In this article we review:

- Even when yields are similar, fixed income investors should consider remaining diversified across asset classes, credit quality, and maturity.

- The current environment of tight spreads and higher-for-longer rates may favor short- to intermediate-term, fixed income investments.

- Active management can help mitigate risks of market shocks by providing fundamental credit analysis while seeking to optimize yield curve, credit, and sector exposures.

The spreads between corporate bonds and U.S. Treasurys have continued to tighten over the past several quarters as corporate bond issuers benefit from pricing power with relatively low default rates. The tighter spreads provide less compensation to investors for taking the additional risk of investing in corporates compared to the relative stability of Treasurys.

Typically, tight credit spreads reflect investor confidence in the economy. Yet stubborn inflation and higher-for-longer interest rates may seem to place downward pressure on economic activity. What are fixed income investors to make of these seemingly mixed signals, and what does it mean for allocation decisions?

This environment of compressed spreads can tempt investors to push their risk and seek higher yields of longer duration or lower-credit bonds. Conversely, investors may travel the safer route and forgo exposure to corporate bonds altogether. It is a conundrum of risk versus return, and it seems likely to continue, as the Federal Open Market Committee has signaled that we're farther from interest rate cuts than we believed at the beginning of the year.

To help parse the risks and trade-offs of seeking yield or playing it safe, we can compare it to some historical examples.

Today’s tighter spreads

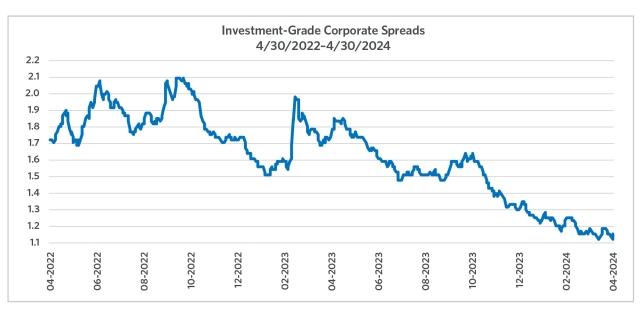

Credit spreads directly impact the potential return that investors can earn from fixed income investments. They also provide investors with valuable insights into the perceived credit risk of different issuers, as changes in credit spreads can signal shifts in economic conditions. Widening spreads typically indicate higher perceived risk, with higher yields required to compensate investors for the increased risk they are taking on. Narrowing spreads may indicate improving economic prospects or increasing investor confidence, as we see in the chart below.

Credit spreads have been narrowing over the past two years

Source: Ice Data Indices, LLC, ICE BofA BBB US Corporate Index Option-Adjusted Spread, retrieved from FRED, Federal Reserve Bank of St. Louis.

Past performance is not indicative of future results. It is not possible to invest directly in an index, which also does not include the application of fees.

While inflation has come down significantly over the past year, it is persistently hovering above the Federal Reserve’s target of 2%. As a result, the Fed is keeping interest rates higher for longer, signaling that this restrictive monetary policy stance is expected to persist in the foreseeable future. The yield curve remains inverted, and while we are likely to see a yield curve normalization at some point, it is not clear when. An inverted yield curve has signaled recessions in the past, but the U.S. economy is still growing, and the Fed would like to see that economic activity cool before cutting rates.

The corporate debt market remains unconcerned

This type of environment may signal danger for corporations and their earnings, as higher interest rates tamp down consumer spending and economic activity. Yet despite today’s challenging conditions, confidence in the health of corporate balance sheets and access to liquidity has acted as a counterbalance, keeping credit spreads low.

Corporations, buoyed by robust earnings and ample liquidity, have demonstrated resilience in navigating the inflationary pressures and higher borrowing costs, bolstering investor confidence in their ability to meet debt obligations. This confidence mitigates concerns about credit risk and supports demand for corporate bonds, thereby compressing credit spreads even in an environment of hawkish monetary policy.

Fixed income investors are often faced with the challenge of finding adequate yield without taking on excessive risk. When credit spreads are tight, this can lead investors to chase higher yields, such as extending duration, investing in lower-rated bonds, or allocating to higher-risk asset classes. Adding the additional risk can eventually come at a cost.

Learning from historical environments that parallel today’s

The “Dot-Com” Boom: Higher Inflation and Tighter Spreads

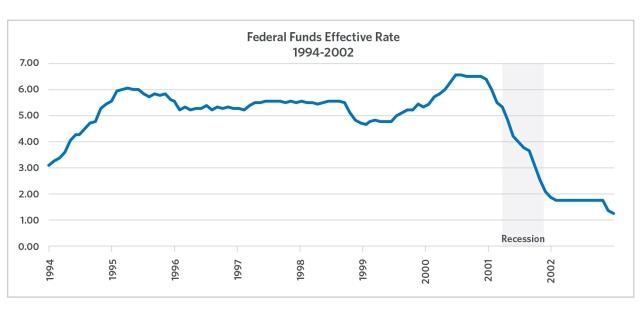

In the mid-to-late 1990s, the fixed income market experienced a period of narrow credit spreads and modestly elevated inflation, similar to our present scenario. To tame inflation, the Fed raised and kept rates above 5% from 1994 to 2001.

Federal funds rate: Higher for longer in the mid-to-late 1990s

Source: Board of Governors of the Federal Reserve System, Federal Funds Effective Rate, retrieved from FRED, Federal Reserve Bank of St. Louis.

Despite enduring higher-for-longer interest rates, confidence in corporate earnings and investor sentiment remained robust, driving tight credit spreads. However, the euphoria of the late 1990s was followed by the dot-com bust in the early 2000s, precipitating a sharp reversal in market sentiment. Amid heightened volatility, investors sought refuge in safe-haven assets such as government bonds and high-quality corporate bonds, resulting in a widening of the credit spread, a decline in yields, and positive returns for fixed income investors holding these securities.

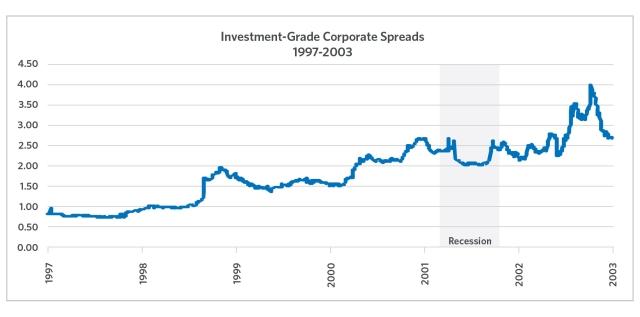

Investment-grade credit spreads rose steadily from 1997 to 2003

Source: Ice Data Indices, LLC, ICE BofA BBB US Corporate Index Option-Adjusted Spread, retrieved from FRED, Federal Reserve Bank of St. Louis.

Past performance is not indicative of future results. It is not possible to invest directly in an index, which also does not include the application of fees.

Investors who may have chased higher yields may not have fared well when the market shifted. High-yield bond performance suffered as the default average climbed to 9.2% and high-yield total returns turned negative in 2000. It’s also worth noting that total returns for corporate bonds and Treasurys diverged substantially year-to-year in the late 90s and early 2000s. Holding one asset class did not serve as a proxy for holding the other. Instead, remaining diversified helped smooth out the year-to-year volatility of the dot-com boom and bust.

The early 1980s: Lower investor confidence drove wide spreads

Unlike the late 90s and today’s environment, spreads often widen in higher inflation eras. In the early 1980s, fixed income investors faced a markedly different environment, including the wider credit spreads prevalent during that period. Investors had less confidence in corporate earnings, reflecting a higher perceived risk associated with corporate debt compared to government-backed securities.

Economic conditions were characterized by stagflation, a combination of stagnant economic growth and high inflation. This environment eroded investor trust in the ability of corporations to generate consistent earnings, leading to higher risk premiums demanded by investors for holding corporate bonds. As a result, fixed income investors were often more cautious and selective in their allocation decisions, prioritizing safety over yield.

Could we see this environment again? It may depend on whether the current rates can drive inflation lower without sending the economy into recession. However, the risks are worth noting for fixed income investors, as a sudden widening of the credit spread can cause corporate bond prices to fall. Other recent examples of economic shocks demonstrate how spreads can widen quickly.

Recent shocks and broadening spreads

During the 2007–08 banking crisis, credit spreads widened dramatically in a relatively short period. The collapse of the subprime mortgage market triggered a domino effect that reverberated throughout the global financial system, leading to widespread panic and a flight to safety among investors. As risk aversion soared, the demand for safe-haven assets surged, causing credit spreads to widen sharply as investors fled from riskier assets such as corporate bonds.

Similarly, the onset of the COVID-19 pandemic in 2020 unleashed unprecedented volatility in financial markets, prompting another surge in credit spreads. The uncertainty surrounding the economic impact of the pandemic and the ensuing lockdown measures led to a wave of corporate downgrades and defaults, exacerbating investor concerns about credit risk. Once again, investors sought refuge in government bonds and high-quality corporate debt, driving up the spreads between these securities and riskier assets.

Applying the lessons of the past

The recent episodes serve as reminders that fixed income markets can be vulnerable to sudden shocks and systemic risks. While the current environment may appear benign compared to the turmoil of past crises, the potential for rapid repricing and widening credit spreads remains a risk to consider.

In this environment, higher interest rates continue to provide investors with yield opportunities that we haven't experienced in some time. If patience prevails, fixed income investors can sit tight with a sensible mix of short- to intermediate-term, fixed income investments, collecting monthly interest to benefit from steady yields without overexposing their portfolios to a higher risk of defaults or large price swings.

Price swings and potential shocks may also be mitigated by investing in actively managed bond funds. A diversified bond fund will generally seek a high level of income while keeping exposures to credit, sectors, and duration within a fund’s prescribed level of risk. Bond fund managers also seek to mitigate the risk of defaults or market shocks by conducting fundamental credit analysis. As always, staying diversified is a strategy designed to manage the crosswinds of an economy and markets that sometimes reflect conflicting stories.

Related Funds

Definitions

The ICE BofA BBB US Corporate Index, a subset of the ICE BofA US Corporate Master Index, tracks the performance of U.S. dollar-denominated, investment-grade-rated-corporate debt publicly issued in the US domestic market.

The Federal Funds Effective Rate is the interest rate depository institutions charge each other for overnight loans of funds.

Important Information

Investments are subject to market risk, including the loss of principal. Asset classes or investment strategies described may not be appropriate for all investors.

Past performance does not guarantee future results.

Mutual funds are sold by prospectus. Before investing, consider the funds' investment objectives, risks, charges, and expenses. This and other important information is contained in the prospectus. Please visit transamerica.com or contact your financial professional to obtain a prospectus or, if available, a summary prospectus containing this information. Please read it carefully before investing.

During periods of market disruption (e.g. COVID-19), which may trigger trading halts, the fund's exposure to the risks described in the prospectus will likely increase. As a result, the value and liquidity of the fund's investments may be negatively affected.

Fixed income securities are subject to risks including credit risk, interest rate risk, counterparty risk, prepayment risk, extension risk, valuation risk, and liquidity risk. The value of fixed income securities generally goes down when interest rates rise. High-yield bond (junk bonds) funds may be subject to greater volatility and risks as the income derived from these securities is not guaranteed and may be unpredictable and the value of these securities tends to decline when interest rates increase. These risks are described in more detail in the prospectus.

Transamerica Funds are advised by Transamerica Asset Management, Inc. (TAM) and distributed by Transamerica Capital, Inc. (TCI), member of FINRA.

1801 California St., Suite 5200, Denver, CO 80202

© 2024 Transamerica Corporation. All Rights Reserved.