In this article we review:

- International equities deserve a place in your portfolio for a variety of reasons.

- Those reasons include old school themes like diversification and fundamentals.

- They also include new themes like opportunities in Japan and the U.K., and, of course, artificial intelligence (AI).

We are often looking for a singular reason why investors should allocate to international equities, and why they should do so now.

However, rarely is there a single overarching reason, and this search for a silver bullet reminds us of a psychological tendency — the fallacy of the single cause (the tendency to assume complex events had a single cause). While studies show humans prefer simple explanations to complicated ones, it doesn’t mean complex systems like equity markets cooperate. Instead, there is typically a mosaic of reasons that collectively add up to a solid case for an investment opportunity, and international equities are no different.

Diversification anyone?

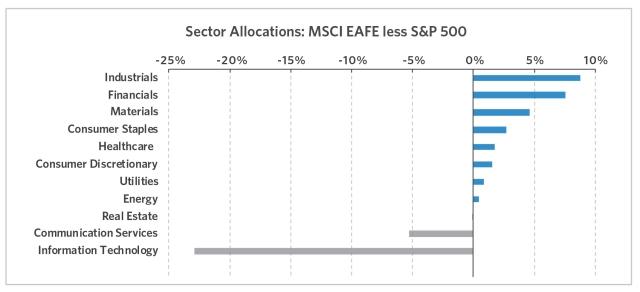

Relatively expensive mega-cap technology stocks and healthcare companies dominate U.S. indexes, while international sectors tilt toward cyclicality and value. Since the great financial crisis (GFC) ended nearly 15 years ago, most of the world economies have experienced low growth, low rates, and low inflation environments that favored higher-duration growth stocks. Quantitative easing and global central banks’ zero interest rate policy post-GFC paved the way for these types of companies to outperform for vast swaths of the period since 2009. Commensurately, this helped the duration-heavy U.S. market outperform for an unusually long time.

While it is true that inflation has begun to fall from its highs and central banks are now considering rate cuts as opposed to hikes, it nevertheless seems clear that the era of artificially low rates and minimal inflation are over for now. We believe if non-zero interest rates and positive inflation are indeed the new normal, this will be supportive of value going forward, and therefore a tailwind for disciplined, long-term focused active managers in general, and for international markets in particular.

Diversification does not guarantee a profit or protect against a loss in a declining market.

Source: Bloomberg as of 6/30/2024. It is not possible to invest directly in an index.

Do fundamentals matter?

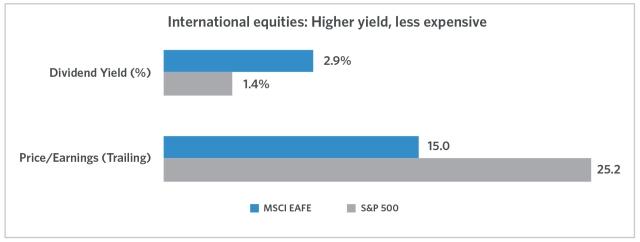

U.S. companies have grown their earnings faster than their international peers over the past five years. However, over the past 12 months, international companies have grown at roughly the same pace as the U.S. Despite that recent growth, companies outside the U.S. trade at a significant valuation discount and exhibit a much higher dividend yield.

At ClariVest, the one opportunity we attempt to capture on an ongoing basis is underappreciated growth. Simply put, earnings growth at a discount. Moreover, because investors are inherently slow to react to new information, companies that are exhibiting said earnings growth at a discount are primed to perform well. We believe investors would be wise to consider the potential for international equities to outperform domestic stocks and ensure their portfolios are well positioned to capitalize on this shift.

Source: FactSet as of 6/30/2024. It is not possible to invest directly in an index. Past performance is not indicative of future results.

Opportunities in Japan

Japan, the world’s fourth-largest economy, has for ages had a reputation as being cheap for a reason, with demographic headwinds and low growth. However, the country is shifting to an inflationary environment after years of deflation. For example, The Bank of Japan recently began normalizing rates this year with its first rate hike in 17 years. In addition, corporate governance reforms are taking root as the Tokyo Stock Exchange’s new policies encourage companies to improve their price/book and return on equity or risk demotion. In response, excess cash and extraneous holdings are being reduced.

Japan has been a very strong performer year to date. Given deep-seated investor biases against Japan paired with improving country fundamentals, we continue to see the opportunity for underappreciated growth.

United Kingdom Brexit fears overdone?

The United Kingdom (U.K.) left the European Union (EU) in 2020. The U.K. is the only country to have left the EU (or its predecessor, the European Communities) since the founding in 1973. We all know the impact of Brexit in the U.K. isn’t a positive one. However, it feels as if markets have priced in the worst-case scenario, though we believe that is unlikely.

In general, we are excited when an entire sector, country, or region is being painted with a broad brush as it frequently leads to investment opportunities. While it is true that Brexit could create a drag for some companies, there are absolutely areas of growth that are underappreciated given the widespread negative sentiment. For example, a British aerospace and defense firm has benefited from the global recovery in travel.

The growing impact of AI

We have all heard the news regarding the impact of AI for companies like Nvidia, but we have had success finding underappreciated growth in less obvious areas like cooling systems. The saying, “During a gold rush, sell shovels,” refers to the fact that suppliers of mining tools like picks and shovels made more money during the California gold rush than the prospectors.

It isn’t a new story that productivity in Europe has lagged the U.S. for structural reasons, but we think the long-term impact of AI could be a narrowing of this gap. The unlocked potential of these varied economies could have a significant global impact.

We believe we are in the early innings of the AI theme, and almost certainly the impact on various industries and countries will play out in unexpected ways. In our opinion, that plays to the strengths of our process where we are agnostic as to where we find growth and have a set of processes that scour the globe daily for such opportunities.

Conclusion

Improving fundamentals, essential diversification, opportunities in Japan and the U.K., and the potential impact of AI are coalescing around international equities in the current market environment. In our opinion, these factors combined are working together to create an atmosphere where investors may wish to reconsider foreign stocks. While the old school value economy of the MSCI EAFE Index constituents has long played second fiddle to the high octane, tech-dominated S&P 500® Index, we have outlined a multitude of reasons why we believe that regime could be changing and why investors ought to consider altering their allocations too.

About the Authors

David Vaughn is a founder and board member of ClariVest Asset Management LLC. Mr. Vaughn is part of the leadership of the investment team, focusing on non-U.S. and Global strategies. Prior to forming ClariVest in March 2006, he worked as the Portfolio Manager for all International and Global Systematic strategies at Nicholas-Applegate and was a member of the Systematic Investment team that managed over $5 billion in assets at the firm. Previously, Mr. Vaughn worked as a Research Analyst at Barclays Global Investors and as a Research Associate at First Quadrant. He was also a Quantitative Research Analyst and Investment Officer with Sanwa Bank in Los Angeles. Mr. Vaughn earned a Bachelor of Science in economics from California Institute of Technology and a master’s in computational finance from Carnegie Mellon University. He began his investment career in 1996.

Bob Zimmer is a Senior Portfolio Strategist on the investment team for ClariVest Asset Management LLC. Mr. Zimmer serves as the main point of contact for our clients and their consultants, responsible for maintaining and enhancing existing relationships as well as developing new ones. In addition, he plays an integral role in the firm’s approach to sustainable investing and stewardship. Prior to joining ClariVest in 2012, Mr. Zimmer was a founding partner at Ten Asset Management in 2004 where he acted as both Chief Investment Officer and President. Before founding Ten, Mr. Zimmer was a portfolio manager at Investment Research Company (later Freeman Associates). Mr. Zimmer received a Bachelor of Arts degree in economics from the University of California, San Diego.

Related Funds

Transamerica International Stock

Index Definitions

The MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada.

The S&P 500® Index is an unmanaged index of 500 common stocks primarily traded on the New York Stock Exchange, weighted by market capitalization.

Past performance is not indicative of future results. It is not possible to invest directly in an index, which also does not include the application of fees.

Important Information

All opinions, estimates, projections, and security selections contained herein are those of the sub-adviser. It does not constitute investment advice and should not be used as a basis for any investment decision.

Mutual funds are subject to market risk, including loss of principal. Past performance is not indicative of future results.

Mutual funds are sold by prospectus. Before investing, consider the funds' investment objectives, risks, charges, and expenses. This and other important information is contained in the prospectus. Please visit transamerica.com or contact your financial professional to obtain a prospectus or, if available, a summary prospectus containing this information. Please read it carefully before investing.

The price of equity securities fluctuates based on changes in a company’s financial condition and overall market and economic conditions. If the market prices of the equity securities owned by the fund fall, the value of the fund will decline. The prices of securities the sub-adviser believes are undervalued may not appreciate as anticipated or may go down. Investments in global/international markets involve risks not associated with U.S. markets, such as currency fluctuations, adverse social and political developments, and the relatively small size, lower market volumes and lesser liquidity of the markets. There also can be no assurance that the use of models will result in effective investment decisions for the fund.

Transamerica Funds are advised by Transamerica Asset Management, Inc. (TAM) and distributed by Transamerica Capital, Inc. (TCI), member of FINRA.

Transamerica Companies and ClariVest Asset Management LLC are not affiliated companies.

1801 California St., Suite 5200, Denver, CO 80202