delivers quality and attractive returns. If that is the goal, a fixed income approach that seeks value in all corners of the market may be worth exploring.

About the Author

Steven Oh is Global Head of Credit and Fixed Income for PineBridge Investments, where he is responsible for coordinating and overseeing the firm’s global credit and fixed income strategies. A Chartered Financial Analyst, he received a Bachelor of Science in finance and management from the Wharton School at the University of Pennsylvania and an MBA in finance from the Kellogg School of Management at Northwestern University.

Related Funds

Transamerica Unconstrained Bond

Index Definitions

The Bloomberg US Aggregate Bond Index is an unmanaged index used as a general measure of market performance.

The Bloomberg US Credit Index measures the investment grade, USD-denominated, fixed-rate, taxable corporate and government-related bond markets.

The Bloomberg US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market.

The Bloomberg US Treasury Bill Index tracks the market for treasury bills issued by the U.S. government.

The Bloomberg US Government Bond Index comprised of the U.S. Treasury and U.S. Agency Indices. The index includes USD-denominated, fixed-rate, nominal U.S. Treasurys and U.S. agency debentures (securities issued by U.S. government-owned or government-sponsored entities, and debt explicitly guaranteed by the U.S. government).

The Bloomberg US TIPS Index is a rules-based, market value weighted index that tracks inflation protected securities issued by the U.S. Treasury.

The Bloomberg US Intermediate Credit Index measures the investment-grade, U.S. dollar-denominated, fixed-rate, taxable corporate and government-related bond markets with a maturity greater than one year and less than 10 years.

The Bloomberg US Long Credit Index measures the performance of investment-grade, U.S. dollar-denominated, fixed-rate, taxable corporate and government-related debt with at least 10 years to maturity.

The Bloomberg US CMBS Investment Grade Index measures the market of U.S. Agency and U.S. Non-Agency conduit and fusion CMBS deals with a minimum current deal size of $300M.

The Bloomberg US Mortgage-Backed Securities (MBS) Index tracks fixed-rate agency mortgage-backed pass-through securities guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC).

The Bloomberg US ABS Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index only includes ABS securities.

The Bloomberg Municipal Bond Index is an unmanaged index considered representative of the broad market for investment-grade municipal bonds.

The Credit Suisse Leveraged Loan Index tracks the investable market of the U.S. dollar-denominated leveraged loan market.

The J.P. Morgan Corporate Emerging Markets Bond Index tracks USD-denominated debt issued by emerging market corporations.

The J.P. Morgan Asia Credit Index is an all-inclusive benchmark that tracks liquid, U.S.-dollar denominated debt instruments issued out of the Asia ex-Japan region.

The J.P. Morgan EMBI Global Diversified Index tracks liquid, U.S. Dollar emerging market fixed and floating-rate debt instruments issued by sovereign and quasi-sovereign entities.

The J.P. Morgan CEMBI Broad Diversified Core Index tracks the performance of U.S. dollar-denominated bonds issued by emerging market corporate entities.

The S&P/LSTA Leveraged Loan Index is a market-value weighted index designed to measure the performance of the U.S. leveraged loan market.

Important Information

1 “Fixed-Income Markets: Issuance, Trading, and Funding,” CFA Institute, 2023 Curriculum

2 Morningstar, Q3 2024 Issue, page 30

Investments are subject to market risk, including the loss of principal. Asset classes or investment strategies described may not be appropriate for all investors.

Past performance does not guarantee future results.

Fixed income securities are subject to risks including credit risk, interest rate risk, counterparty risk, prepayment risk, extension risk, valuation risk, and liquidity risk. The value of fixed income securities generally goes down when interest rates rise. High-yield bond (junk bonds) funds may be subject to greater volatility and risks as the income derived from these securities is not guaranteed and may be unpredictable and the value of these securities tends to decline when interest rates increase. These risks are described in more detail in the prospectus.

Important Information

All opinions, estimates, projections, and security selections contained herein are those of the sub-adviser. It does not constitute investment advice and should not be used as a basis for any investment decision.

Mutual funds are subject to market risk, including loss of principal. Past performance is not indicative of future results.

Mutual funds are sold by prospectus. Before investing, consider the funds' investment objectives, risks, charges, and expenses. This and other important information is contained in the prospectus. Please visit transamerica.com or contact your financial professional to obtain a prospectus or, if available, a summary prospectus containing this information. Please read it carefully before investing.

Fixed income securities and, therefore, the fund, are subject to risks including credit risk, interest rate fluctuation risk, counterparty default risk, which is greater with respect to high-yield/non-investment grade bonds, prepayment risk, extension risk, valuation risk, and liquidity risk. Changes in interest rates, the market's perception of the issuers and the creditworthiness of the issuers may significantly affect the value of a bond. Using derivatives exposes the fund to additional or heightened risks, including leverage risk, liquidity risk, valuation risk, market risk, counterparty risk, and credit risk.

Transamerica Funds are advised by Transamerica Asset Management, Inc. (TAM) and distributed by Transamerica Capital, Inc. (TCI), member of FINRA.

Transamerica Companies and PineBridge Investments are not affiliated companies.

1801 California St., Suite 5200, Denver, CO 80202