Why It Matters

- Clients often overestimate how much life insurance will cost and may not know it’s typically cheaper to buy when they’re young.

- Some clients may want to consider buying life insurance while they’re healthy rather than risk not being able to buy affordable coverage when they’re older.

Life events like weddings, adoptions, college graduations, or the purchase of a new home can be an opportunity to send clients a note of congratulations — and an offer to meet to discuss options for protecting loved ones.

Not everyone needs to buy life insurance, but financial professionals are in a position to guide those who do — including younger clients who may not realize until too late that they need it.

Some clients may already be thinking about purchasing life insurance after a big life event like an addition to the family, so they can take care of loved ones and help protect their families’ finances in the event of their passing. But they may not know how much coverage they need or what types of life insurance they should buy.

Financial professionals can help clear up misconceptions and give clients answers to questions they didn’t know to ask in the first place.

Be sure your clients know these seven things

Buying life insurance isn’t the same rite of passage as getting a license to drive or voting for the first time. It doesn’t tend to happen at a set age. While financial professionals know best practices for when to buy life insurance, it’s worth reminding clients of a few key points:

- The time to think about life insurance is when others start depending on your income.

About 4 in 10 insured people wish they had bought life insurance sooner, according to the trade association LIMRA.1 If your clients have partners, children, or parents who rely on your clients’ income to pay the bills, help them think through how their loved ones would replace that income if the worst should happen. Life events like weddings, births, adoptions, college graduations, or the purchase of a new home can be an opportunity to send clients a note of congratulations with a simple offer: “I know you’re busy planning for what’s next. I hope you get to take some well-deserved time to celebrate. At some point, let’s get together to talk about steps some of my other clients have taken to provide financial security in this exciting time in life.”

- Young, single people who are paying off loans or credit card debt and don’t want to burden their family may also want to consider life insurance.

Common reasons for buying life insurance include to pay off debt like a mortgage, cover burial or funeral expenses, or help survivors replace or supplement income.

- A group life insurance benefit provided by an employer may not be enough to meet someone’s needs.

Many employer-provided group life insurance benefits may only replace one to two years’ worth of a client’s salary. A family with a 30-year mortgage may need the client’s salary for many more years than one or two if the client should die unexpectedly.

- Having a portable supplemental life insurance policy, which stays in force after someone leaves their employer, can provide extra protection.

This could be extremely valuable if your clients need or want to look for new work or move on to the next stage of their career.

- Buying life insurance at a younger age can mean lower premiums.

Educate first-time insurance buyers on the factors that can influence how much they pay in premiums, including their age, gender, health, medical history, habits, and risky hobbies.

- There’s a good chance life insurance costs less than they think.

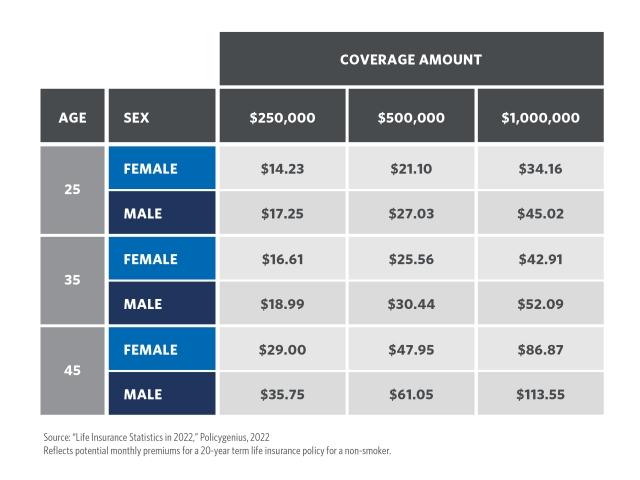

More than half of Americans overestimate the cost of life insurance, LIMRA says, with some thinking it costs three times as much as it really does. But here’s a sample of what monthly premiums could look like for a 20-year term life insurance policy for a non-smoker, according to Policygenius.2

- There are many types of life insurance. So many types.

Just as first-time home buyers don’t always know all the mortgage options available to them, clients may need your help exploring whole and term life insurance, plus riders they can buy. If your client has started a business, remember to bring up key employee life insurance.

Start the conversation

These questions can help you determine which clients should consider life insurance now:

- Are they married or engaged?

- Do they have children, or are they about to start a family?

- Are they homeowners or looking to buy a home?

- Are they retired or almost retired?

- If they’re single, do they have loans that still need to be paid off?

- Do they run a business with employees who aren’t family members?

Financial professionals can play a helpful role in prompting clients to consider life insurance at the right time, showing clients options that fit their budgets, and determining how much coverage they need, so they can protect the ones they love.

Things to Consider:

- Clients may not know all the different types of life insurance available to them.

- Set expectations early on for what life insurance might cost. It may be much lower than what clients would have guessed.

- You’ve helped clients plan for their future financial needs. Now you can help them protect their wealth too.

1 “Top Misconceptions About Life Insurance,” LIMRA, 2021

2 “Life insurance statistics in 2022,” Policygenius, 2022

Transamerica Resources, Inc. is an Aegon company and is affiliated with various companies which include, but are not limited to, insurance companies and broker dealers. Transamerica Resources, Inc. does not offer insurance products or securities. The information provided is for educational purposes only and should not be construed as insurance, securities, ERISA, tax, investment, legal, medical or financial advice or guidance. Please consult your personal independent professionals for answers to your specific questions.