Why It Matters:

- Student debt has tripled in the last 16 years.1

- 45 million Americans now owe more than $1.7 trillion in debt.1

- There’s a lot of speculation in the media that the Biden administration might increase existing provisions for student debt forgiveness.

As the number of college graduates continues to rise each year, so too does the number and amount of student loans. Of course, there are two sides to the issue, with one side requesting debt be forgiven or canceled altogether and the other side demanding repayment by every individual who incurred the debt. Regardless of where one stands on the debate, it’s hard to deny that there is, indeed, a student debt crisis. The numbers themselves are staggering. Student debt has tripled in the last 16 years, and more than 45 million Americans now owe a collective $1.7 trillion in student debt.1

Since taking office in January 2021, the Biden administration has been working to fulfill campaign promises to cancel or forgive student debt. The programs that Biden has put into effect, such as improvements to the Public Service Loan Forgiveness (PSLF) program, discharging debt for those who attended closed schools, and fixing IDR counting, resulted in $17 billion in targeted loan relief to 725,000 borrowers since he took office.2 In addition, the pause in student loan payments with zero percent interest has eliminated a lot of interest debt that borrowers would have accrued during the pause.

No one knows whether the Biden administration will offer broad debt cancellation for student loan borrowers. Wiping out $10,000 of debt for each borrower, which Biden discussed while campaigning, would result in $457 billion cancelled.3 Here’s what we do know about Biden’s plan regarding student loan cancellation, including types of forgiveness, and what you can expect in the future.

Forgiving, discharging, or canceling student debt

With all the talk on forgiving, canceling, or discharging student debt from the Biden administration, it’s important to note they all represent different outcomes. While the distinctions are small, they make a dramatic difference in who will be eligible for what kind of relief. To be clear, the terms forgiveness, cancellation, and discharge mean nearly the same thing, but they’re used in different ways.4

If you’re no longer required to make payments on your loans due to your job, this is generally called forgiveness or cancellation. If you’re no longer required to make payments on your loans due to other circumstances, such as a total and permanent disability or the closure of the school where you received your loans, this is generally called discharge.4

Payments pause for student loan debt relief

As stated before, no one knows what additional relief, if any, will be provided. But there has been an official announcement that student loan payments are paused through August 31, 2022.5 This pause comes with a zero percent interest rate and affects 41 million people.6 These zero-dollar payments still count as an eligible payment for student loan forgiveness, discharge, or cancellation programs. The U.S. government has also temporarily stopped collections on defaulted loans.7

Ending student loan forbearance steering

The Public Service Loan Forgiveness (PSLF) Program provided immediate debt cancellation for at least 40,000 borrowers. In conjunction with this action, there has also been a move to end “forbearance steering.”2 Previously, borrowers could have gone into an income-driven repayment (IDR) program with as low as a $0 repayment, and those months of $0 payment would have counted towards on-time payments in their payment term. Instead, they were wrongly steered towards forbearance as their option. Federal Student Aid (FSA) offered a one-time adjustment to count some long-term forbearances toward income-driven repayment (IDR) and PSLF forgiveness.2

Fix IDR payment counting

This one-time revision to IDR payments provides credit toward the IDR payment term (after which any remainder is forgiven) for payments made when not on an IDR plan for some borrowers. FSA will issue new guidance to student loan servicers to ensure accurate and uniform payment counting practices, and it will track payment counts in its own modernized data systems. In 2023, FSA will begin displaying IDR payment counts on StudentAid.gov so borrowers can view their progress after logging into their accounts. In addition, the department plans to revise the terms of IDR through rulemaking to further simplify payment counting by allowing more loan statuses to count toward IDR forgiveness, including certain types of deferments and forbearances.2

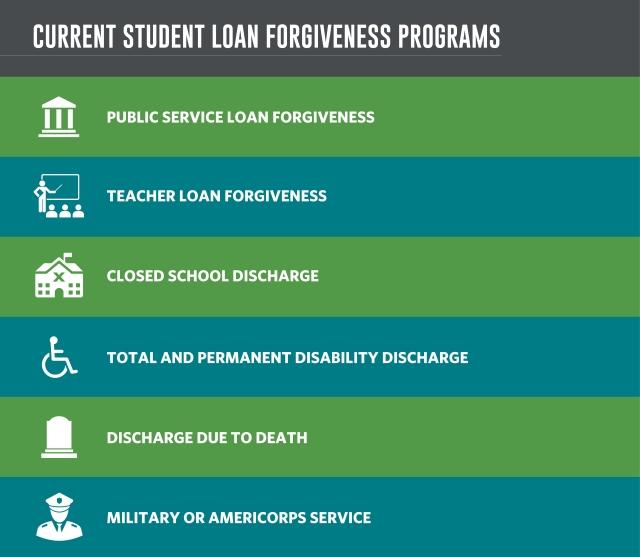

Types of current student loan debt forgiveness programs

The Department of Education currently offers several programs that can assist borrowers in repaying student loans. These are active programs and don’t reflect what could be offered in the future.

Public service loan forgiveness

If you work full-time for a government or not-for-profit organization, you may qualify for forgiveness of the entire remaining balance of your Federal Direct Loans after you’ve made 120 qualifying payments — that is, 10 years of payments. To benefit from PSLF, you should repay your federal student loans under an income-driven repayment plan.8

Teacher loan forgiveness

If you teach full-time for five complete and consecutive academic years in certain elementary or secondary schools or educational service agencies that serve low-income families, and meet other qualifications, you may be eligible for forgiveness of up to a combined total of $17,500 on eligible federal student loans.8

Closed school discharge

If your school closes while you’re enrolled or soon after you withdraw, you may be eligible for discharge of your federal student loan.4

Total and permanent disability discharge

If you’re totally and permanently disabled, you may qualify for a discharge of your federal student loans and/or Teacher Education Assistance for College and Higher Education (TEACH) Grant service obligation.4

Discharge due to death

Federal student loans will be discharged due to the death of the borrower or of the student on whose behalf a PLUS loan was taken out.4

Military or AmeriCorps service

For military service, you may be eligible for benefits such as interest rate caps under the Servicemembers Civil Relief Act and Department of defense. The Segal AmeriCorps Education Award is a benefit received by participants who complete a term of national service in an approved AmeriCorps program — AmeriCorps VISTA, AmeriCorps NCCC, or AmeriCorps State and National. After you successfully complete your service, you’re eligible to receive a Segal AmeriCorps Education Award, which can be used to repay qualified student loans.8

Income-driven repayment plans (IDR)

Another option for those dealing with student loan debt is income-driven repayment (IDR) plans. These plans set monthly student loan payments at an amount that is intended to be affordable based on income and family size. They offer low-income student loan borrowers the ability to reduce their payments to 10-20% of their discretionary income. The loan balance is then forgiven after a set period of payments (often 20-25 years).9

However, under these plans principal may grow despite the borrower making payments, if the payment determined by the IDR plan is less than the monthly interest payment on the loan. As income grows, so too will payments.

Federal Student Aid offers four income-driven repayment plans:

- Revised Pay As You Earn Repayment Plan (REPAYE Plan)

- Pay As You Earn Repayment Plan (PAYE Plan)

- Income-Based Repayment Plan (IBR Plan)

- Income-Contingent Repayment Plan (ICR Plan)9

For those who are interested in seeing what their loan repayments may look like under an IDR plan, Studentaid.gov’s loan simulator is an excellent resource.10

Biden’s student loan forgiveness plan continues to evolve. At a news conference on April 28, President Biden said: "I am considering dealing with some debt reduction; I am not considering $50,000 in debt reduction. But I'm in the process of taking a hard look of whether or not there will be additional debt forgiveness, and I'll have an answer on that in the next couple of weeks." No provision in Biden’s 2022 budget proposal included broad student loan forgiveness. Since there is no formal forgiveness proposal, there are no details about which loans might be canceled.3

As the end of the August payment freeze date looms closer, the best course of action is to continue to monitor the White House for updates on possible changes to the current programs already in place.

Things to Consider:

- Once the existing freeze on payments ends in August, it will be the borrower’s responsibility to resume payments.

- Explore current programs to see if you’re eligible for debt forgiveness or debt discharge of your student loans.

- Continue to stay up to date with the White House’s press releases on student loan forgiveness.

1“How the US Student Loan Debt Crisis Started — And How It Could End,” Theguardian.com, May 2022

2 “Department of Education Announces Actions to Fix Longstanding Failures In The Student Loan Programs,” Ed.gov, May 2022

3 “Will Student Loans Be Canceled? Where We Stand,” Nerdwallet.com, May 2022

4 “Student Loan Forgiveness,” Studentaid.gov, May 2022

5 “Statement by President Biden Extending the Pause on Student Loan Repayment Through August 31st, 2022,” Whitehouse.gov, April 2022

6 “Statement by Vice President Kamala Harris on Extending the Pause on Student Loan Repayment Through August 31st, 2022,” Whitehouse.gov, April 2022

7 “Education Department Halts Collection Action On Student Loans Through November,” Forbes, February 2022

8 “Student Loan Forgiveness (And Other Ways the Government Can Help You Repay Your Loans),” Studentaid.gov, May 2022

9 “If Your Federal Student Loan Payments Are High Compared to Your Income, You May Want to Repay Your Loans Under an Income-Driven Repayment Plan,” Studentaid.gov, May 2022

10 “See Your Federal Student Loan Repayment Options with Loan Simulator,” Studentaid.gov, May 2022

Transamerica Resources, Inc. is an Aegon company and is affiliated with various companies which include, but are not limited to, insurance companies and broker dealers. Transamerica Resources, Inc. does not offer insurance products or securities. The information provided is for educational purposes only and should not be construed as insurance, securities, ERISA, tax, investment, legal, medical or financial advice or guidance. Please consult your personal independent professionals for answers to your specific questions.