In this article, we review:

- Fundamentals that investors should seek when looking for companies better positioned to withstand volatility

- Why an emerging trend marks a clear inflection point for value stocks

- Which specific sectors stand out as prime opportunities for value investors in 2025

Introduction

The market optimism that defined the past two years could be starting to fade, with investors growing increasingly wary of elevated stock valuations and macroeconomic and policy uncertainty. Bearish sentiment among individual investors reached its highest level since 2023, fueled by concerns over trade policy shifts, persistent inflation, and dwindling expectations for interest rate cuts.

At the same time, the S&P 500® surged 23% in 2024, driven heavily by a concentrated group of mega-cap tech stocks. However, as many of these companies now appear stretched in valuation by historical standards, it seems some investors are reconsidering their exposure to growth stocks, with many concluding that now is the time to rebalance portfolios. Many are shifting toward large-cap value stocks for their inherent stability, steady cash flow, and more attractive valuations.

Indeed, value stocks have led the market at the start of 2025, though growth retains a long-term edge. This rotation suggests investors are seeking higher-quality holdings with solid fundamentals — companies that can manage uncertain economic conditions while continuing to generate strong cash flows.

Fundamentals take center stage

In today’s investment landscape, quality matters more than ever. Companies with strong balance sheets, robust earnings, and consistent cash flows are better positioned to withstand market volatility. Large-cap value stocks — particularly those in defensive sectors such as consumer staples, healthcare, telecommunications, and utilities — have historically demonstrated resilience in economic downturns.

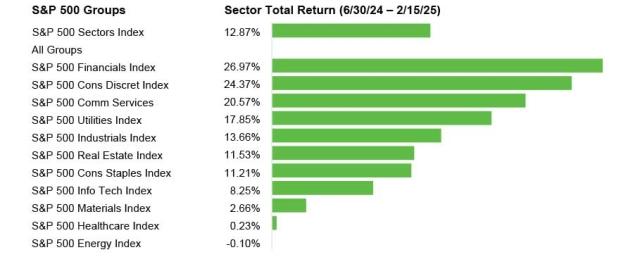

Financial stocks have been among the best-performing sectors in early 2025, benefitting from higher interest rates, favorable valuations, and a more constructive capital markets backdrop. In contrast, the highly valued tech sector, which fueled much of 2024’s rally, has started to show signs of fatigue, prompting some investors to seek a more defensive posture through value-oriented stocks. The chart below highlights the broadening of market returns over the past six months.

Source: Bloomberg

Value stocks are seeing an earnings inflection

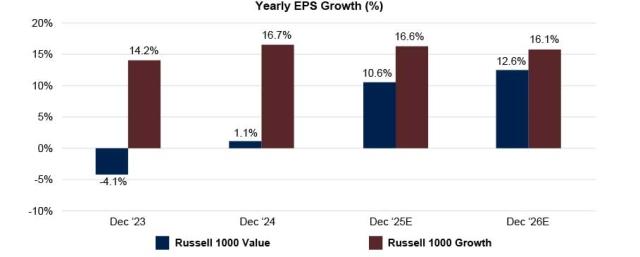

Earnings growth dynamics between the Russell 1000® Value (RIV) and Russell 1000® Growth (RIG) are shifting, drawing renewed attention from many investors. While the RIG continues to outpace RIV in terms of absolute earnings growth (estimated at 16–17% in 2025 for the RIG), the gap has narrowed significantly, with the RIV estimated to post roughly 12% earnings growth in 2025. This marks a clear inflection point for value stocks — the RIV’s earnings trajectory is strengthening at a time when RIG’s growth is decelerating.

Source: FactSet.

Notes: Calendar years ending in E indicate estimated EPS Growth

Yet, valuation disparities remain stark, with RIV trading at nearly a 50% discount on EV/EBITDA basis. This dynamic suggests a potential opportunity for value stocks, particularly as investors seek earnings stability at attractive valuations.

Source: FactSet as of 2/20/2025

Note: EV/EBITDA NTM – Enterprise Value (EV) to Earnings Before Interest, Taxes, Depreciation, and Amortization (EBTIDA) on a Next 12 Months (NTM) basis. This measures a company’s total value relative to its expected EBITDA over the next year, providing insight into its relative valuation compared to peers.

Avoiding value traps: The importance of earnings quality

Not all “cheap” stocks are good investments. One of the biggest mistakes in value investing is falling into a value trap — stocks that appear undervalued but lack the fundamental strength to recover.

Historically, investors relied on price-to-book ratios to identify undervalued stocks, but in the modern economy, this approach has limitations. A better metric for assessing value today is price to cash flow, which considers a company’s ability to generate cash relative to its valuation.

Many companies in traditional value sectors generate substantial cash flow, which allows them to reinvest in their business to gain market share and extend their competitive advantages. The costs to compete are ever-increasing, disadvantaging smaller players.

Where to find quality in today’s market

Several sectors stand out as prime opportunities for value investors in 2025:

- Financials: Benefiting from higher interest rates and improving loan margins, well-capitalized banks and insurance companies are offering strong dividend yields and solid earnings growth. A more constructive capital markets backdrop is also favorable for this sector.

- Healthcare: As an essential industry with steady demand, healthcare companies provide stability and are increasingly leveraging AI and innovation to drive future growth.

- Manufacturing: Offers many second derivative ways to gain exposure to some of the biggest themes in the market, such as AI, global electrification and de-carbonization, manufacturing onshoring and supply-chain security.

Conclusion

As investors reassess their market positioning in 2025, the case for quality value investing seems to be increasing. With growing concerns about stretched growth-stock valuations and increased uncertainty surrounding macroeconomic policy, many are turning to large-cap value stocks for their stability, and attractive valuations.

By focusing on strong fundamentals and avoiding value traps, investors can navigate today’s market complexities while capitalizing on the long-term potential of value stocks. Now may be the time to consider rebalancing portfolios and ensure exposure to high-quality, fundamentally strong investments that can weather whatever lies ahead.

As an investment advisor, you can provide additional insights and value to your clients on these emerging trends to help confirm your daily attention to their investment portfolios and position them for the successful outcomes you have crafted for them.

About the Authors

Paul Roukis is a Portfolio Manager on the Great Lakes Advisors Fundamental Equity Large Cap Value and Focused Large Cap Value strategies. Paul joined Rothschild & Co Asset Management US in 2005 and has been in the industry since 1992. Previously, Paul was a research analyst for more than 12 years with Sidoti & Company, Schroders, NatWest Securities, and Value Line. Paul earned a BBA from Hofstra University and is a CFA® charterholder.

Jeff Agne is a Portfolio Manager on the Great Lakes Advisors Fundamental Equity Large Cap Value and Focused Large Cap Value strategies. Jeff joined Rothschild & Co Asset Management US in 2015 and has been in the industry since 2001. Previously, he served as a co-portfolio manager for the Global Focus strategy at PineBridge Investments. He was also an Equity Research Analyst at Banc of America Securities and Schwab Soundview Capital Markets, and a Consultant for FactSet Research Systems. Jeff earned a B.S. from the University of Vermont and an MBA from New York University's Stern School of Business.

Related Funds

Index Definitions

The Russell 1000® Growth Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values.

The Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with relatively lower price-to-book ratios, lower I/B/E/S forecast medium term (2-year) growth and lower sales per share historical growth (5 years).

The S&P 500® Index is a widely regarded gauge of large-cap U.S. equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

Past performance is not indicative of future results. It is not possible to invest directly in an index, which also does not include the application of fees.

Important Information

All opinions, estimates, projections, and security selections contained herein are those of the sub-adviser. It does not constitute investment advice and should not be used as a basis for any investment decision.

Comments and general market-related projections are based on information available at the time of writing and believed to be accurate; are for informational purposes only, are not intended as individual or specific advice, may not represent the opinions of the entire firm, and may not be relied upon for future investing. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decisions. The value of any investment may fluctuate.

Mutual funds are subject to market risk, including loss of principal. Past performance is not indicative of future results.

Mutual funds are sold by prospectus. Before investing, consider the funds' investment objectives, risks, charges, and expenses. This and other important information is contained in the prospectus. Please visit transamerica.com or contact your financial professional to obtain a prospectus or, if available, a summary prospectus containing this information. Please read it carefully before investing.

The price of equity securities fluctuates based on changes in a company’s financial condition and overall market and economic conditions. If the market prices of the equity securities owned by the fund fall, the value of the fund will decline. Value approach carries the risk that the market will not recognize a security’s intrinsic value for a long time or that an undervalued stock is actually appropriately priced. The fund may be more concentrated than that of a more diversified fund, subjecting it to greater fluctuation and risk.

Transamerica Companies and Great Lakes Advisors LLC are not affiliated companies.

Note: Rothschild & Co Asset Management US was acquired by Great Lakes Advisors LLC on April 3, 2023.

Transamerica Funds are advised by Transamerica Asset Management, Inc., (TAM) and distributed by Transamerica Capital, LLC, member FINRA.

1801 California St., Suite 5200, Denver, CO 80202

© 2025 Transamerica Corporation. All Rights Reserved.