Why It Matters:

- According to the U.S. Department of Health and Human Services, about 70% of people turning 65 will have a long term care need during their lifetime.1

- An estimated 53 million Americans serve as the primary providers of care to older adults living in the community.2

- About one in six caregivers of recipients ages 50+ report experiencing high financial strain as a result of providing care. 3

Even before the pandemic, an estimated 10,000 Baby Boomers were leaving the workforce each day.4 Between the aging population and a rise in the incidence of chronic conditions, retirees and their families will likely face increasing demands when it comes to evaluating housing options, managing finances and health, understanding legal issues, and creating contingency plans for unanticipated events. Making informed decisions can take time as you learn the options available to you.

Navigating the Journey

Hiring a Geriatric Care Manager (GCM) is one way to navigate the complex caregiver journey.

Most GCM’s charge by the hour, with fees ranging from about $75 to $200 an hour, and an initial assessment can cost hundreds of dollars.5 For many, this option may be financially out of reach. Especially since the cost is entirely out of pocket because Medicare, Medicaid, and most private insurance plans don’t cover it.

PACE (Programs for All-Inclusive Care for the Elderly) is a less costly alternative offered by Medicare and Medicaid, and it may be partially or fully covered for some individuals.

Whether you seek help from agencies or choose to handle it yourself, there are several factors to be aware of as you explore the possibilities.

Long Term Care

The modern landscape of long term care planning is much different than it used to be, with many options available to meet individual needs. Providers generally fall into one of two categories: informal or formal care.

Informal care typically consists of family or friends who help with basic everyday tasks like eating, bathing, and dressing (also known as activities of daily living, or ADLs). Formal care involves a facility or provider being compensated for a specific level of care. As the level of assistance needed becomes greater than informal caregivers can provide, individuals will usually transition to a more formal care provider.

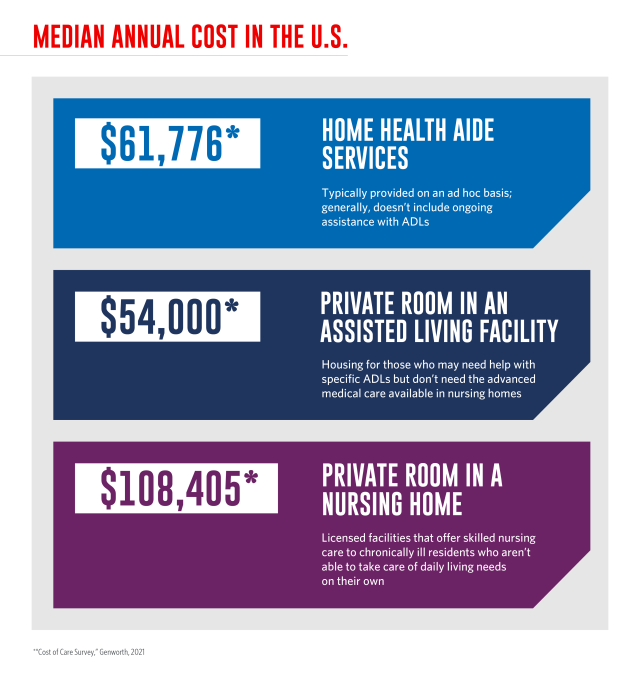

The Financial Costs of Care

Finding ways to fund future healthcare costs is one of the most important parts of retirement planning. Many individuals cover expenses with the help of insurance, some pay out of pocket, and others may be eligible for government assistance. While it’s tough to say exactly how much retirees will need, it’s helpful to consider the median costs for three common types of care.

The Other Costs of Caregiving

While family and friends undoubtedly want to help their loved ones, they may not be fully aware of caregiving’s inherent costs beyond finances. For example, in most cases, caregivers are sacrificing their own family and work responsibilities. Ultimately, the financial and emotional toll can be overwhelming, with researchers finding that if the stress of caregiving is left unchecked, it can take a toll on health, relationships, and state of mind — eventually leading to burnout, a state of emotional, mental, and physical exhaustion.6

Quality of Life

While caregiving has its challenges, it can also be fulfilling, and there are several ways caregivers can get the help they need. Technology-based, or online caregiver support, education, and skills training can be an effective and efficient way to enhance caregiver knowledge and skills. Support groups, self-care, relaxation training, and respite programs can also improve the quality of life for caregivers and their patients.6

Other questions to consider regarding the retiree’s quality of life include:

- Will my loved one be safe with his or her current level of care? For example, a certain level of independence can be maintained with the addition of a service that provides alerts for emergency medical help.

- Are there opportunities for my loved one to have regular social interaction? Isolation can lead to overall decline.

- Can my loved one take care of his or her basic needs? Determine what level of care is needed ― light housework, medication management, meal preparation, basic ADLs ― to begin your search for an appropriate provider.

Every situation is unique, and every choice is an individual one. The key is to be open to a range of possibilities and to maintain an ongoing dialogue. If you’re a caregiver, include the retiree in as many transition decisions as possible to ensure that their objectives are being met. If you’re a care recipient, be sure to speak up and make your personal preferences known.

Things to Consider:

- Whenever feasible, retirees and caregivers should work together when making transition decisions.

- Be sure the level of care needed and the level of care provided are a good fit.

- Work closely with your financial professional to be sure future healthcare costs are part of your overall financial strategy.

1 "How Much Care Will You Need?" LongTermCare.gov, accessed January 2022

2 "Caregiving in the United States 2020," AARP, May 2020

3 “Caregiving in the U.S. 2020: A Focused Look at Family Caregivers of Adults Age 50+,” AARP and National Alliance for Caregiving, May 2020

4 "Social Security Recipients Are Getting A Big Raise But Also Are Falling Further Behind," MarketWatch, January 2022

5 “Do You Need a Geriatric Care Manager?” A Place for Mom, July 2020

6 “Caregiver Stress and Burnout,” Helpguide.org, November 2021

Transamerica Resources, Inc. is an Aegon company and is affiliated with various companies which include, but are not limited to, insurance companies and broker dealers. Transamerica Resources, Inc. does not offer insurance products or securities. The information provided is for educational purposes only and should not be construed as insurance, securities, ERISA, tax, investment, legal, medical or financial advice or guidance. Please consult your personal independent professionals for answers to your specific questions.