Why It Matters:

- It’s important to cover all your bases in preparing for your family’s financial future.

- Life insurance is not a one-size-fits-all proposition.

- Knowing the difference between whole and term life is a good place to start in determining your financial needs.

According to a 2021 LIMRA study, more than half of those surveyed (53%) say they haven't purchased life insurance because they don't know how much they need or what type to buy.1 Yet, 36% of participants surveyed plan to purchase life insurance within the next 12 months.2 So, for those looking to protect themselves from the unexpected, here’s our quick guide to buying life insurance.

Term life and whole life are the two most common types of insurance.

Term Life Insurance

Term life provides coverage for a specific “term” or period of time should you pass away. It’s similar to car insurance in the sense that once the specified period is over or you stop paying premiums, you’re no longer covered. Most policies are purchased for 10-, 20-, or 30-year terms. Some policies allow you to renew after your term runs out, but policies tend to get more expensive because you’re older.

When compared to whole life, term life typically offers larger amounts of coverage for relatively smaller premiums. It provides a cost-effective way of meeting a temporary insurance need, which makes it appealing to families with large expenses such as child care, bills, mortgage, etc. Often, by the time the term expires, the kids will have moved out, the mortgage will be paid off, and their insurance needs may be less.

While term life pays a set death benefit, it does not accumulate any cash value, nor can you borrow against it. If, at the end of the term, you haven’t used it, you get nothing. But, some companies offer “living benefits” on certain types of term life policies. Living benefits or “accelerated death benefits” allow the policyholder to access their death benefit early in the case of a qualified critical, chronic, or terminal illness. This means you don’t have to die to tap into those funds. You can use a portion of your anticipated death benefit to pay for medical bills and replace lost income.*

Whole Life Insurance

Whole life insurance provides “permanent” or lifelong protection. You might encounter other types of life insurance such as universal life, variable universal life, and indexed universal life, but don’t get confused. These are all just different forms of permanent life insurance with varying features. With all forms of permanent life insurance, as long as your premiums are paid, the policy remains in force for as long as you live. When you pass away, your named beneficiaries will receive the death benefit.

Premiums for whole life tend to be higher than term, but whole life policies include a component allowing you to accumulate cash value over time. If there’s enough cash value, it also means you may be able to use it to pay future premiums or borrow against it in an emergency. But, if you don’t repay the loan with interest, you’ll reduce your death benefit. Should you choose to cancel your policy early, the cash value or “cash surrender value” may be returned to you.

In addition, some types of whole life policies provide the opportunity to earn annual dividends. This is basically a portion of the insurer’s financial surplus. While never guaranteed, these dividends can be paid out in cash, left to accumulate interest, used to pay premiums, repay policy loans, or buy additional coverage.

Which one is best for you?

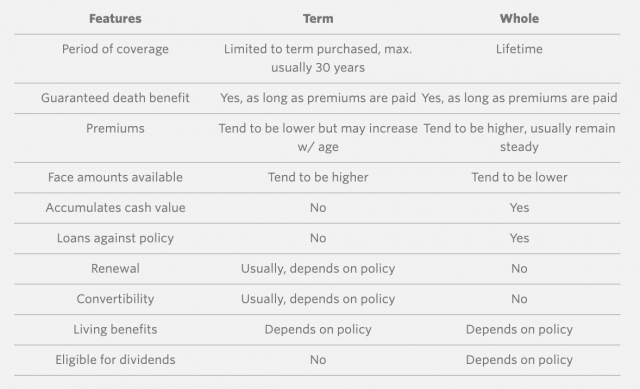

Not everyone buys insurance for the same reasons. So one size does not fit all. It depends on your individual situation and financial goals. Compare the different types of features of term and whole life insurance in the following chart to see which one best suits your needs. Then talk to a financial professional to make sure you’re getting the right coverage for you.

Things to Consider:

- Talk to a financial professional to make sure you have enough of the right kind of life insurance for your individual situation.

- If you have a term policy, ask your financial professional about if or when you should convert it to a whole life policy?

- How important is it for you to leave an inheritance for loved ones and, if so, how much?

- Do you have major medical, disability, and/or long term care insurance? If not, could living benefits make sense for you?

1 "2021 Insurance Barometer Study," LIMRA, April 2021

2 "2021 Insurance Barometer Study Reveals common Misconceptions That Prevent Americans from Getting Life Insurance They Know They Need," LIMRA, April 2021

* Benefits provided through the Living Benefits, including the critical, chronic, and terminal illness accelerated death benefits, are subject to certain limitations and exclusions. Amounts payable under the benefits vary based in part on the nature and severity of the Insured’s health condition and the Insured’s remaining life expectancy at the time of the acceleration as determined by the company. Refer to the policy contract for complete details.

Neither Transamerica nor its agents or representatives may provide tax or legal advice. Anyone to whom this material is promoted, marketed, or recommended should consult with and rely on their own independent tax and legal professionals regarding their particular situation and the concepts presented herein.

Transamerica Resources, Inc. is an Aegon company and is affiliated with various companies which include, but are not limited to, insurance companies and broker-dealers. Transamerica Resources, Inc. does not offer insurance products or securities. The information provided is for educational purposes only and should not be construed as insurance, securities, ERISA, tax, investment, legal, medical or financial advice or guidance. Please consult your personal independent professionals for answers to your specific questions.