In this article we review:

- Current domestic equity valuations relative to history

- Potential uses and advantages of multi-asset strategies given the environment

- The benefits of active management in the space

Multi-asset income strategies can offer a balanced approach to investing. While specific strategy objectives can vary, the potential for combining benefits of diversification, income generation, and potential capital appreciation make them a popular choice for investors seeking a well-rounded investment solution. Given the recent outperformance of equities and a potential shift in interest rate policy, the asset class may pique the interest of investors placing a priority on such characteristics at this stage of the cycle.

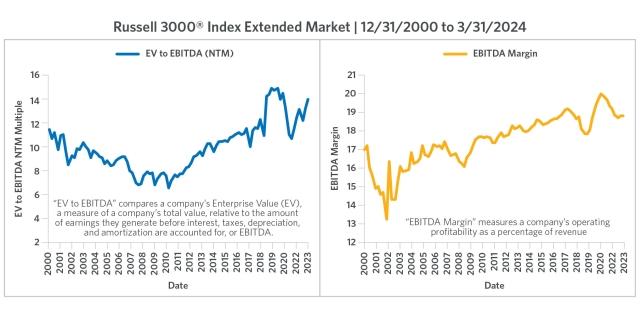

Market Valuation Metrics Nearing All-Time Highs

When looking at the broad market of U.S. stocks (using the Russell 3000® Index as a proxy), valuation and profitability metrics are nearing all-time highs, as seen below. This has been fueled by resilient corporate earnings coupled with increasing expectations for a Federal Reserve-induced “soft-landing.” Despite this, the brunt of market performance can be attributed to just a handful of stocks, often referred to as the “Magnificent 7” — Apple, Microsoft, Alphabet, Amazon, NVIDIA, Tesla, and Meta Platforms.

Current Broad Equity Valuations and Profitability Close to Record Highs

Source: FactSet (June 2024). It is not possible to invest directly in an index.

We believe investor sentiment and market volatility will continue to be driven by macro data points, global central bank policy, geopolitical tensions, and the pending November U.S. election. This setup, combined with what we believe to be a speculative period for domestic markets, may create vulnerability with U.S. equity valuation metrics near all-time highs.

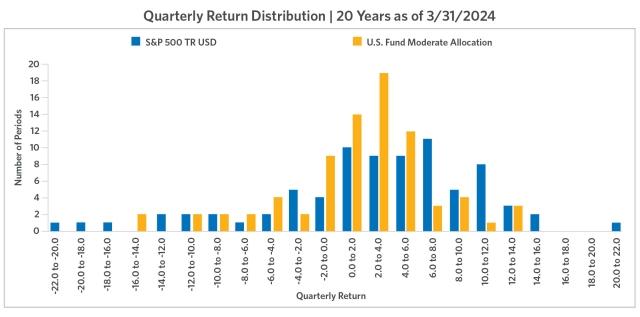

How to Use Multi-Asset Income Strategies in This Environment

Multi-asset income strategies afford allocators a means to “dial back” their overall equity risk by investing in an asset class that generally falls between equity and traditional fixed income from a risk perspective. Many of these strategies were specifically developed to meet the needs of investors seeking a combination of participation in the long-term capital appreciation of equity markets, albeit with reduced swings in short-term volatility, and above-average income generation. Using Morningstar’s Moderate Allocation category (which includes strategies with an equity allocation between 50–70%) as a proxy, we can see that the quarterly return distribution over the past 20 years compared to the S&P 500® is not as volatile, especially on the tail ends.

Multi-Asset Income Strategies Have Historically Exhibited Subdued Volatility

Source: Morningstar® (June 2024). It is not possible to invest directly in an index. Past performance is not indicative of future results.

The strategic asset allocation of these strategies gives investors the ability to moderate the extremes and become increasingly defensive when they see fit, which has shown to be particularly useful during significant market-drawdowns. Many of these strategies are not measured against a specific benchmark and instead focus on providing a certain investment outcome or return profile. Generally, the primary objective of multi-asset income strategies is to provide investors with income generation, growth opportunities, and risk management, while implementing a diversified investment approach across multiple asset classes. These differentiated investment goals help reduce the volatile swings and often “cut off the tails” from equity market returns.

Potential Advantages of an Active Approach to Multi-Asset Income Investing

Given the mostly benchmark-neutral nature of the multi-asset income asset class, portfolio managers enjoy a wide range of flexibility in their attempt to achieve investment goals. Active management in the space allows for tactical asset allocation and security selection to both play a meaningful role — critical given the nature of today’s rapidly changing environment. Given the potential for increased volatility in the U.S. equity and fixed income markets, multi-asset income portfolio managers have an opportunity to take advantage of dislocations across both asset classes.

To summarize, we believe this is an opportune time to consider the multi-asset income asset class, especially given where we are in the market cycle and the investment characteristics these strategies can provide a portfolio.

About the Author

Bill Bellamy is the Portfolio Manager for the Transamerica Multi-Asset Income fund. Bill began his career in the investment industry in 1987. Prior to joining TSW in 2002, he was a Portfolio Manager at Trusco Capital Management, managing total return-oriented institutional accounts. Previously, Bill was a Vice President of Institutional Fixed Income for First Union Capital Markets and Clayton Brown & Associates after beginning his career in Institutional Sales and Trading at Merrill Lynch. He earned his undergraduate degree from Cornell University and his MBA from The Fuqua School of Business at Duke University. He holds the Chartered Financial Analyst® designation, is a member the Richmond Society of Financial Analysts, and is registered as an Investment Adviser Representative.

Related Funds

Transamerica Multi-Asset Income

Index Definitions

The Russell 3000® Index measures the performance of the largest 3,000 U.S. companies, representing approximately 98% of the investable U.S. equity market.

The S&P 500® Index is a market-capitalization weighted index of 500 large U.S. companies with common stock listed on the New York Stock Exchange and NASDAQ Stock Market.

Past performance is not indicative of future results. It is not possible to invest directly in an index, which also does not include the application of fees.

Important Information

All opinions, estimates, projections, and security selections contained herein are those of the sub-adviser. It does not constitute investment advice and should not be used as a basis for any investment decision.

Diversification cannot ensure a profit or protect against loss in a declining market. It is a strategy used to help mitigate risk.

Mutual funds are subject to market risk, including loss of principal. Past performance is not indicative of future results.

Mutual funds are sold by prospectus. Before investing, consider the funds' investment objectives, risks, charges, and expenses. This and other important information is contained in the prospectus. Please visit transamerica.com or contact your financial professional to obtain a prospectus or, if available, a summary prospectus containing this information. Please read it carefully before investing.

The price of equity securities fluctuates based on changes in a company’s financial condition and overall market and economic conditions. If the market prices of the equity securities owned by the fund fall, the value of the fund will decline. Fixed-income securities are subject to risks including credit risk, interest rate risk, counterparty risk, prepayment risk, extension risk, valuation risk, and liquidity risk. High-yield bonds tend to be volatile and more susceptible to adverse events, credit downgrades, and negative sentiments. Investing in high-yield securities may be subject to greater volatility and risks as the income derived from these securities is not guaranteed and may be unpredictable and the value of these securities tends to decline when interest rates increase. Preferred stock tends to vary more with fluctuations in the underlying common stock and less with fluctuations in interest rates and tends to exhibit greater volatility.

Transamerica Funds are advised by Transamerica Asset Management, Inc. (TAM) and distributed by Transamerica Capital, Inc. (TCI), member of FINRA.

Transamerica Companies and TSW are not affiliated companies.

1801 California St., Suite 5200, Denver, CO 80202

© 2024 Transamerica Corporation. All Rights Reserved.