How life insurance can benefit you

As a life insurance agent, I’m dedicated to helping people build a secure financial future — one that gives them the freedom to live life on their terms. Life insurance has evolved to fit the needs of today’s families, whether it’s helping them save for college, pay-down debt, protect their businesses, or other important goals. It can be part of a solid foundation for a sound financial strategy.

Help provide peace of mind

Life insurance can help reassure you that your loved ones will be taken care of when you can’t be there. The tax-free death benefit of a life insurance policy can help your loved ones replace income, maintain their lifestyle, and much more.

Grow cash value

The cash value of permanent life insurance can help cover any number of expenses, including funding college for a child, paying off debt, or supplementing your retirement. Whole life, universal life, and index universal life insurance can include a “cash value” component that grows over time and is separate from the death benefit. It may also offer more tax advantages than you realize.

Leave a legacy

Life insurance can help you leave the legacy of your choice. You may want to leave money to your family, fund a nonprofit, cover end-of-life expenses, pay debts your estate may have, and more. Certain policies also offer benefits the insured can use while living in the case of terminal, chronic, or critical illnesses. Other riders are available to assist with medical expenses related to long-term care.

Protect your business

Life insurance can help you attract, reward, and retain critical employees as well as play a role in your business succession plan. It can also protect against the loss of an employee who’s key to your business’ ongoing operation.

When to assess your life insurance needs

Life changes can offer exciting opportunities. To make sure your financial strategy still meets your financial goals, I suggest consulting with a life insurance agent to assess your plan on a regular basis. A good rule of thumb is either every two years or when you have one of the major life events listed below.

Getting married

Buying a new home

Having a baby

Starting a business

Enjoying your empty nest

Nearing retirement

What kind of life insurance is right for you?

There are many types of life insurance, which can help people find an option that’s the best fit for them. Term life insurance covers you for a certain period, such as 10, 20 or 30 years. Permanent life insurance doesn’t expire as long as payments are made. It can provide security through every stage of your life and may build tax-deferred cash value over time. Types of permanent life insurance include whole life, universal life, index universal life, and more.

Learn about Transamerica

Financial services should be available to everyone. This idea is what moved our founder, Amadeo P. Giannini, to open a bank in San Francisco in 1904. After the devastating earthquake and fire of 1906, he set up a desk on the docks and sealed deals with a handshake for loans to rebuild. The goal of serving the many, not just the few, still drives Transamerica today. That’s why we design products that work in people’s real lives today and anticipate an evolving future. So no matter where someone is on their journey, we can help them develop the freedom to live the life they want.

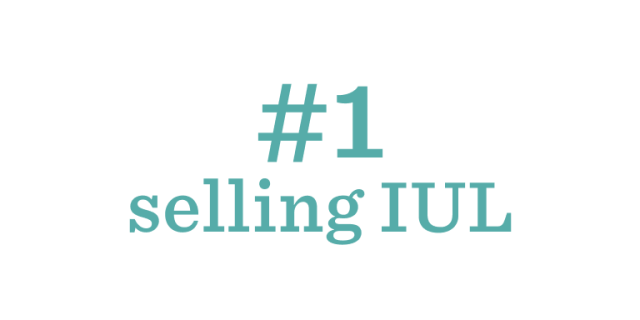

for nine consecutive quarters1

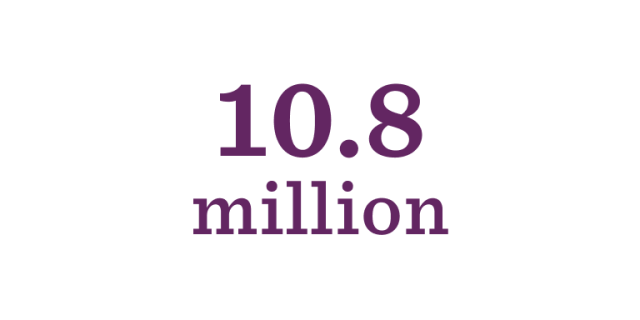

Transamerica customers 2

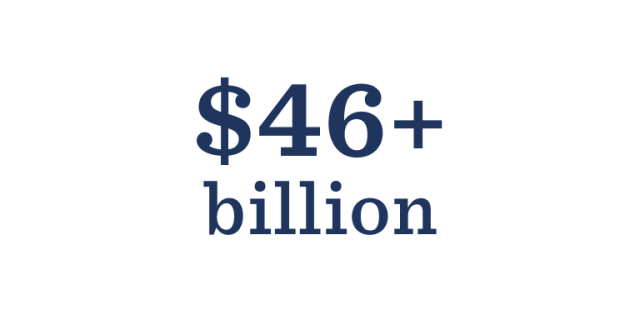

paid by Transamerica in insurance, retirement, and annuity claims and benefits 2

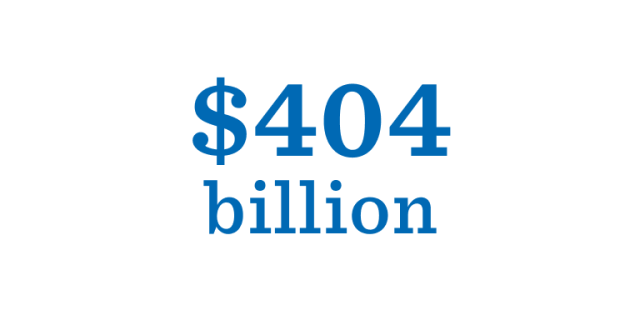

in revenue-generating investments2

1 According to Wink’s Sales Report Life 1b IUL: 4Q 2021–2Q 2023

2 As of December 31, 2022

A wealth of knowledge

Transamerica is dedicated to improving the financial well-being of everyone. As a life insurance agent, I want to ensure my clients have the information they need to make sound financial decisions. This includes providing guidance and educational materials that help them plan for the future so they can live their best life.

Top 9 features of life insurance

You may be surprised by some of the ways life insurance can help secure your financial future. It can help you save for college, pay off debt, save for retirement, and achieve other goals.

Understanding universal life insurance video

A form of permanent life insurance, index universal life insurance (IUL) provides the death benefit protection you need while building cash value — all with downside protection. With optional living benefits riders, it also can give you the option to access your death benefit early in the event of a qualifying chronic, critical, or terminal illness.

Living benefits video

Living benefits riders on life insurance policies can provide benefits if you experience critical illness, chronic illness, or terminal illness. These riders can give you early access to a portion of the policy’s death benefits when certain conditions are met.

Understanding final expense life insurance

Final expense insurance can help make a difficult time for your family a little easier. It’s a form of whole life insurance designed to cover funeral and other end-of-life expenses.