In this article we review:

- The Fed, recession potential, and the path of interest rates

- The supply/demand technicals’ tailwind

- The strength of municipal credits

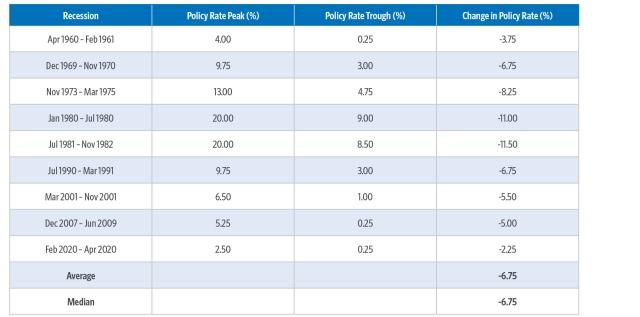

After several straight meetings of keeping the federal funds rate unchanged, the tightening cycle appears to be wrapping up as inflation continues to normalize. That said, the Fed seems hesitant to begin easing again, and a future recession is becoming more likely as inaction persists. Belle Haven’s thoughts are that the Fed will remain tight for too long and will likely break something in the financial markets. Whether it’s an uptick in corporate defaults, cracks in the regional banking sector, or the looming commercial real estate mortgage bubble, any one of these could fall victim to the Fed leaving rates too high for too long.

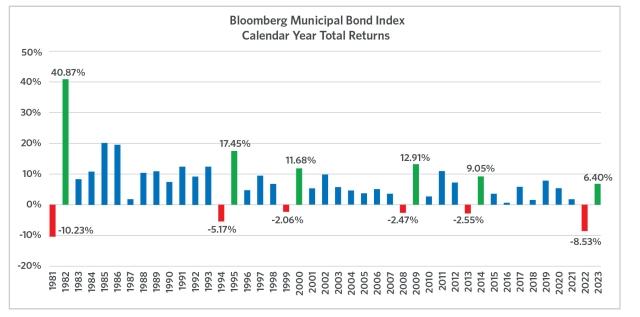

Historically, municipals tend to rebound significantly after down years

Source: Bloomberg, 1/1/1981 to 12/31/2023. Past performance is not indicative of future results. It is not possible to invest directly in an index, which also does not include the application of fees.

In 2022, the Bloomberg Municipal Bond Index posted a -8.53% return. Alas, history repeated itself yet again for 2023 as the fourth quarter reversed the sell-off experienced throughout the year and led to positive returns across the asset class. The Bloomberg Municipal Bond Index posted a return of 6.40% for 2023 and a 7.89% return for the fourth quarter alone. Year-to-date gross issuance totaled nearly $380 billion and estimates for 2024 point to a similar figure. 2023 ended with $27 billion in mutual fund outflows for the year, with a positive $12 billion in inflows for ETFs.

Typically, ETFs see inflows as a short-term place holder for tax loss harvesting, so should investor sentiment continue to strengthen, we can expect to see supportive inflows into the mutual fund space, driving demand for munis. With increased demand and relatively stable supply, market technicals may present a welcome tailwind and serve as a performance driver for munis in 2024.

Why the asset class?

Projected Rate Cuts: According to recent Federal Open Market Committee minutes, nearly all participants indicated a lower target rate by the end of 2024, based on the improvements in their inflation outlooks. While the number and timing of potential rate cuts remain to be seen, the anticipation of even slightly lower rates this year will prove positive for municipal performance. After nearly two years of fear-induced inaction on the part of investors (due to skyrocketing interest rates), the idea that rates may soon be peaking could assist in bringing back some of the money that’s been sitting idle on the sidelines.

Source: Alpine Macro 2022

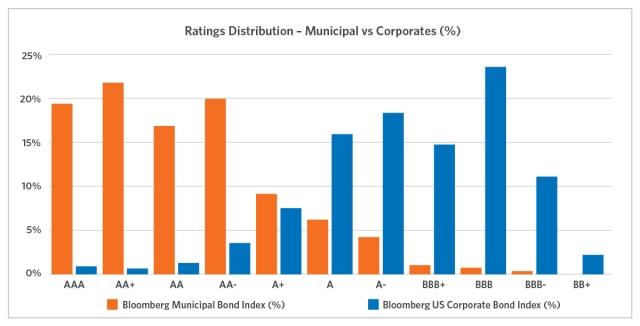

Strength in Municipal Credits: Municipal credits are remarkably strong, due in large part to their proactive debt and budget management as well as the direct federal aid received during the pandemic. Since December 31, 2022, only two states have been downgraded by major rating agencies whereas 12 have been upgraded. This, coupled with high levels of reserves, reflects resiliency in municipal issuers should there be an economic downturn. Moreover, their historically low default rate and diverse revenue sources represent stability in the asset class during potentially volatile conditions.

Source: Bloomberg, as of 3/31/2024

Municipal bonds are well positioned for where we believe we are in the current economic cycle. The Fed may hold rates where they are for the short-term; however, all signs point to the Fed having wrapped up its tightening cycle at this juncture. This will bring demand back into the space, as investors no longer need to be fearful of rates heading meaningfully higher from here. This demand, paired with muted supply and strong credit fundamentals, is a favorable dynamic for investors seeking steady and predictable income.

About the Author

Cara Grealy is a Portfolio Manager on the Investment Team at Belle Haven Investments. Cara launched her career in the industry upon joining Belle Haven in 2011 as an associate. She has been a member of the Investment Team since that time and was named a Partner of the Firm in 2017. She worked her way through various roles over the years, using the accumulated knowledge as a stepping-stone to her present position as a Portfolio Manager. Her current responsibilities focus on risk and portfolio construction and overseeing the reporting and analytics team. Throughout her tenure, Cara has leveraged her deep knowledge of the Firm’s internal systems and macro view of the Firm’s investment process to provide the team with a unique leadership perspective.

Related Funds

Transamerica Intermediate Muni

Index Definitions

The Bloomberg Municipal Bond Index is an unmanaged index considered representative of the broad market for investment-grade municipal bonds.

Past performance is not indicative of future results. It is not possible to invest directly in an index, which also does not include the application of fees.

Important Information

All opinions, estimates, projections, and security selections contained herein are those of the sub-adviser. It does not constitute investment advice and should not be used as a basis for any investment decision.

Mutual funds are subject to market risk, including loss of principal. Past performance is not indicative of future results.

Mutual funds are sold by prospectus. Before investing, consider the funds' investment objectives, risks, charges, and expenses. This and other important information is contained in the prospectus. Please visit transamerica.com or contact your financial professional to obtain a prospectus or, if available, a summary prospectus containing this information. Please read it carefully before investing.

The interest from municipal bonds is expected to be exempt from federal income tax. If a fund investor is a resident in the state of issuance of the bonds held by the fund, interest dividends may also be free of state and local income taxes. Such interest dividends may be subject to federal and/or state alternative minimum taxes. Municipal bond prices can rise or fall depending on interest rates. Interest rates may go up, causing the value of the Fund's investments to decline. The municipal bond market can be susceptible to unusual volatility, particularly for lower-rated and unrated securities. All municipal bonds carry credit risk that the issuer will default or be unable to make timely payments of interest and principal. Generally, lower rated bonds carry more credit risk. High-yield bond (junk bonds) funds may be subject to greater volatility and risks as the income derived from these securities is not guaranteed and may be unpredictable and the value of these securities tends to decline when interest rates increase.

Transamerica Funds are advised by Transamerica Asset Management, Inc. (TAM) and distributed by Transamerica Capital, Inc. (TCI), member of FINRA.

1801 California St., Suite 5200, Denver, CO 80202

Transamerica Companies and Belle Haven are not affiliated companies.

© 2024 Transamerica Corporation. All Rights Reserved.